In the competitive landscape of the global tire market, sourcing high-quality tires that are properly inflated is a critical yet often overlooked challenge. Under inflated tires not only compromise vehicle safety and performance but also lead to increased costs due to fuel inefficiency, uneven wear, and potential damage to vehicles. This comprehensive guide delves into the various types of tires, their applications across different sectors, and the importance of selecting the right suppliers. By providing insights into supplier vetting, cost considerations, and best practices for maintenance, this guide equips international B2B buyers—particularly those from Africa, South America, the Middle East, and Europe, including regions like Vietnam and Germany—with the knowledge to make informed purchasing decisions.

With the rising demand for efficient and reliable transportation solutions, understanding the implications of tire inflation is essential. Under inflated tires can result in dangerous driving conditions, increased operational costs, and reduced vehicle longevity. This guide serves as a valuable resource, highlighting actionable strategies to mitigate these risks. By addressing the intricacies of tire sourcing and management, we aim to empower businesses to enhance their fleet performance, reduce costs, and ensure safety on the roads. As you navigate this complex market, rely on this guide to steer your decisions towards optimal tire solutions that meet your operational needs.

| Typ Name | Wichtigste Unterscheidungsmerkmale | Primäre B2B-Anwendungen | Kurze Vor- und Nachteile für Käufer |

|---|---|---|---|

| Light Truck Tires | Designed for heavy loads, typically under-inflated for better grip and cushioning | Transportation, Delivery Services | Vorteile: Enhanced stability under load. Nachteile: Increased wear if consistently under-inflated. |

| Passenger Vehicle Tires | Often under-inflated to improve ride comfort; susceptible to uneven wear | Fleet Management, Car Rentals | Vorteile: Improved comfort. Nachteile: Reduced fuel efficiency and handling. |

| Agricultural Tires | Lower pressure for better traction on soft ground; may lead to sidewall damage | Farming, Agricultural Equipment | Vorteile: Better ground contact and less soil compaction. Nachteile: Risk of blowouts if pressure is too low. |

| Off-Road Tires | Designed for rugged terrain; can be under-inflated for traction but at risk of punctures | Construction, Mining, Adventure Tours | Vorteile: Enhanced grip on rough surfaces. Nachteile: Increased risk of tire damage and reduced lifespan. |

| Performance Tires | Often under-inflated for optimal grip during racing; must be monitored closely | Motorsports, High-Performance Vehicles | Vorteile: Maximum traction and cornering ability. Nachteile: Requires careful pressure management to avoid blowouts. |

Light truck tires are engineered to support heavy loads while maintaining stability and traction. When slightly under-inflated, these tires can provide enhanced grip on various surfaces, making them suitable for transportation and delivery services. However, consistent under-inflation can lead to accelerated wear and tear, which is a key consideration for businesses managing fleets. Buyers must balance the need for load-bearing capabilities with the potential for increased maintenance costs.

Passenger vehicle tires can benefit from slight under-inflation, which often enhances ride comfort by providing a softer feel on the road. This is particularly relevant for fleet management and car rental services, where driver comfort is a priority. However, under-inflated tires can lead to reduced fuel efficiency and impaired handling, which may result in higher operational costs. B2B buyers should evaluate the trade-offs between comfort and performance when selecting these tires.

Agricultural tires are specifically designed for low-pressure operation to maximize traction on soft ground. Under-inflation in this context can significantly improve ground contact and minimize soil compaction, which is crucial for farming applications. Nonetheless, overly low pressure can increase the risk of sidewall damage and blowouts, necessitating careful monitoring. Buyers in the agricultural sector should prioritize durability and performance in varying soil conditions when considering these tires.

Off-road tires are designed for rugged terrains and can be under-inflated to improve traction on loose surfaces. This feature is particularly advantageous in construction and mining industries where grip is essential. However, under-inflation increases the likelihood of punctures and reduces tire lifespan, which can lead to costly replacements. B2B buyers should assess the environmental conditions and operational risks when opting for these specialized tires.

Performance tires are often under-inflated to achieve optimal grip during high-speed driving and racing conditions. This practice is common in motorsports and high-performance vehicle applications, where traction is critical. However, the margin for error is small; improper inflation can lead to blowouts and loss of control. For B2B buyers, understanding the precise pressure requirements and the implications for safety and performance is essential when selecting performance tires.

| Industrie/Sektor | Specific Application of Tires Under Inflated | Wert/Nutzen für das Unternehmen | Wichtige Überlegungen zur Beschaffung für diese Anwendung |

|---|---|---|---|

| Transport und Logistik | Fuhrpark-Management | Reduces fuel costs and extends tire lifespan | Supplier reliability, local availability, pricing |

| Landwirtschaft | Agricultural Machinery | Improves traction on uneven terrain, enhances crop yield | Durability, weather resistance, size compatibility |

| Bauwesen | Heavy Equipment | Increases stability and load-bearing capacity | Compliance with safety standards, maintenance support |

| Mining | Mining Vehicles | Enhances operational efficiency and reduces downtime | Supplier experience, availability of specialized tires |

| Public Transport | Buses and Coaches | Ensures passenger safety and comfort | Tire performance ratings, warranty terms |

In the transportation and logistics sector, under-inflated tires are often a result of neglect in fleet maintenance. However, this condition can be leveraged to optimize costs, as slightly lower pressures can sometimes enhance traction on specific terrains. While not advisable for safety, understanding tire pressure dynamics can lead to reduced fuel consumption and prolonged tire life. International buyers should focus on sourcing from suppliers that offer comprehensive tire management solutions to ensure optimal performance across diverse geographies.

In agricultural applications, under-inflated tires can provide improved traction on soft and uneven ground, which is essential for machinery like tractors and harvesters. This can lead to better performance in field operations, ultimately enhancing crop yields. Buyers in this sector must consider tire durability and resistance to wear, especially in regions with challenging weather conditions. Sourcing partners should offer specialized tires designed for agricultural use to ensure compatibility with various machinery.

Illustrative image related to tires under inflated

Under-inflated tires in construction equipment can enhance stability and load-bearing capabilities, allowing heavy machinery to operate efficiently on rugged job sites. This can lead to increased safety and productivity, as operators can navigate uneven surfaces more effectively. B2B buyers in construction should prioritize suppliers that comply with safety standards and offer ongoing maintenance support to ensure tires remain in optimal condition, minimizing the risk of equipment failure.

In the mining industry, the use of under-inflated tires is sometimes a calculated risk to improve traction and reduce slippage on loose materials. This can significantly enhance operational efficiency and reduce downtime caused by tire failures. Buyers should look for suppliers with experience in mining applications and the ability to provide specialized tires that meet the demanding conditions of the sector. Availability of these tires is crucial to maintain continuous operations.

In public transport, the condition of tires is critical for passenger safety and comfort. While under-inflated tires may lead to a smoother ride on certain surfaces, they can also pose significant risks, such as increased stopping distances. Thus, public transport operators must source tires that provide excellent performance ratings and warranties to ensure the safety of passengers. Selecting suppliers that understand the unique challenges of the public transport sector is essential for maintaining service reliability.

Illustrative image related to tires under inflated

Das Problem:

B2B buyers managing fleets often encounter the issue of under-inflated tires leading to inflated operational costs. When tires are not adequately inflated, rolling resistance increases, which results in lower fuel efficiency. For companies that rely heavily on transportation, such as logistics and delivery services, this can lead to significant financial losses over time. Furthermore, under-inflated tires can wear out more quickly, necessitating more frequent replacements and additional maintenance costs, thereby straining budgets.

Die Lösung:

To mitigate these challenges, B2B buyers should implement a proactive tire maintenance program that includes regular tire pressure checks and adjustments. Investing in tire pressure monitoring systems (TPMS) can provide real-time data on tire inflation levels, allowing fleet managers to address issues before they escalate. Additionally, training drivers to perform pre-trip inspections, including checking tire pressure, can foster a culture of accountability and awareness. By standardizing tire pressure checks at regular intervals—ideally once a month or before long trips—companies can maintain optimal tire performance, reduce fuel consumption, and extend tire lifespan, ultimately leading to substantial cost savings.

Das Problem:

Under-inflated tires can severely compromise vehicle safety, leading to potential accidents and liability issues. For B2B buyers in industries like transportation and logistics, ensuring the safety of drivers and cargo is paramount. When tires are under-inflated, they can cause poor handling and increased stopping distances, making it difficult for drivers to maneuver their vehicles safely, particularly in emergency situations. This not only poses a risk to the drivers but can also lead to costly insurance claims and damage to the company’s reputation.

Die Lösung:

To enhance safety, B2B buyers should establish a routine tire inspection schedule that emphasizes tire pressure checks. Implementing a standardized maintenance checklist for drivers can ensure that tire pressures are checked regularly. Additionally, investing in high-quality, durable tires designed to withstand varying loads can significantly reduce the risk of under-inflation. Utilizing training sessions focused on safe driving practices, including understanding the importance of tire maintenance, will also empower drivers to recognize and report issues before they lead to accidents. Furthermore, consider partnering with tire suppliers who offer comprehensive warranty and service packages, ensuring that any tire-related issues are promptly addressed.

Das Problem:

For businesses that rely on timely deliveries and high levels of service, under-inflated tires can negatively affect vehicle performance, leading to delays and dissatisfied customers. When tire pressure is low, it results in sluggish acceleration, increased braking distances, and an overall poor driving experience. This can be particularly detrimental for B2B service providers, such as food delivery or emergency services, where reliability is crucial. Customers may experience delays, which can damage business relationships and lead to lost contracts.

Die Lösung:

To improve vehicle performance and customer satisfaction, B2B buyers should prioritize a comprehensive fleet management strategy that includes regular tire maintenance. Implementing a digital tracking system that logs tire pressure readings, maintenance history, and service schedules can ensure all vehicles are operating at optimal levels. Additionally, consider using telematics to monitor vehicle performance metrics in real time, allowing for quick adjustments and preventive measures. Training staff on the importance of tire maintenance not only enhances operational efficiency but also fosters a culture of excellence in customer service. By taking these steps, businesses can ensure their vehicles deliver consistently high performance, ultimately leading to enhanced customer satisfaction and loyalty.

When considering tire materials in the context of under-inflation, several key materials come into play. Each material offers distinct properties, advantages, and disadvantages that can significantly impact performance, durability, and overall safety. Below, we analyze four common materials used in tire manufacturing, focusing on their relevance to under-inflated tires.

Natural rubber is a widely used material in tire manufacturing due to its excellent elasticity and resilience. It can withstand a variety of temperatures and pressures, making it suitable for diverse driving conditions. However, natural rubber is susceptible to degradation from UV light and ozone, which can be a concern in regions with high sun exposure.

Vorteile:

– High elasticity and flexibility enhance ride comfort.

– Good grip and traction on various surfaces.

Nachteile:

– Prone to wear and tear, especially in harsh environments.

– Requires additives for UV and ozone resistance, increasing manufacturing complexity.

Natural rubber’s performance in under-inflated conditions can lead to increased rolling resistance, making it less fuel-efficient. Buyers in regions with extreme weather conditions, such as Africa and the Middle East, should consider the need for additives to enhance durability.

Synthetic rubber, often used in conjunction with natural rubber, offers superior resistance to wear and aging. It can be engineered to provide specific performance characteristics, such as improved heat resistance and lower rolling resistance, which is crucial for tires that may be under-inflated.

Vorteile:

– Enhanced durability and longer lifespan compared to natural rubber.

– Customizable properties for specific performance needs.

Nachteile:

– Generally higher production costs due to complex manufacturing processes.

– May have lower elasticity compared to natural rubber.

For international buyers, particularly in Europe and South America, synthetic rubber tires can meet stringent safety and performance standards, but the higher costs may be a consideration for budget-conscious buyers.

Steel belts are commonly used in tire construction to provide strength and stability. They help maintain the tire’s shape under various loads and pressures, which is particularly important for under-inflated tires that experience increased flexing.

Vorteile:

– Increases tire strength and puncture resistance.

– Enhances handling and stability, especially under load.

Nachteile:

– Can add significant weight to the tire, affecting fuel efficiency.

– Higher manufacturing complexity and cost.

B2B buyers from regions with rough terrains, such as parts of Africa and South America, may find steel-belted tires beneficial for their durability and performance, despite the potential trade-off in weight and cost.

Polyester and nylon are commonly used in tire sidewalls and inner linings. They provide excellent tensile strength and flexibility, which helps in maintaining tire shape and performance, especially under varying inflation levels.

Vorteile:

– Lightweight and strong, contributing to overall tire efficiency.

– Good resistance to abrasion and impact, enhancing longevity.

Illustrative image related to tires under inflated

Nachteile:

– May not withstand extreme temperatures as well as other materials.

– Can be more expensive than traditional fabric options.

For international buyers, especially in regions with diverse climates like Europe and the Middle East, the choice of polyester or nylon can be influenced by local conditions and regulatory standards regarding material safety and performance.

| Material | Typical Use Case for tires under inflated | Hauptvorteil | Wesentlicher Nachteil/Beschränkung | Relative Kosten (niedrig/mittel/hoch) |

|---|---|---|---|---|

| Natural Rubber | General tire manufacturing | High elasticity and comfort | Prone to wear in harsh environments | Mittel |

| Synthetic Rubber | Performance tires | Enhanced durability and lifespan | Higher production costs | Hoch |

| Steel Belts | Heavy-duty and all-terrain tires | Increased strength and puncture resistance | Adds weight, affecting fuel efficiency | Mittel |

| Polyester/Nylon | Sidewalls and inner linings | Lightweight and strong | Limited temperature resistance | Mittel |

This analysis provides B2B buyers with actionable insights into material selection for tires at risk of under-inflation, helping them make informed decisions based on performance, cost, and regional considerations.

The manufacturing process for tires involves several critical stages that ensure the final product meets safety and performance standards. Each stage is designed to prepare materials, form them into the desired shape, assemble components, and finish the product for distribution.

Illustrative image related to tires under inflated

The first step in tire manufacturing is the preparation of raw materials. This includes rubber, fabric, and steel. Natural and synthetic rubbers are mixed with various chemicals to enhance durability, flexibility, and resistance to wear. This compound is then processed into sheets or bands, which will form the tire’s outer layer and inner linings. In addition to rubber, steel belts are prepared to provide structural integrity and improve performance.

Once materials are ready, the next stage is forming. This involves cutting and shaping the rubber sheets to create the tire components. Key techniques in this stage include:

This stage is crucial as it sets the foundation for the tire’s performance characteristics, including traction and durability.

Following the forming stage, assembly occurs. This involves combining the various components—such as treads, sidewalls, and inner linings—into a single unit. The assembly is often done using automated systems that ensure precision. During this phase, the steel belts are integrated, providing the necessary strength and reducing the risk of under-inflation issues.

The final stage is finishing, where the tires undergo a curing process. Curing involves heating the assembled tire in a pressurized mold, allowing the rubber to vulcanize and harden. This process enhances the tire’s strength and elasticity. After curing, tires are inspected for defects, and any necessary adjustments are made before they are packaged for shipment.

Quality assurance in tire manufacturing is paramount, especially in international markets. Several standards guide the industry, ensuring that products meet safety and performance criteria.

ISO 9001: This standard focuses on quality management systems and is crucial for manufacturers aiming to ensure consistent quality in their products. Compliance with ISO 9001 indicates that a manufacturer has established processes for continuous improvement.

ECE Regulation 30: This European standard governs the safety and performance of tires, focusing on durability, traction, and rolling resistance.

DOT Certification: In the United States, tires must meet Department of Transportation regulations, which cover various safety aspects, including performance under various conditions.

CE-Kennzeichnung: In Europe, CE marking indicates that the tire complies with EU legislation, ensuring safety and environmental standards.

Quality control (QC) is an integral part of the manufacturing process, with multiple checkpoints to ensure product integrity.

Eingehende Qualitätskontrolle (IQC): Raw materials are inspected upon arrival to ensure they meet specifications. This includes checking rubber compounds and steel for quality and consistency.

Prozessbegleitende Qualitätskontrolle (IPQC): During the manufacturing process, various checks are performed to monitor the quality of the formed components. This may involve measuring dimensions and conducting tests to ensure adherence to design specifications.

Endgültige Qualitätskontrolle (FQC): Once tires are completed, they undergo rigorous testing. This includes visual inspections, pressure tests, and performance evaluations to ensure they meet international standards.

Testing methods are essential for verifying that tires meet safety and performance benchmarks. Common methods include:

These tests help identify any potential issues, such as those related to under-inflation, ensuring that tires are safe for consumers.

Illustrative image related to tires under inflated

When sourcing tires, especially from international suppliers, B2B buyers must ensure that quality control measures are robust. Here are some actionable steps:

Durchführung von Lieferantenaudits: Regular audits can help verify compliance with international standards and ensure that quality control processes are followed.

Request Quality Reports: Suppliers should provide documentation detailing their quality control measures, including results from testing and inspections.

Inspektionen durch Dritte: Engaging third-party inspection agencies can provide an unbiased assessment of the supplier’s quality control practices. This is particularly important for buyers in Africa, South America, the Middle East, and Europe, where varying standards may be in place.

B2B buyers must navigate various certification requirements that differ from region to region.

Understanding Local Regulations: Buyers should familiarize themselves with the specific regulations and standards applicable in their regions, such as the ECE regulations in Europe or DOT standards in the U.S.

Certification Validity: Ensure that certifications are up-to-date and relevant to the specific tire types being purchased. Some certifications may only apply to certain tire categories (e.g., passenger vs. commercial).

Supplier Reputation: Investigate the supplier’s reputation in the market. Reviews, testimonials, and industry awards can provide insights into their commitment to quality.

By understanding the manufacturing processes and quality assurance measures in tire production, B2B buyers can make informed decisions that prioritize safety and performance, ultimately leading to better outcomes for their businesses.

This practical sourcing guide is designed for B2B buyers looking to procure solutions for the challenges posed by under-inflated tires. Properly addressing this issue is crucial for enhancing safety, reducing costs, and ensuring optimal vehicle performance. This checklist will help you navigate the sourcing process effectively, ensuring that you select the best suppliers and products tailored to your specific needs.

Establishing clear technical specifications is the foundation of successful sourcing. Consider the types of vehicles your organization operates and their specific tire requirements, such as load capacity, tire size, and tread patterns. This step ensures that you procure tires that meet the operational demands of your fleet while adhering to safety standards.

Illustrative image related to tires under inflated

Understanding the market landscape is vital for informed purchasing decisions. Research various tire suppliers, comparing their product offerings, pricing, and reputation. Utilize industry reports, trade publications, and online resources to gather insights on emerging trends and technologies related to tire performance and maintenance.

Before committing to a supplier, verify their certifications and compliance with industry standards. Look for ISO certifications, safety ratings, and adherence to regional regulations, especially since tire quality can vary significantly across markets. This ensures that you are partnering with suppliers who prioritize safety and quality.

Obtaining product samples allows you to assess the quality and suitability of tires for your vehicles. Testing samples in real-world conditions can reveal performance characteristics, such as durability and fuel efficiency, that are not always evident from specifications alone. Ensure you document the results to compare against other potential suppliers.

When evaluating suppliers, consider the total cost of ownership rather than just the upfront purchase price. Factor in aspects such as installation costs, maintenance requirements, and potential fuel savings from properly inflated tires. This holistic approach will help you identify the most cost-effective solutions over the tire’s lifespan.

Once you have shortlisted potential suppliers, engage in negotiations to secure the best terms. Discuss payment terms, delivery schedules, and warranty conditions to ensure they align with your business needs. A clear understanding of these elements can prevent future misunderstandings and foster a strong supplier relationship.

After procurement, establish a system for ongoing tire pressure monitoring and maintenance. Regular checks can prevent issues related to under-inflation and extend the lifespan of your tires. Consider investing in technology that automates this process, providing alerts when tire pressure falls below optimal levels, ultimately enhancing safety and efficiency across your fleet.

By following this checklist, you can effectively navigate the complexities of sourcing solutions for under-inflated tires, ensuring that your procurement process is both efficient and effective.

When evaluating the cost structure for sourcing tires, particularly those that may be prone to under-inflation, several key components come into play:

Materialien: The primary cost driver in tire manufacturing is the raw materials, including rubber, steel belts, and fabric. The quality of these materials directly influences performance and durability. Sourcing high-quality materials may incur higher costs but can lead to long-term savings through reduced maintenance and replacement rates.

Arbeit: Labor costs involve the workforce required for manufacturing, assembling, and quality control. In regions with higher wage standards, such as parts of Europe, labor costs can significantly affect overall pricing. In contrast, sourcing from countries with lower labor costs, like Vietnam, can provide cost advantages.

Fertigungsgemeinkosten: This encompasses the indirect costs associated with production, such as utilities, depreciation of equipment, and factory management. Efficient operations can reduce these costs, impacting the final price.

Werkzeugbau: The cost of specialized tools and molds used in tire production should not be overlooked. Custom designs or unique specifications will require additional investment in tooling, thus influencing the overall pricing.

Qualitätskontrolle (QC): Ensuring that tires meet safety and performance standards incurs costs related to testing and inspection. Buyers should prioritize suppliers with rigorous QC processes, as this can affect the longevity and safety of the tires.

Logistik: Transportation costs for moving tires from manufacturing facilities to distribution points or directly to buyers can vary significantly based on distance, mode of transport, and regional tariffs. Effective logistics planning can help mitigate these costs.

Marge: Suppliers will typically add a profit margin to their costs. Understanding the market dynamics and competitive pricing can help buyers negotiate better deals.

Several factors can influence the pricing of tires, especially those susceptible to under-inflation:

Illustrative image related to tires under inflated

Volumen/MOQ: Buying in bulk can lead to significant discounts. Suppliers often have minimum order quantities (MOQs) that, when met, can lower the per-unit cost.

Spezifikationen und Anpassungen: Custom specifications, such as tread patterns or specific material blends, can increase costs. Buyers should weigh the benefits of customization against potential price increases.

Materialien und Qualitätszertifikate: Tires that meet international quality standards or certifications (e.g., ISO, DOT) may command higher prices. These certifications can assure buyers of safety and performance, justifying the investment.

Lieferanten-Faktoren: The reputation and reliability of the supplier can influence pricing. Established suppliers with a strong track record may charge more but offer better guarantees and service.

Incoterms: Understanding the terms of trade is crucial for international buyers. Incoterms dictate responsibilities for shipping, insurance, and tariffs, which can add to the total cost of ownership.

Negotiate Based on Total Cost of Ownership: Focus on the long-term value rather than just the upfront costs. Consider factors like fuel efficiency, wear rates, and warranty when evaluating offers.

Forschung Marktpreise: Stay informed about market trends and pricing benchmarks. This knowledge can empower buyers during negotiations and help identify fair pricing.

Leverage Volume Discounts: If feasible, consolidate orders across multiple business units to meet MOQs and secure better pricing.

Lokale Zulieferer berücksichtigen: For buyers in Africa, South America, and the Middle East, local suppliers may offer competitive pricing and reduced logistics costs, alongside faster delivery times.

Achten Sie auf preisliche Nuancen: Different regions may experience fluctuations due to local economic conditions, tariffs, or availability of materials. Buyers should consider these factors when sourcing tires internationally.

While prices can vary significantly based on the factors discussed, it is essential for buyers to conduct thorough due diligence and consider the total cost implications. This approach not only ensures optimal purchasing decisions but also enhances vehicle safety and performance in the long run. Always remember that indicative prices can fluctuate based on market conditions, so continuous monitoring and flexible sourcing strategies are recommended.

When it comes to tire management, particularly in the context of tires under inflated, it is crucial for B2B buyers to explore viable alternatives that can enhance safety, performance, and cost-effectiveness. The implications of using under-inflated tires can be severe, including increased risk of blowouts, reduced fuel efficiency, and costly vehicle damage. By comparing this conventional approach with alternative solutions, businesses can make informed decisions that align with their operational needs.

| Vergleich Aspekt | Tires Under Inflated | Tire Pressure Monitoring Systems (TPMS) | Automatic Tire Inflation Systems (ATIS) |

|---|---|---|---|

| Leistung | Decreased control and handling | Enhances safety by alerting low pressure | Maintains optimal pressure continuously |

| Kosten | Low initial cost, potential high long-term expenses | Moderate cost, cost-effective in the long run | Higher initial investment, lower maintenance costs |

| Leichte Implementierung | Simple to overlook; requires manual checks | Easy installation, requires monitoring | Requires professional setup, but low ongoing effort |

| Wartung | High risk of damage, regular checks needed | Minimal upkeep, mostly automated alerts | Low maintenance, system self-regulates |

| Bester Anwendungsfall | Suitable for budget-conscious users | Ideal for fleet management and safety | Best for high-usage vehicles or critical operations |

TPMS provides a significant upgrade over the traditional approach of managing tire inflation. This system automatically monitors tire pressure and alerts drivers when levels drop below the recommended threshold. The primary advantage of TPMS is its ability to enhance safety by preventing the dangers associated with under-inflated tires, such as blowouts and compromised vehicle handling. However, the system does require some initial investment and regular monitoring to ensure its effectiveness. For businesses managing fleets, the long-term savings on tire replacements and fuel efficiency can justify the cost.

Automatic Tire Inflation Systems represent a technological advancement that continuously maintains tire pressure at optimal levels. By automatically adjusting tire inflation in real-time, ATIS minimizes the risks associated with both over and under-inflated tires. This system is especially beneficial for heavy-duty vehicles or fleets that operate under demanding conditions. While the upfront installation costs can be higher than traditional tire management methods, the reduction in maintenance needs and the extended lifespan of tires can lead to significant savings over time. ATIS is best suited for operations where tire performance directly impacts safety and efficiency.

Selecting the appropriate tire management solution involves evaluating the specific needs of your operation against the benefits and costs of each alternative. For businesses prioritizing safety and efficiency, investing in systems like TPMS or ATIS may provide long-term advantages that far outweigh the initial expenditures. Conversely, if cost is the primary concern and vehicle usage is not intensive, maintaining tires under inflated may be a temporary solution. Ultimately, a thorough analysis of your fleet’s operational demands, budget constraints, and safety standards will guide you in making the most effective choice.

Understanding the technical properties of under inflated tires is crucial for B2B buyers, particularly those in the automotive and transport sectors. Here are some critical specifications that influence tire performance and longevity:

Tire Pressure (PSI)

– Definition: Pounds per square inch (PSI) measures the air pressure within the tire.

– Importance: Maintaining the correct PSI is vital for optimal tire performance. Under inflated tires increase rolling resistance, leading to higher fuel consumption and potential safety hazards. Regular monitoring can prevent costly repairs and enhance vehicle efficiency.

Tread Depth

– Definition: The depth of the tire’s grooves, which affects traction and water displacement.

– Importance: Insufficient tread depth can exacerbate issues associated with under inflation, such as hydroplaning in wet conditions. B2B buyers must ensure that tires meet regulatory standards for tread depth to maintain safety and performance.

Load Index

– Definition: A numerical code that indicates the maximum load a tire can safely carry at a specified pressure.

– Importance: Selecting tires with the appropriate load index is critical for commercial vehicles that transport heavy loads. Under inflated tires can lead to excessive flexing and overheating, increasing the risk of tire failure.

Materialzusammensetzung

– Definition: The materials used in tire construction, including rubber compounds and reinforcing fabrics.

– Importance: High-quality materials enhance durability and resistance to wear. Under inflated tires can accelerate degradation, leading to premature tire replacement and increased operational costs.

Temperature Resistance

– Definition: The tire’s ability to withstand heat generated during operation.

– Importance: Under inflated tires generate more heat due to increased friction, potentially leading to blowouts. Understanding temperature resistance is vital for ensuring tire safety, especially in regions with extreme temperatures.

Tread Pattern

– Definition: The design of the tire’s surface that influences traction and handling.

– Importance: Certain tread patterns perform better under various conditions. Under inflated tires can distort these patterns, reducing grip and stability. B2B buyers should consider the tread design when selecting tires for specific applications.

Navigating the procurement process for tires requires familiarity with industry terminology. Here are some essential trade terms that B2B buyers should know:

OEM (Original Equipment Manufacturer)

– Definition: A company that produces parts or equipment that may be marketed by another manufacturer.

– Importance: Understanding OEM specifications is crucial when sourcing replacement tires to ensure compatibility with existing vehicles, which can affect safety and performance.

MOQ (Mindestbestellmenge)

– Definition: The smallest quantity of a product that a supplier is willing to sell.

– Importance: Knowing the MOQ helps businesses plan their inventory and manage cash flow effectively. Purchasing below the MOQ can lead to higher costs per unit.

RFQ (Request for Quotation)

– Definition: A document sent to suppliers requesting pricing and terms for specific products.

– Importance: An RFQ is essential for obtaining competitive pricing and ensuring that suppliers understand the specifications needed for tires, including size and performance characteristics.

Incoterms (Internationale Handelsklauseln)

– Definition: A series of pre-defined commercial terms published by the International Chamber of Commerce that clarify the responsibilities of buyers and sellers.

– Importance: Familiarity with Incoterms helps B2B buyers understand shipping responsibilities, costs, and risks associated with tire procurement, especially in international trade.

Gewährleistungsfrist

– Definition: The period during which a product is guaranteed against defects and performance issues.

– Importance: Understanding warranty terms can influence purchasing decisions, especially for high-volume buyers. A longer warranty may indicate higher confidence in product quality.

Vorlaufzeit

– Definition: The time it takes from placing an order to receiving the product.

– Importance: Knowing the lead time is crucial for inventory management and planning. Delays in tire deliveries can impact operations and logistics, affecting overall efficiency.

By grasping these technical properties and trade terms, B2B buyers can make informed decisions that enhance operational efficiency and safety in their tire procurement processes.

The global tire market is undergoing significant transformation, driven by various factors that impact sourcing and procurement strategies for B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe. One of the primary drivers is the increasing awareness of safety concerns associated with under-inflated tires. These concerns not only affect vehicle performance but also contribute to environmental issues such as increased fuel consumption and emissions. As a result, international regulations are tightening, pushing manufacturers to prioritize innovations in tire technology that enhance safety and efficiency.

Emerging technologies, such as predictive analytics and IoT (Internet of Things) systems, are becoming vital in monitoring tire health. These technologies enable real-time data collection on tire pressure and wear, allowing businesses to optimize maintenance schedules and reduce costs associated with under-inflated tires. B2B buyers are increasingly seeking suppliers who offer these advanced solutions as part of their product offerings.

Additionally, the rise of e-commerce platforms is reshaping how B2B buyers source tires. Online marketplaces provide access to a wider range of suppliers, allowing buyers to compare prices and quality from various manufacturers globally. This trend is particularly notable in regions like Africa and South America, where market access has traditionally been limited.

Sustainability is no longer a mere buzzword; it is a crucial factor influencing procurement decisions in the tire industry. The environmental impact of under-inflated tires is significant, contributing to higher carbon emissions due to increased fuel consumption. As global awareness of climate change intensifies, B2B buyers are prioritizing suppliers who adhere to sustainable practices.

Ethical sourcing is also gaining traction, with businesses increasingly focused on the integrity of their supply chains. Buyers are looking for manufacturers who utilize ‘green’ certifications and materials in their production processes. This includes the use of sustainable rubber and eco-friendly production methods that minimize waste and energy consumption. Companies that can demonstrate a commitment to sustainability not only enhance their brand reputation but also attract environmentally conscious customers.

Furthermore, the integration of sustainability into the supply chain can lead to cost savings. For instance, using high-quality, ethically sourced materials can result in longer-lasting tires, reducing the frequency of replacements and associated disposal issues.

The tire industry has undergone a significant evolution, particularly concerning the challenges posed by under-inflated tires. In the early days, tire technology was relatively basic, often leading to frequent issues with pressure maintenance. However, as vehicle safety standards improved and consumer awareness grew, manufacturers began investing heavily in research and development.

One notable advancement was the introduction of Tire Pressure Monitoring Systems (TPMS), which alert drivers to low tire pressure, significantly reducing the risks associated with under-inflation. This technology has become standard in many vehicles, reflecting a broader trend towards integrating technology into automotive safety.

Additionally, the development of more durable materials and innovative tire designs has enhanced performance and reduced wear associated with improper inflation. The evolution of tire technology is now a vital consideration for B2B buyers, who must stay informed about the latest advancements to ensure they are sourcing the safest and most efficient products available.

In conclusion, navigating the dynamics of the tire market requires a keen understanding of current trends, a commitment to sustainability, and an awareness of historical advancements that shape today’s procurement strategies. B2B buyers must leverage this knowledge to make informed decisions that align with their operational goals and sustainability objectives.

Illustrative image related to tires under inflated

How do I solve the issue of sourcing under-inflated tires for my fleet?

To address the challenge of sourcing under-inflated tires, it’s crucial to work with reliable suppliers who can provide accurate tire pressure data and maintenance guidelines. Establish a routine inspection protocol to ensure all tires are regularly checked for proper inflation levels. Additionally, consider investing in Tire Pressure Monitoring Systems (TPMS) to provide real-time data on tire conditions. Engage with manufacturers who offer training and resources on tire maintenance to enhance your team’s knowledge.

What is the best tire type for vehicles operating in humid climates?

For vehicles operating in humid climates, all-season tires are generally the best choice due to their versatility and ability to maintain grip in wet conditions. Look for tires with a high tread depth and water channeling capabilities to minimize the risk of hydroplaning. Additionally, consult with manufacturers who can provide tires specifically designed for high humidity, ensuring that they can handle the increased friction and heat often associated with under-inflation in such environments.

How can I verify the quality of tires before making a bulk purchase?

To verify tire quality, request detailed specifications and certifications from potential suppliers. Perform a thorough vetting process that includes checking for industry certifications, such as ISO or DOT compliance. Consider ordering a small sample batch to assess performance under your specific conditions. Additionally, seek reviews and testimonials from other businesses that have used the supplier’s products, ensuring they align with your quality standards.

What are the minimum order quantities (MOQ) for tires, and how does it vary by supplier?

Minimum order quantities (MOQ) for tires can vary significantly depending on the supplier and the type of tire. Typically, manufacturers may have MOQs ranging from 50 to several hundred units. Discuss your specific needs with suppliers to negotiate favorable terms. Some suppliers may offer flexibility for first-time buyers or for long-term partnerships, so it’s beneficial to establish a relationship and clarify your requirements upfront.

What payment terms should I expect when sourcing tires internationally?

When sourcing tires internationally, payment terms can vary widely. Common terms include upfront payment, 30% deposit with the balance on delivery, or letters of credit. It’s essential to negotiate terms that protect both parties, especially considering currency fluctuations and potential import duties. Ensure that payment methods are secure and documented to facilitate smooth transactions, and consider working with suppliers that offer trade financing options to ease cash flow.

How do I ensure compliance with international tire regulations?

To ensure compliance with international tire regulations, familiarize yourself with the specific standards applicable in your target markets. This may include certifications for safety, environmental impact, and performance metrics. Collaborate closely with suppliers who are knowledgeable about local regulations and can provide documentation proving compliance. Regular audits and checks can also help maintain adherence to these regulations throughout the supply chain.

What logistics considerations should I keep in mind when importing tires?

When importing tires, logistics considerations include shipping methods, freight costs, and lead times. Choose a reliable logistics partner experienced in handling tire shipments to navigate customs efficiently. Assess the best shipping method based on urgency and cost—air freight is faster but more expensive than ocean freight. Additionally, factor in warehousing needs upon arrival and any regional distribution challenges to ensure timely delivery to your end customers.

How can I customize tire orders to meet specific business needs?

Customizing tire orders begins with clear communication about your specific requirements, such as tread patterns, sizes, and load ratings. Work closely with suppliers who offer customization options and be prepared to discuss volume requirements for tailored solutions. Additionally, inquire about any available technology enhancements, such as improved durability or fuel efficiency features, that can be integrated into your tire order. Collaborating early in the design process can yield optimal results for your fleet’s needs.

Bereich: hendrickatlanta.com

Registriert: 2007 (18 Jahre)

Einleitung: Rick Hendrick Chevrolet Duluth offers tire services including inspections, replacements, and rotations. They emphasize the importance of maintaining properly inflated tires to avoid dangers such as total tire failure, costly vehicle damage, difficulty handling, and increased fuel consumption. The service center provides trusted tire service and frequently has service specials for new tires and tir…

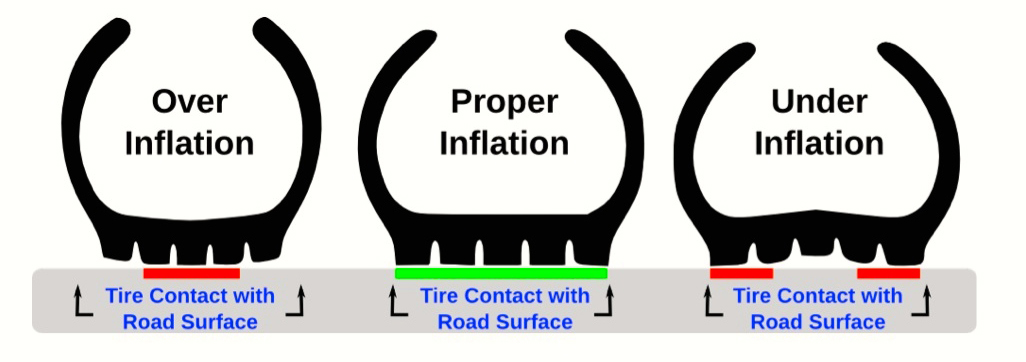

Bereich: reddit.de

Registriert: 2005 (20 Jahre)

Einleitung: Proper tire air pressure is crucial for vehicle safety and performance. Over-inflated tires reduce contact with the road, increasing stopping distance and risk of blowouts, while under-inflated tires can lead to loss of control and decreased gas mileage. Vehicle tire pressure information can typically be found on a sticker in the driver’s door jamb.

Bereich: eastcoasttoyota.com

Registriert: 2000 (25 Jahre)

Einleitung: The article discusses the hidden risks associated with overinflated and underinflated tires, emphasizing the importance of maintaining proper tire pressure for vehicle performance and safety. Key points include: 1. Uneven Tread Wear: Overinflated tires wear the center faster, while underinflated tires wear the outer edges, leading to costly replacements and alignment issues. 2. Reduced Vehicle Con…

Bereich: rnrtires.com

Registriert: 2006 (19 Jahre)

Einleitung: RNR Tire Express offers a range of tire and car-care services, including tire checks and replacements. They emphasize the importance of maintaining proper tire pressure to avoid dangers such as blowouts, compromised handling, extended braking distances, poor fuel efficiency, and uneven tire wear. Customers can visit their locations in Lubbock, TX for expert assistance and to browse their tire inve…

Driving on under-inflated tires poses significant risks not only to vehicle performance but also to overall safety and operational costs. Key takeaways for international B2B buyers include the importance of regular tire pressure monitoring to prevent uneven wear, costly repairs, and compromised vehicle control. Strategic sourcing of high-quality tires and maintenance services can mitigate these risks, ensuring reliability and efficiency in fleet operations.

Investing in optimal tire solutions will lead to improved fuel efficiency, reducing overall operational costs while enhancing safety standards. As markets in Africa, South America, the Middle East, and Europe evolve, the demand for reliable transportation solutions grows. By prioritizing quality and performance in tire sourcing, businesses can position themselves for sustainable growth and operational excellence.

Looking ahead, it is crucial for B2B buyers to engage with trusted suppliers who can provide not only products but also expert insights into tire maintenance and safety standards. Embrace proactive sourcing strategies to navigate the challenges of under-inflated tires effectively, ensuring your fleet remains safe, efficient, and competitive in an ever-changing marketplace.

Die in diesem Leitfaden enthaltenen Informationen, einschließlich der Angaben zu Herstellern, technischen Spezifikationen und Marktanalysen, dienen ausschließlich Informations- und Bildungszwecken. Sie stellen keine professionelle Kaufberatung, Finanzberatung oder Rechtsberatung dar.

Obwohl wir alle Anstrengungen unternommen haben, um die Richtigkeit und Aktualität der Informationen zu gewährleisten, übernehmen wir keine Verantwortung für etwaige Fehler, Auslassungen oder veraltete Informationen. Marktbedingungen, Unternehmensangaben und technische Standards können sich ändern.

Illustrative image related to tires under inflated

B2B-Käufer müssen ihre eigene unabhängige und gründliche Due-Diligence-Prüfung durchführen bevor Sie eine Kaufentscheidung treffen. Dazu gehört, dass Sie sich direkt mit den Anbietern in Verbindung setzen, Zertifizierungen überprüfen, Muster anfordern und sich professionell beraten lassen. Das Risiko, sich auf die Informationen in diesem Leitfaden zu verlassen, trägt allein der Leser.