In today’s competitive global market, sourcing under inflated tires can pose significant challenges for B2B buyers, particularly those operating in diverse regions such as Africa, South America, the Middle East, and Europe. The intricacies of tire performance, safety, and cost-efficiency necessitate a deep understanding of how under inflated tires impact vehicle operation and maintenance. This guide provides a comprehensive analysis of various tire types, their applications, and the critical importance of selecting the right suppliers.

By delving into the nuances of tire performance, potential hazards associated with under inflation, and the implications for fleet management, this resource empowers international buyers to make informed purchasing decisions. The guide also covers vital aspects such as supplier vetting criteria, cost analysis, and strategies for ensuring compliance with regional regulations.

With a focus on delivering actionable insights, this guide serves as a valuable tool for businesses looking to enhance their operational efficiency while minimizing risks associated with tire management. Whether you’re in Germany, Vietnam, or any other part of the world, understanding the dynamics of under inflated tires will not only improve safety but also contribute to significant cost savings in the long run.

| Typ Name | Wichtigste Unterscheidungsmerkmale | Primäre B2B-Anwendungen | Kurze Vor- und Nachteile für Käufer |

|---|---|---|---|

| Passenger Vehicle Tires | Standard tires designed for everyday road use | Fuhrparkmanagement, Vermietungsdienstleistungen | Vorteile: Cost-effective, widely available. Nachteile: Limited performance under heavy loads. |

| Light Truck Tires | Enhanced durability and load capacity for light trucks | Logistik, Lieferdienste | Vorteile: Better handling under load, improved stability. Nachteile: Higher initial cost than passenger tires. |

| Commercial Vehicle Tires | Designed for heavy-duty applications with reinforced sidewalls | Freight transport, construction | Vorteile: Long lifespan, enhanced safety. Nachteile: Heavier, may affect fuel efficiency. |

| Off-Road Tires | Aggressive tread patterns for traction in rugged conditions | Mining, agriculture | Vorteile: Superior grip, designed for rough terrains. Nachteile: Noisy on highways, higher wear rates. |

| Performance Tires | Specialized for high-speed stability and handling | Sports and luxury car markets | Vorteile: Enhanced responsiveness, better cornering. Nachteile: Quick wear, sensitive to inflation levels. |

Passenger vehicle tires are the most common type found in everyday vehicles. They are designed primarily for comfort and fuel efficiency rather than heavy load-bearing. These tires are suitable for urban and highway driving, making them ideal for fleet management and rental services. When purchasing, B2B buyers should consider the availability of replacement options and the cost-effectiveness of bulk purchasing. While they offer a good balance of performance and price, they may not be suitable for vehicles that frequently carry heavy loads.

Light truck tires are built to withstand the rigors of carrying heavier loads while providing improved handling. These tires are essential for logistics and delivery services where reliability is key. They typically feature reinforced sidewalls and tread patterns designed for better traction. B2B buyers should evaluate their specific load requirements and consider the initial investment against the potential for longer tire life. While they may come with a higher price tag, their durability can lead to cost savings over time.

Commercial vehicle tires are engineered for heavy-duty applications, such as freight transport and construction. These tires are characterized by their robust construction and enhanced safety features, ensuring they can handle the demands of commercial use. For B2B buyers, the focus should be on the tire’s lifespan and performance under heavy loads. Although they may be heavier and can impact fuel efficiency, their longevity and reliability make them a wise investment for businesses requiring consistent performance.

Off-road tires are specifically designed for rugged terrains and challenging conditions. Their aggressive tread patterns provide superior grip, making them essential for industries like mining and agriculture. Buyers in these sectors should consider the trade-off between performance and wear rates, as off-road tires tend to wear faster on paved surfaces. While they excel in off-road conditions, B2B buyers must account for the noise and potential comfort issues when used on highways.

Performance tires are tailored for high-speed stability and enhanced handling, making them ideal for the sports and luxury car markets. They offer a significant advantage in responsiveness and cornering capabilities, which is crucial for businesses focused on delivering high-performance vehicles. However, these tires can wear quickly and require careful monitoring of inflation levels. B2B buyers should weigh the benefits of performance against the potential for increased maintenance and replacement costs.

Illustrative image related to under inflated tire

| Industrie/Sektor | Specific Application of Under Inflated Tire | Wert/Nutzen für das Unternehmen | Wichtige Überlegungen zur Beschaffung für diese Anwendung |

|---|---|---|---|

| Transport und Logistik | Fleet Management for Delivery Vehicles | Reduced fuel consumption and maintenance costs | Durable tire options suitable for diverse terrains |

| Landwirtschaft | Agricultural Machinery (e.g., tractors) | Improved traction and reduced soil compaction | Tires designed for heavy loads and rough terrains |

| Bauwesen | Heavy Equipment (e.g., bulldozers, excavators) | Enhanced stability and control on uneven surfaces | High-load capacity tires with robust sidewall protection |

| Mining | Mining Trucks | Increased safety and reduced risk of blowouts | Heavy-duty tires that withstand harsh conditions |

| Automotive Service | Tire Replacement and Maintenance Services | Longer tire lifespan and improved vehicle safety | Access to reliable tire monitoring systems and tools |

In the transportation and logistics sector, under inflated tires can significantly impact fleet management, especially for delivery vehicles. When tires are not inflated to the optimal pressure, they increase rolling resistance, leading to higher fuel consumption. By ensuring proper tire inflation, companies can achieve substantial savings on fuel costs and reduce the frequency of maintenance. International buyers should consider sourcing durable tire options that can withstand diverse terrains, particularly in regions like Africa and South America where road conditions may vary widely.

In agriculture, under inflated tires are often utilized in heavy machinery, such as tractors. Proper tire inflation is crucial as it enhances traction while minimizing soil compaction, which can adversely affect crop yields. Under inflated tires allow agricultural equipment to navigate uneven fields more effectively. Buyers in this sector should prioritize tires designed for heavy loads and rough terrains, ensuring they can withstand the demands of agricultural work in various environments, including the Middle East and Europe.

The construction industry relies heavily on heavy equipment like bulldozers and excavators, where under inflated tires play a vital role. Tires that are properly inflated contribute to enhanced stability and control on uneven surfaces, reducing the risk of accidents. This is particularly important for construction sites that may have challenging terrain. For international buyers, sourcing high-load capacity tires with robust sidewall protection is essential to ensure safety and efficiency on the job site.

In the mining sector, under inflated tires are critical for mining trucks operating in rugged environments. Proper tire inflation is essential for safety, as under inflated tires are more prone to blowouts, which can lead to costly downtime and hazardous situations. Mining companies should focus on sourcing heavy-duty tires that can withstand harsh conditions and heavy loads, especially in regions with extreme weather and terrain challenges like South America and Africa.

In the automotive service industry, understanding the implications of under inflated tires is essential for tire replacement and maintenance services. Properly inflated tires lead to longer lifespan and improved safety for vehicles, which is a significant selling point for service providers. Access to reliable tire monitoring systems and tools is vital for automotive businesses to ensure their clients maintain optimal tire pressure, enhancing customer satisfaction and safety. International buyers should look for quality tire service equipment that meets local standards and regulations.

Illustrative image related to under inflated tire

Das Problem: B2B buyers operating fleets often face significant operational costs associated with fuel inefficiency due to under inflated tires. When tires are not inflated to the manufacturer’s recommended pressure, the rolling resistance increases, forcing the engine to work harder. This not only leads to higher fuel consumption but also results in frequent refueling, which can strain budgets and disrupt logistics planning. The ripple effect of these added costs can impact overall profitability, particularly for businesses operating in competitive markets where every expense counts.

Die Lösung: To combat this issue, businesses should implement a proactive tire maintenance program that includes regular tire pressure checks. Investing in a Tire Pressure Monitoring System (TPMS) can automate this process, providing real-time data on tire inflation levels. Additionally, educate drivers on the importance of maintaining proper tire pressure and encourage them to perform routine inspections. Consider creating a schedule for monthly tire checks and integrating these checks into your fleet’s maintenance routine. This approach not only reduces fuel costs but also extends the lifespan of the tires, leading to further savings.

Das Problem: Under inflated tires significantly compromise vehicle control, posing safety risks for drivers and cargo. For B2B buyers managing transportation services, the consequences of accidents or near-misses can lead to liability issues, increased insurance costs, and damage to the company’s reputation. Under inflated tires can result in longer stopping distances and decreased handling responsiveness, especially in emergency situations. This scenario is particularly critical in regions with challenging driving conditions, such as heavy rains or rough terrains, where optimal tire performance is essential.

Illustrative image related to under inflated tire

Die Lösung: Implementing a comprehensive driver training program focused on vehicle safety and tire maintenance can be instrumental in mitigating this risk. Provide training that emphasizes the signs of under inflated tires, such as poor handling or unusual noises, and encourage drivers to report any abnormalities immediately. Additionally, establishing a partnership with a reliable tire service provider can ensure that your fleet receives timely inspections and necessary adjustments. Consider investing in high-quality tires that are designed to perform well under varying conditions, which can enhance safety and reduce the likelihood of accidents.

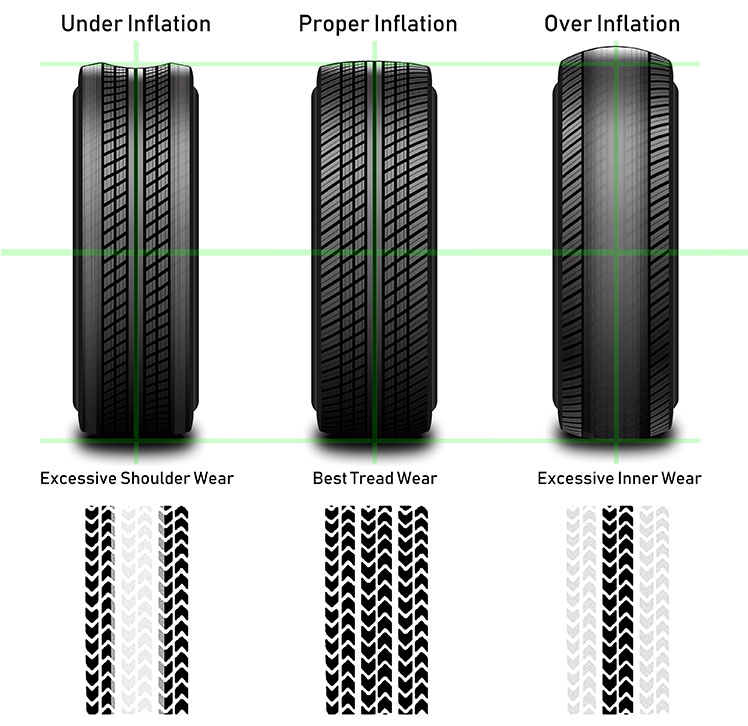

Das Problem: Under inflated tires lead to uneven tread wear, which is a common pain point for businesses managing fleets. When tires wear unevenly, it not only necessitates more frequent replacements but also affects vehicle alignment, leading to additional wear on suspension components. For B2B buyers, this results in escalating maintenance costs and potentially unexpected downtime, which can disrupt operations and impact service delivery. In industries where timely deliveries are critical, such maintenance issues can be detrimental to customer satisfaction.

Die Lösung: To address uneven wear and extend the life of your tires, implement a tire rotation schedule as part of your routine maintenance plan. Regularly rotating tires can help distribute wear more evenly and enhance performance. Educating fleet managers on the importance of monitoring tire pressure and recognizing early signs of uneven wear is crucial. Additionally, consider utilizing tire alignment services as part of your preventive maintenance strategy. By investing in quality tires and ensuring they are properly inflated and maintained, companies can mitigate the risk of costly repairs and downtime, ultimately leading to improved operational efficiency.

When selecting materials for tires that may be subjected to under-inflation, it is essential to consider properties such as temperature and pressure ratings, durability, and corrosion resistance. The following analysis examines four common materials used in tire manufacturing, focusing on their advantages and disadvantages from a B2B perspective.

Natural rubber is a traditional material used in tire manufacturing. It offers excellent elasticity and resilience, which helps maintain tire shape even under varying pressure conditions.

Wichtige Eigenschaften: Natural rubber has a high tensile strength and can withstand moderate temperatures, typically up to 80°C. Its inherent flexibility allows for better performance under low-pressure conditions.

Pro und Kontra: While natural rubber is durable and provides a comfortable ride, it can degrade under UV exposure and ozone, leading to cracking over time. Additionally, its cost can be higher than synthetic alternatives, which may affect pricing strategies for B2B buyers.

Auswirkungen auf die Anwendung: Natural rubber is compatible with various media, including air and moisture, making it suitable for diverse environments.

Überlegungen für internationale Einkäufer: Compliance with ASTM and DIN standards is crucial, especially in regions like Europe, where regulations are stringent. Buyers should also consider the availability of natural rubber, which may vary by region.

Synthetic rubber, such as styrene-butadiene rubber (SBR), is widely used in tire production due to its versatility and cost-effectiveness.

Wichtige Eigenschaften: SBR exhibits excellent abrasion resistance and can handle temperatures ranging from -40°C to 100°C. Its chemical stability also makes it less prone to degradation compared to natural rubber.

Pro und Kontra: Synthetic rubber is generally less expensive than natural rubber and offers consistent quality. However, it may not provide the same level of elasticity, which can affect performance under low-pressure conditions.

Auswirkungen auf die Anwendung: SBR is compatible with air and various chemicals, making it suitable for tires used in different environments.

Überlegungen für internationale Einkäufer: Buyers in regions like Africa and South America should be aware of local sourcing and manufacturing capabilities, as synthetic rubber can be produced locally, reducing transportation costs.

Steel belts are often incorporated into tire designs to improve strength and durability.

Wichtige Eigenschaften: Steel belts provide high tensile strength and excellent resistance to punctures and impacts. They can withstand high pressures, making them ideal for tires that may experience under-inflation.

Pro und Kontra: The inclusion of steel belts enhances tire stability and performance but increases manufacturing complexity and cost. Additionally, if not properly coated, steel can corrode, leading to potential tire failure.

Auswirkungen auf die Anwendung: Steel belts are compatible with various tire compounds and enhance overall tire performance, especially in demanding conditions.

Überlegungen für internationale Einkäufer: Compliance with safety standards is paramount, particularly in Europe and the Middle East. Buyers should ensure that steel belts meet local regulations to avoid liability issues.

Illustrative image related to under inflated tire

Reinforced fabrics, such as polyester or nylon, are often used in tire construction to enhance strength and flexibility.

Wichtige Eigenschaften: These fabrics provide excellent tensile strength and resistance to wear and tear, withstanding pressures up to 80 PSI.

Pro und Kontra: Reinforced fabrics improve tire durability and performance but can add to manufacturing complexity and cost. Additionally, they may not provide the same level of heat resistance as rubber materials.

Illustrative image related to under inflated tire

Auswirkungen auf die Anwendung: These fabrics are compatible with various tire compounds and enhance overall tire performance, particularly in high-load situations.

Überlegungen für internationale Einkäufer: Buyers should be aware of local fabric sourcing options and compliance with international standards, particularly in Europe and the Middle East, where regulations may dictate specific fabric types.

| Material | Typical Use Case for Under Inflated Tire | Hauptvorteil | Wesentlicher Nachteil/Beschränkung | Relative Kosten (niedrig/mittel/hoch) |

|---|---|---|---|---|

| Natural Rubber | Standard passenger and light truck tires | Excellent elasticity and comfort | UV-Zersetzung im Laufe der Zeit | Mittel |

| Synthetic Rubber (SBR) | All-weather and performance tires | Cost-effective and consistent quality | Lower elasticity than natural rubber | Niedrig |

| Steel Belts | Heavy-duty and performance tires | High tensile strength and puncture resistance | Increased cost and corrosion risk | Hoch |

| Reinforced Fabrics | High-load and durable tires | Enhanced durability and flexibility | Added manufacturing complexity | Mittel |

This strategic material selection guide provides valuable insights for B2B buyers considering the implications of tire materials in under-inflation scenarios. Understanding the properties, advantages, and limitations of each material can help in making informed purchasing decisions that align with regional compliance and performance standards.

Illustrative image related to under inflated tire

The manufacturing process of tires, particularly those that may become under-inflated, involves several critical stages: material preparation, forming, assembly, and finishing. Each of these stages requires precise execution to ensure that the final product meets safety and performance standards.

The first step in tire manufacturing is the preparation of raw materials. Tires are made from a combination of natural and synthetic rubbers, fabric materials, and steel. The rubber is typically compounded with various additives, including carbon black, sulfur, and chemicals that enhance durability and flexibility. The quality of these raw materials is crucial, as inferior materials can lead to tires that are more susceptible to under-inflation and related failures.

Once the materials are selected, they undergo a quality inspection to ensure they meet the required specifications. This stage may involve checking for consistency in the rubber’s chemical composition and physical properties.

Illustrative image related to under inflated tire

The forming stage involves creating the different components of the tire, such as the tread, sidewalls, and inner liner. This is usually accomplished through a combination of extrusion and calendering processes.

After forming, each component is carefully inspected to ensure it meets quality standards before moving on to the assembly stage.

During assembly, the various components are brought together to create the tire. The inner liner, which is crucial for maintaining air pressure, is first placed onto a tire building machine. Next, the steel belts and the tread are added, followed by the sidewalls.

The assembly process is a critical point for quality assurance, as the tires must be constructed correctly to avoid issues like uneven wear or compromised structural integrity, which can lead to under-inflation.

Once the tire is assembled, it undergoes a finishing process that includes curing. Curing involves placing the tire in a mold and subjecting it to heat and pressure, which allows the rubber to vulcanize. This process enhances the tire’s strength and elasticity.

After curing, the tires are once again subjected to quality inspections, including visual checks and measurements to ensure conformity to specifications. Any tires that do not meet the standards are discarded or reworked.

Illustrative image related to under inflated tire

Quality control (QC) is paramount in tire manufacturing, especially given the safety implications of under-inflated tires. Manufacturers adhere to several international and industry-specific standards to ensure product reliability.

Many tire manufacturers comply with ISO 9001, a globally recognized standard for quality management systems. This standard ensures that the manufacturers maintain consistent quality throughout their production processes.

In addition to ISO standards, other certifications, such as the European CE marking and the American Tire and Rubber Association (ATRA) specifications, provide additional assurance that the tires meet specific safety and performance criteria.

Illustrative image related to under inflated tire

Quality control checkpoints are strategically placed throughout the manufacturing process:

These checkpoints help to identify and rectify any issues before the tires reach the market, minimizing the risk of under-inflation and related failures.

For B2B buyers, particularly those in international markets such as Africa, South America, the Middle East, and Europe, verifying a supplier’s quality control processes is crucial.

Lieferanten-Audits: Conducting audits can provide firsthand insight into a manufacturer’s quality control practices. Buyers should look for evidence of compliance with ISO 9001 and other relevant standards during these audits.

Qualitätsberichte: Requesting detailed quality reports from suppliers can help buyers understand their manufacturing and QC processes. These reports should include metrics on defect rates, testing results, and compliance with standards.

Inspektionen durch Dritte: Utilizing third-party inspection services can offer an unbiased evaluation of a manufacturer’s quality control measures. These organizations can perform inspections at various stages of the production process.

Certifications and Accreditations: Buyers should ensure that suppliers possess the necessary certifications and accreditations that demonstrate adherence to quality standards. Checking for compliance with international standards can help mitigate risks.

International buyers must be aware of specific nuances when dealing with suppliers from different regions. Factors such as local regulations, cultural differences in business practices, and varying standards can impact quality assurance processes.

For instance, European suppliers may have stricter regulations regarding tire safety and performance compared to those in other regions. Buyers should familiarize themselves with these differences to ensure that the products they source will meet local regulatory requirements and customer expectations.

By understanding the manufacturing processes and quality assurance practices for tires, B2B buyers can make informed decisions, ensuring they procure high-quality products that minimize the risks associated with under-inflated tires.

In the realm of vehicle maintenance, ensuring proper tire inflation is paramount for safety, efficiency, and longevity. This practical sourcing guide serves as a step-by-step checklist for B2B buyers looking to address the issue of under-inflated tires. By following these guidelines, businesses can enhance their procurement process and ensure they are making informed decisions.

Understanding your specific tire requirements is essential. Consider factors such as vehicle type, load capacity, and operating conditions. This assessment will guide you in selecting the right tire specifications, ensuring they meet both safety and performance standards.

Illustrative image related to under inflated tire

Defining a clear budget is critical for successful procurement. Take into account not only the initial cost of the tires but also potential long-term savings associated with fuel efficiency and reduced maintenance costs. This comprehensive financial view will help you make a cost-effective decision.

When sourcing tires, it’s vital to partner with reputable suppliers. Research potential vendors by examining their market presence, customer reviews, and product offerings. Prioritize suppliers with a proven track record in tire performance and customer service.

Before making a purchase, confirm that the tires meet the required specifications for your vehicles. Check for the appropriate tire pressure ratings, tread design, and durability features.

A solid warranty can provide peace of mind and financial protection against premature tire failure. Investigate the warranty terms offered by suppliers, including coverage duration and what it entails.

Consider the logistics of tire delivery, as timely procurement is crucial for maintaining fleet operations. Discuss shipping options and lead times with potential suppliers.

Illustrative image related to under inflated tire

Before fully committing to a large order, consider implementing a trial period with a smaller batch of tires. This will allow you to assess their performance and compatibility with your fleet.

By following this structured checklist, B2B buyers can effectively navigate the complexities of sourcing tires, particularly when addressing the critical issue of under-inflation. This proactive approach not only enhances vehicle safety but also promotes operational efficiency and cost savings.

Understanding the cost structure of sourcing under inflated tires is crucial for B2B buyers looking to optimize their procurement strategy. The primary components of cost include:

Materialien: The cost of raw materials, such as rubber and synthetic compounds, forms the foundation of tire pricing. The quality of these materials directly influences performance, longevity, and safety.

Arbeit: Labor costs encompass both skilled and unskilled workforce expenses involved in manufacturing tires. This can vary significantly based on the region, with countries in Africa and South America generally having lower labor costs compared to Europe.

Fertigungsgemeinkosten: This includes utilities, facility maintenance, and other indirect costs associated with tire production. Effective management of these overheads can lead to more competitive pricing.

Werkzeugbau: Initial setup costs for molds and machinery can be substantial. These costs are amortized over the production volume, making them a critical factor in determining unit pricing.

Qualitätskontrolle (QC): Investing in robust QC processes ensures that tires meet safety and performance standards. While this adds to upfront costs, it ultimately reduces liability and enhances brand reputation.

Logistik: Transportation and warehousing costs vary based on the sourcing location and destination. Efficient logistics can mitigate costs, especially for international shipments.

Marge: Suppliers typically include a profit margin that varies based on market conditions, competition, and perceived value.

Several factors can influence pricing in the sourcing of under inflated tires:

Volumen/MOQ: Buying in bulk can lead to significant discounts. Establishing minimum order quantities (MOQs) is essential for negotiating favorable terms.

Spezifikationen und Anpassungen: Tires made to specific requirements or with unique features may incur additional costs. Buyers should assess whether these enhancements are necessary for their operations.

Materials Quality and Certifications: Higher-quality materials and certifications (e.g., ISO, DOT) may increase costs but provide assurances of safety and performance.

Lieferanten-Faktoren: The reputation and reliability of suppliers can affect pricing. Established suppliers may charge more for their experience and quality assurance.

Incoterms: Understanding the terms of shipping and delivery (Incoterms) is vital. They dictate who bears the costs and risks at various stages of the supply chain, impacting overall pricing.

For international B2B buyers, particularly from Africa, South America, the Middle East, and Europe, the following strategies can enhance cost-efficiency in sourcing under inflated tires:

Bedingungen verhandeln: Engage suppliers in discussions about pricing, payment terms, and delivery schedules. Flexibility can lead to better deals.

Berücksichtigen Sie die Gesamtbetriebskosten (Total Cost of Ownership, TCO): Assess not just the purchase price but also the long-term costs associated with tire performance, maintenance, and potential liabilities from under inflated tires.

Nuancen der Preisgestaltung verstehen: Prices can fluctuate based on global demand, geopolitical factors, and currency exchange rates. Staying informed about these dynamics can aid in timing purchases effectively.

Beziehungen nutzen: Building long-term relationships with suppliers can lead to better pricing and service over time. Trust and reliability are valuable assets in B2B transactions.

Due to the myriad factors influencing tire pricing, including market volatility and changes in raw material costs, it is crucial to provide disclaimers for indicative prices. This transparency ensures that buyers understand the potential for fluctuations and can plan their budgets accordingly. Regular communication with suppliers can provide updates on pricing trends and adjustments, helping buyers stay informed and prepared.

In the realm of tire management, the risks associated with under inflated tires are well-documented. However, there are various alternatives and solutions that can enhance vehicle safety, efficiency, and overall performance. This section delves into a comparative analysis of under inflated tires against alternative solutions, highlighting their pros and cons to assist B2B buyers in making informed decisions.

| Vergleich Aspekt | Under Inflated Tire | Tire Pressure Monitoring Systems (TPMS) | Automatic Tire Inflation Systems (ATIS) |

|---|---|---|---|

| Leistung | Reduced traction, longer stopping distances | Real-time pressure monitoring, alerts for low pressure | Maintains optimal pressure automatically, minimizes risks |

| Kosten | Low initial cost, but high long-term repair costs | Moderate initial investment, low maintenance | Higher upfront cost, long-term savings on fuel and tire wear |

| Leichte Implementierung | Common practice, minimal effort required | Requires installation, but easy to use | More complex installation, but automated once set up |

| Wartung | Requires regular checks to avoid issues | Minimal ongoing maintenance, requires battery checks | Low maintenance, periodic system checks needed |

| Bester Anwendungsfall | Suitable for short-term, low-speed applications | Ideal for fleets and long-distance travel | Best for commercial vehicles with high usage |

TPMS provides real-time monitoring of tire pressure, alerting drivers when levels fall below recommended thresholds. This proactive approach can significantly reduce the risks associated with under inflation, such as blowouts and poor vehicle handling. The major advantage of TPMS is its ability to enhance safety without requiring constant manual checks. However, the initial installation costs can be moderate, and users must ensure that batteries are regularly checked to maintain functionality. Overall, TPMS is an excellent solution for businesses that prioritize safety and efficiency in fleet management.

ATIS is an advanced solution designed to automatically maintain optimal tire pressure while the vehicle is in operation. This system minimizes the risks associated with both under and over inflation, leading to improved fuel efficiency and tire lifespan. Although the upfront investment is higher than traditional methods, ATIS can lead to significant savings over time through reduced fuel costs and lower tire replacement frequency. The complexity of installation may deter some users, but for commercial fleets or heavy-duty vehicles, the long-term benefits far outweigh the initial challenges.

When evaluating the best approach for tire management, B2B buyers must consider their unique operational needs, budget constraints, and safety priorities. While under inflated tires may seem like a cost-effective solution in the short term, the long-term implications on vehicle performance and maintenance can lead to significant expenses. Alternatives like TPMS and ATIS offer enhanced safety and efficiency, making them worthwhile investments for companies aiming to optimize their vehicle fleets. By weighing the pros and cons of each option, businesses can select the most suitable solution that aligns with their operational goals and ensures the safety of their vehicles on the road.

Understanding the technical specifications of under inflated tires is crucial for B2B buyers, particularly those in the automotive and transportation sectors. Here are some essential properties to consider:

Tire pressure, measured in pounds per square inch (PSI), is critical for optimal performance. Under inflated tires typically operate below the manufacturer’s recommended PSI, leading to increased friction and heat buildup. For B2B buyers, maintaining the correct tire pressure is essential not only for safety but also for minimizing maintenance costs and extending tire life.

Tread depth is a measure of the thickness of the tire tread, which affects traction and handling. Under inflated tires can cause uneven tread wear, often leading to premature tire replacement. This is particularly important for fleet operators who must manage operational costs effectively, as maintaining proper tread depth can significantly impact vehicle safety and fuel efficiency.

The load index indicates the maximum weight a tire can safely support when properly inflated. Under inflation can reduce this capacity, increasing the risk of tire failure. For businesses that transport goods, understanding the load index helps in selecting the right tires for their vehicles, ensuring compliance with safety standards and reducing liability risks.

Rolling resistance is the energy lost as a tire rolls, influenced by its inflation level. Under inflated tires exhibit higher rolling resistance, which can lead to increased fuel consumption. For B2B buyers, especially in logistics, reducing rolling resistance translates into significant fuel savings and improved operational efficiency.

Illustrative image related to under inflated tire

Tires are designed to operate within specific temperature ranges. Under inflated tires can overheat due to excessive flexing, leading to blowouts. It is vital for businesses to consider the temperature rating of tires, especially in regions with extreme climates, to avoid potential safety hazards and costly downtimes.

Familiarity with industry jargon is essential for B2B buyers in navigating tire procurement effectively. Here are several key terms:

OEM refers to the manufacturer of the original components of a vehicle. When sourcing tires, businesses often seek OEM specifications to ensure compatibility and performance. Understanding OEM standards helps in maintaining vehicle integrity and optimizing performance.

MOQ represents the smallest quantity of a product that a supplier is willing to sell. For B2B buyers, knowing the MOQ is crucial for managing inventory and ensuring that procurement aligns with operational needs without incurring excess costs.

An RFQ is a document issued by buyers to suppliers requesting pricing and terms for specific products or services. In the context of tire procurement, issuing an RFQ allows businesses to compare offers and negotiate better terms, ensuring cost-effectiveness.

Incoterms are a series of predefined commercial terms used in international trade to clarify the responsibilities of buyers and sellers. Understanding these terms is vital for B2B buyers involved in cross-border tire procurement, as they dictate shipping responsibilities and cost allocations.

TPMS is a safety feature that alerts drivers when tire pressure is below the recommended level. For fleet managers, incorporating vehicles with TPMS can significantly reduce the risk of operating under inflated tires, thereby enhancing safety and reducing maintenance costs.

Warranty terms outline the coverage provided by tire manufacturers for defects or performance issues. Understanding these terms is essential for B2B buyers to ensure they are adequately protected against potential losses due to under inflated tires or other related issues.

By grasping these technical properties and trade terminologies, B2B buyers can make informed decisions, optimize their procurement strategies, and enhance overall operational efficiency.

The global market for tires, particularly under inflated tires, is witnessing significant shifts driven by various factors. One of the primary drivers is the increasing awareness around vehicle safety and maintenance. Businesses in Africa, South America, the Middle East, and Europe are more focused on ensuring optimal tire pressure to avoid the risks associated with under inflated tires, such as blowouts and increased fuel consumption. Additionally, the rise in e-commerce and digital sourcing platforms is enabling B2B buyers to easily access tire maintenance services and products, streamlining the supply chain for tire procurement.

Emerging technologies, such as tire pressure monitoring systems (TPMS), are becoming standard in new vehicles and are influencing buyer preferences. These systems not only alert drivers to low tire pressure but also facilitate data collection that can be leveraged for predictive maintenance. Moreover, the growing trend towards fleet management solutions is pushing businesses to adopt tire monitoring technologies, which can enhance vehicle performance and reduce operational costs.

In terms of market dynamics, international B2B buyers are increasingly looking for suppliers that can provide comprehensive tire solutions, including installation, maintenance, and real-time monitoring. The competitive landscape is also evolving, with suppliers focusing on innovation and customer service to differentiate themselves. Buyers are now seeking partnerships that offer value-added services, which can significantly impact their sourcing decisions.

The environmental impact of tire production and disposal is a growing concern within the B2B sector. Buyers are increasingly prioritizing sustainability in their sourcing decisions, pushing manufacturers to adopt eco-friendly practices. This includes the use of sustainable materials in tire production, such as recycled rubber and bio-based materials, which can significantly reduce the carbon footprint associated with under inflated tires.

Ethical sourcing is also becoming paramount as consumers demand transparency in supply chains. B2B buyers are looking for suppliers who can provide certifications that demonstrate their commitment to sustainable practices, such as ISO 14001 for environmental management or certifications related to responsible sourcing. By choosing partners with these credentials, businesses can enhance their brand reputation and align with global sustainability goals.

Moreover, the shift towards circular economy principles is influencing the tire industry. Many manufacturers are exploring options for tire retreading and recycling, which not only extends the life of tires but also minimizes waste. B2B buyers are encouraged to consider suppliers who actively participate in these initiatives, as this can lead to cost savings and a reduced environmental impact.

The under inflated tire issue has evolved significantly over the decades. Initially, tire technology was primarily focused on durability and cost-efficiency, often neglecting the importance of proper inflation. However, as vehicle safety standards tightened and consumer awareness increased, the focus shifted towards the implications of under inflated tires on vehicle performance and safety.

In the late 20th century, the introduction of tire pressure monitoring systems marked a pivotal change in how tire inflation was managed. This technology not only improved safety but also prompted manufacturers to innovate in tire design, leading to better performance metrics. Today, the conversation around under inflated tires is intrinsically linked to broader themes of sustainability and efficiency, reflecting the changing landscape of the automotive industry and the demands of B2B buyers globally.

How do I solve the problem of under-inflated tires in my fleet?

To address under-inflated tires in your fleet, implement a regular tire maintenance schedule. This should include monthly pressure checks and visual inspections for signs of wear or damage. Utilize Tire Pressure Monitoring Systems (TPMS) to alert drivers about low tire pressure in real-time. Additionally, train your drivers on the importance of tire maintenance and establish protocols for reporting issues immediately. This proactive approach not only enhances safety but also extends the lifespan of your tires and reduces fuel consumption.

What is the best way to source under-inflated tire solutions for my business?

When sourcing solutions related to under-inflated tires, prioritize suppliers who offer comprehensive tire management programs. Look for vendors that provide high-quality tires, maintenance services, and technology solutions like TPMS. Research suppliers’ reputations through industry reviews and ratings. Additionally, consider those with experience in your specific market, such as Africa, South America, or Europe, as they will better understand regional conditions and regulations, ensuring you receive tailored solutions.

What are the common signs of under-inflated tires that I should monitor?

Common signs of under-inflated tires include uneven tread wear, decreased fuel efficiency, and a noticeable drop in vehicle handling. Look for flapping noises when driving, longer stopping distances, and the activation of the Tire Pressure Monitoring System (TPMS) warning light. Regular inspections can help catch these issues early, allowing for timely interventions that prevent further damage and ensure safety for drivers and cargo.

How can I ensure the quality of tires sourced internationally?

To ensure the quality of tires sourced from international suppliers, conduct thorough supplier vetting. This includes checking certifications, quality assurance processes, and compliance with international safety standards. Request samples for testing and review previous client testimonials or case studies. Establish clear quality metrics in your contracts and consider regular audits to monitor compliance with these standards throughout the supply chain.

What minimum order quantity (MOQ) should I expect for under-inflated tires?

Minimum order quantities (MOQs) for under-inflated tires can vary significantly depending on the supplier and the type of tire. Typically, MOQs can range from a few dozen to several hundred units. It’s essential to discuss your specific needs with potential suppliers and negotiate terms that align with your business model. Consider consolidating orders with other products to meet MOQ requirements without overcommitting to inventory.

What payment terms are common when sourcing tires internationally?

Common payment terms for international tire sourcing include letters of credit, wire transfers, and payment upon delivery. Some suppliers may offer net terms, allowing you to pay within a specified period post-delivery. It’s crucial to negotiate terms that provide both security and flexibility. Ensure clarity in contracts regarding payment schedules, currency fluctuations, and potential penalties for late payments to avoid misunderstandings.

How can I manage logistics for importing tires from overseas?

Effective logistics management for importing tires involves selecting reliable shipping partners and understanding customs regulations in your destination country. Collaborate with freight forwarders experienced in tire shipments to optimize shipping routes and costs. Ensure all necessary documentation, such as bills of lading and customs declarations, is prepared in advance. Establish a clear timeline for delivery and consider warehousing options to manage inventory effectively upon arrival.

What customization options are available for tires sourced from suppliers?

Customization options for tires can include variations in tread patterns, rubber compounds, and sizes to suit specific vehicle types or regional conditions. Some suppliers may offer branding options, allowing you to print your logo or brand name on the tires. Discuss your requirements with suppliers early in the sourcing process to explore available options and ensure that the customized tires meet your performance and safety standards.

Bereich: hendrickatlanta.com

Registriert: 2007 (18 Jahre)

Einleitung: Rick Hendrick Chevrolet Duluth offers tire service including inspections, replacements, and rotations. The service center emphasizes the dangers of driving on under inflated tires, which can lead to total tire failure, costly vehicle damage, difficulty handling, and increased fuel consumption. Symptoms of under inflated tires include TPMS alerts, poor fuel economy, unusual noises, decreased steeri…

Bereich: reddit.de

Registriert: 2005 (20 Jahre)

Einleitung: Tire inflation recommendations for a 2025 Rogue SL: 33 psi front and 30 psi rear. Discussion on over-inflation (4 psi over) and under-inflation effects on tire wear, handling, and safety. Over-inflation can lead to blowouts and jittery handling, while under-inflation decreases handling, increases wear, and can also cause blowouts. General consensus suggests that maintaining tire pressure between 3…

Bereich: eastcoasttoyota.com

Registriert: 2000 (25 Jahre)

Einleitung: The text discusses the hidden risks associated with overinflated and underinflated tires, emphasizing the importance of maintaining proper tire pressure for vehicle performance and safety. Key points include: 1. Uneven tread wear leading to costly replacements and alignment issues. 2. Reduced vehicle control affecting grip and responsiveness. 3. Increased risk of blowouts due to improper inflation…

Bereich: guerrallp.com

Registered: 2024 (1 years)

Einleitung: Driving on underinflated tires poses significant dangers, including increased likelihood of tire-related accidents, overheating, failure, longer stopping distances, and adverse effects on handling and tread life. A study by the NHTSA found that vehicles with tires under-inflated by at least 25% are three times more likely to be involved in accidents. Under-inflation causes tires to age 32% faster,…

Bereich: rnrtires.com

Registriert: 2006 (19 Jahre)

Einleitung: RNR Tire Express offers a range of tire-related services and products, including tire pressure checks, tire replacements, and a variety of tire inventory. They emphasize the importance of maintaining proper tire inflation to ensure safety and performance, highlighting the dangers of underinflated tires such as increased risk of blowouts, compromised handling, extended braking distances, poor fuel …

Bereich: michelinman.com

Registriert: 2001 (24 Jahre)

Einleitung: Michelin offers a complete range of tires for various mobility needs, including passenger cars, SUVs, light commercial vehicles, electric and hybrid vehicles, motorcycles, and bicycles. Their tire families include CrossClimate, Defender, Pilot Sport, Primacy, LTX, X Ice, Energy™, Latitude Sport, Pilot Alpin, and Premier. Michelin also provides specialized tires for classic cars and motorsport. The…

In addressing the critical issue of under-inflated tires, international B2B buyers must prioritize strategic sourcing to enhance vehicle safety, reduce costs, and improve operational efficiency. By investing in high-quality tire products and reliable maintenance services, businesses can mitigate the risks associated with under-inflated tires, including increased fuel consumption, potential vehicle damage, and safety hazards.

Understanding the implications of tire performance extends beyond mere compliance; it translates into enhanced fleet reliability and reduced downtime. For regions like Africa, South America, the Middle East, and Europe, where road conditions can vary significantly, sourcing tires that are engineered for durability and performance is paramount.

As you look to the future, consider the long-term benefits of forging partnerships with suppliers who prioritize quality, innovation, and sustainability. Regular tire pressure monitoring and maintenance should be integrated into your operational protocols to ensure optimal performance. Take proactive steps now to secure your supply chain and enhance your fleet’s safety and efficiency. By making informed sourcing decisions, you position your business for growth and resilience in a competitive marketplace.

Die in diesem Leitfaden enthaltenen Informationen, einschließlich der Angaben zu Herstellern, technischen Spezifikationen und Marktanalysen, dienen ausschließlich Informations- und Bildungszwecken. Sie stellen keine professionelle Kaufberatung, Finanzberatung oder Rechtsberatung dar.

Obwohl wir alle Anstrengungen unternommen haben, um die Richtigkeit und Aktualität der Informationen zu gewährleisten, übernehmen wir keine Verantwortung für etwaige Fehler, Auslassungen oder veraltete Informationen. Marktbedingungen, Unternehmensangaben und technische Standards können sich ändern.

B2B-Käufer müssen ihre eigene unabhängige und gründliche Due-Diligence-Prüfung durchführen bevor Sie eine Kaufentscheidung treffen. Dazu gehört, dass Sie sich direkt mit den Anbietern in Verbindung setzen, Zertifizierungen überprüfen, Muster anfordern und sich professionell beraten lassen. Das Risiko, sich auf die Informationen in diesem Leitfaden zu verlassen, trägt allein der Leser.