In today’s global market, accurately sourcing a Michelin tire inflation chart is essential for businesses that rely on commercial transportation and logistics. Ensuring that tires are properly inflated not only enhances vehicle performance but also significantly reduces operational costs through improved fuel efficiency and tire longevity. This comprehensive guide delves into various aspects of Michelin tire inflation charts, including types of tires, their specific applications, and the importance of understanding load capacities and inflation pressures.

International B2B buyers, especially those operating in regions like Africa, South America, the Middle East, and Europe—such as Brazil and Germany—face unique challenges in selecting the right tire solutions. These markets often experience fluctuations in standards and regulations, making it imperative to stay informed about the latest industry practices. In this guide, we will explore how to effectively vet suppliers, assess costs, and navigate the complexities of tire inflation to ensure optimal safety and performance.

By empowering businesses with the knowledge to make informed purchasing decisions, this guide aims to enhance operational efficiency and mitigate risks associated with tire management. Whether you’re a fleet manager, a logistics coordinator, or a procurement specialist, understanding the intricacies of Michelin tire inflation charts is crucial for maintaining a competitive edge in the marketplace.

| Tipo Nombre | Principales rasgos distintivos | Aplicaciones B2B principales | Breves pros y contras para los compradores |

|---|---|---|---|

| Passenger Vehicle Charts | Tailored for standard passenger vehicle tires, includes recommended PSI for various loads. | Automotive repair shops, fleet services | Pros: Easy reference; Cons: Limited to passenger vehicles. |

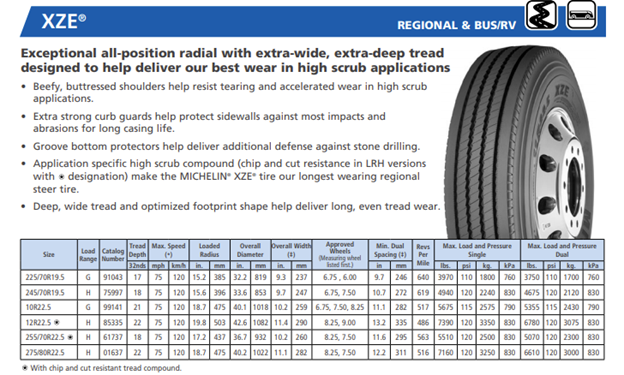

| Commercial Truck Charts | Specific to heavy-duty trucks, detailing load capacities and inflation pressures for dual and single axle configurations. | Logistics companies, transportation fleets | Pros: Enhances safety and efficiency; Cons: Requires precise load measurements. |

| RV Tire Inflation Charts | Designed for recreational vehicles, addressing unique load requirements and tire configurations. | RV rental services, outdoor adventure companies | Pros: Ensures safety during travel; Cons: May require specialized knowledge for accurate use. |

| Specialty Tire Charts | Covers tires for specific applications, including agricultural, industrial, and construction equipment. | Agriculture, construction, and mining sectors | Pros: Tailored for niche markets; Cons: May be less accessible for general users. |

| Performance Tire Charts | Focus on high-performance and racing tires, highlighting optimal pressure for track conditions. | Motorsports teams, performance vehicle shops | Pros: Maximizes performance; Cons: Not suitable for everyday vehicles. |

Passenger vehicle tire inflation charts are designed to provide the recommended tire pressures for standard cars and light trucks. They typically include details for various tire sizes and the corresponding PSI (pounds per square inch) needed for optimal performance. B2B buyers, such as automotive repair shops and fleet services, find these charts invaluable for ensuring that vehicles are maintained at the correct pressure, which helps in minimizing tire wear and enhancing fuel efficiency. However, their applicability is limited to passenger vehicles, making them less useful for commercial or specialized applications.

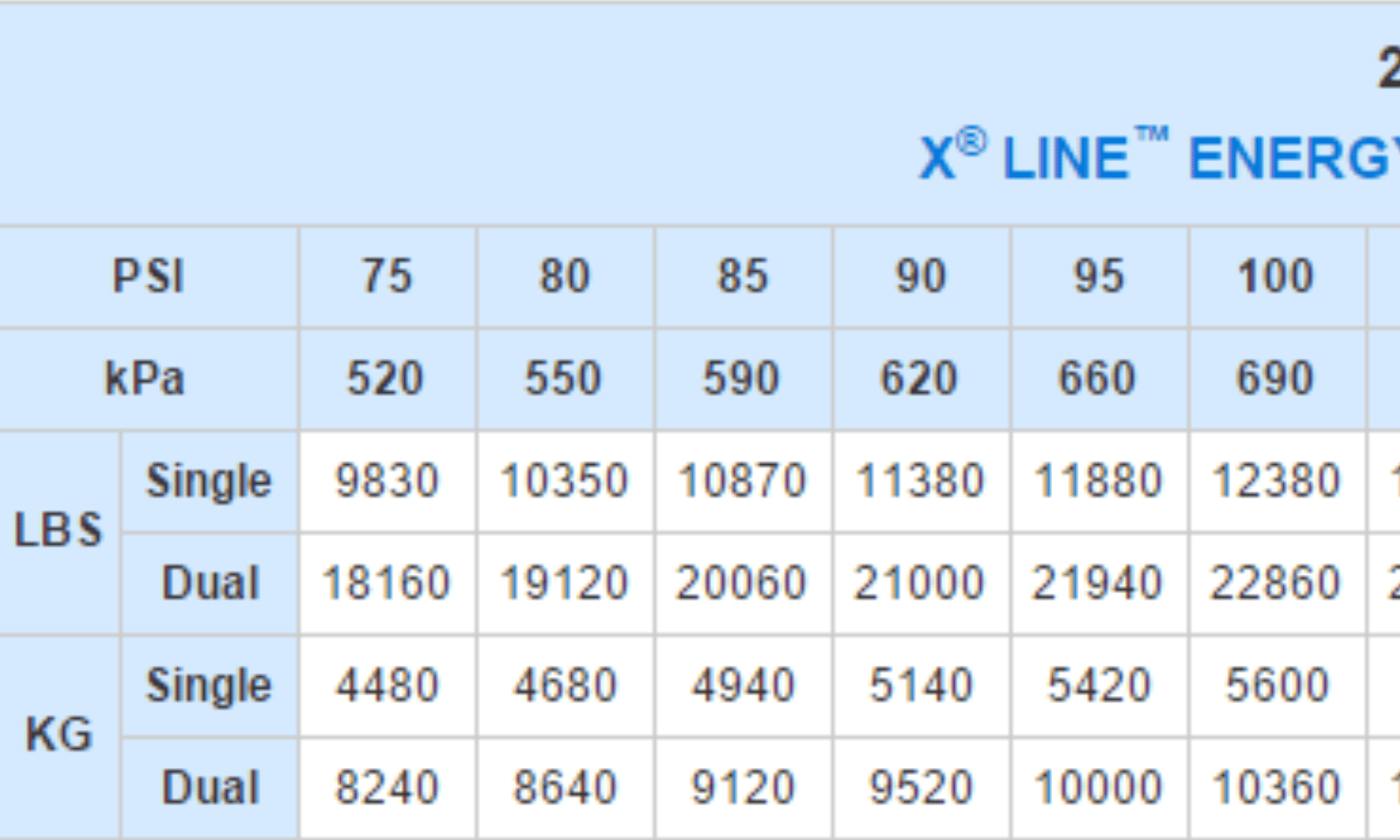

Commercial truck tire inflation charts cater specifically to heavy-duty trucks, offering detailed specifications for both single and dual axle configurations. These charts are crucial for logistics companies and transportation fleets, as they help ensure that vehicles are loaded correctly and tires are inflated to the appropriate PSI based on the load. This not only enhances safety but also improves fuel efficiency and tire longevity. However, they require accurate load measurements, which can complicate the inflation process if not properly managed.

RV tire inflation charts are specifically designed for recreational vehicles, taking into account their unique weight distribution and tire configurations. These charts are essential for RV rental services and outdoor adventure companies, as they ensure the safety and performance of vehicles during travel. Proper inflation is critical in preventing blowouts and enhancing handling. However, users may need specialized knowledge to interpret the charts correctly, which can be a barrier for some buyers.

Specialty tire inflation charts address the needs of specific industries, including agriculture, construction, and mining. These charts provide tailored recommendations for tires used in unique applications, ensuring that equipment operates safely and efficiently under various conditions. B2B buyers in these sectors benefit from the precision these charts offer, although they may be less accessible for general users who are unfamiliar with niche tire applications.

Performance tire inflation charts focus on high-performance and racing tires, detailing optimal pressures for various track conditions. These charts are particularly useful for motorsports teams and performance vehicle shops, as they help maximize grip and handling. However, they are not suitable for everyday vehicles, limiting their market appeal to a niche segment of buyers focused on racing and performance enhancements.

| Industria/Sector | Specific Application of Michelin Tire Inflation Chart | Valor/beneficio para la empresa | Consideraciones clave para el aprovisionamiento de esta aplicación |

|---|---|---|---|

| Transportation & Logistics | Fleet Management for Trucks | Enhanced safety, reduced fuel consumption, and tire wear | Need for precise load measurements and tire specifications |

| Agricultura | Agricultural Vehicle Operations | Improved operational efficiency and reduced downtime | Consideration of tire load capacities and inflation needs |

| Construcción | Heavy Equipment Usage | Maximized equipment lifespan and reduced maintenance costs | Requirement for specialized tire inflation charts |

| RV & Leisure | Recreational Vehicle Maintenance | Ensured safety and comfort during travel | Importance of adhering to manufacturer specifications |

| Automotive Services | Tire Service Centers | Accurate tire pressure maintenance for customer vehicles | Demand for updated charts reflecting the latest standards |

In the transportation and logistics sector, the Michelin tire inflation chart is critical for fleet management. By using these charts, fleet operators can ensure that each tire is inflated to the correct pressure based on the load it carries. This practice enhances safety, reduces the risk of blowouts, and optimizes fuel consumption, which is crucial for maintaining profitability in this highly competitive industry. International buyers must consider the specific load requirements of their fleet and the varying road conditions in regions like Africa and South America.

For agricultural businesses, the Michelin tire inflation chart assists in managing tire pressure for various farming equipment, such as tractors and harvesters. Proper tire inflation is essential for maximizing traction and reducing soil compaction, which directly impacts crop yields. Buyers in this sector need to ensure they understand the specific load capacities and inflation requirements for their equipment, particularly in regions with diverse agricultural practices, such as Brazil and Germany.

In the construction industry, the Michelin tire inflation chart is utilized to maintain heavy machinery such as excavators and bulldozers. Correct tire inflation is vital for maximizing equipment lifespan and minimizing maintenance costs, as under-inflated tires can lead to premature wear and increased fuel consumption. B2B buyers in this sector should focus on sourcing tires that meet the specific inflation requirements outlined in the charts, particularly in regions where heavy machinery operates under challenging conditions.

For recreational vehicle (RV) owners, the Michelin tire inflation chart provides essential information for maintaining tire pressure, which is crucial for safe and comfortable travel. Proper inflation prevents uneven tire wear and enhances vehicle handling. International buyers, especially those in the Middle East and Europe, should pay attention to their specific RV model’s requirements and the local regulations regarding tire maintenance to ensure compliance and safety.

Tire service centers utilize the Michelin tire inflation chart to accurately maintain tire pressure for a diverse range of vehicles. By adhering to the specifications provided in these charts, service centers can enhance customer satisfaction through improved vehicle performance and safety. B2B buyers in this sector must ensure they are equipped with the most current tire inflation charts to reflect any updates in tire technology or regulations, catering to the needs of their clientele across different regions.

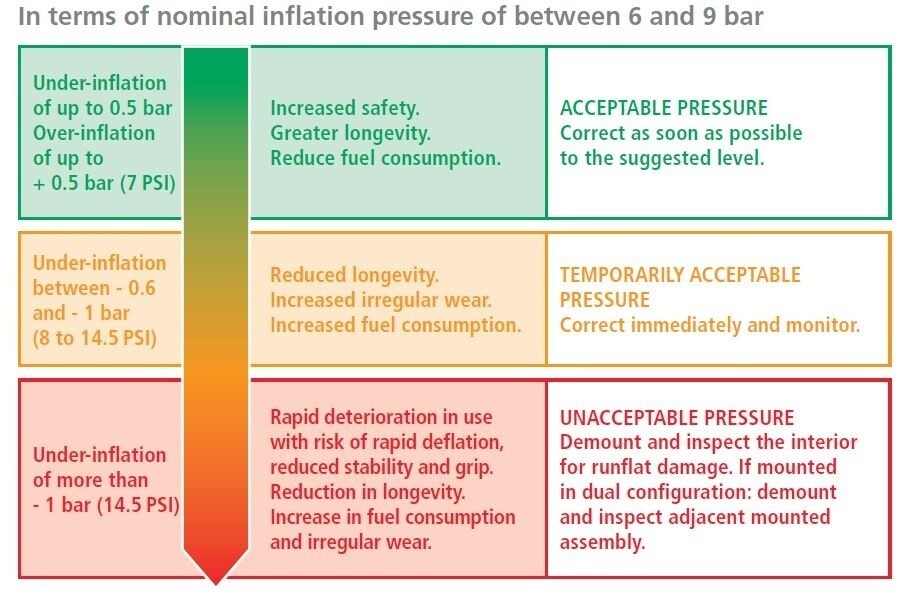

El problema: B2B buyers often encounter confusion when trying to match their specific tire sizes with the corresponding inflation standards outlined in Michelin’s tire inflation charts. This challenge is particularly prevalent among fleet managers who need to ensure that all vehicles maintain optimal tire pressure for safety and efficiency. The risks of incorrect inflation include increased tire wear, higher fuel consumption, and potential safety hazards. Many buyers lack the technical expertise to interpret the charts, leading to errors that can escalate operational costs and compromise vehicle performance.

La solución: To effectively utilize the Michelin tire inflation chart, B2B buyers should first ensure they have accurate data on the tire sizes used in their fleet. This involves not only knowing the tire dimensions but also understanding the load specifications associated with each tire. Buyers can enhance their accuracy by consulting with Michelin representatives or authorized dealers who can provide tailored advice on the latest charts and standards. Additionally, investing in training sessions for fleet personnel can significantly improve their understanding of how to read and apply the inflation charts correctly. By weighing each axle and using the heaviest end weight to determine cold inflation pressure, companies can maintain optimal tire performance, thereby reducing overall costs and increasing safety.

El problema: Many businesses operating a diverse fleet of vehicles face the issue of inconsistent tire pressure due to varying tire specifications across different models. This inconsistency can lead to uneven wear, affecting the lifespan of tires and resulting in increased maintenance costs. Fleet operators may struggle to keep track of the different recommended pressures for each vehicle type, particularly when dealing with vehicles from multiple manufacturers that may have different inflation requirements.

La solución: A practical approach to managing this issue is to create a centralized tire pressure management system that incorporates the Michelin tire inflation charts. Fleet managers can develop a reference guide that includes each vehicle’s specific tire size, recommended PSI, and maintenance schedule. Utilizing digital tools or mobile applications that allow for real-time updates and reminders can enhance compliance with tire pressure checks. Regular training and awareness programs for drivers about the importance of maintaining correct tire pressures can also foster a culture of safety and efficiency. By standardizing procedures and ensuring that all team members are informed, businesses can significantly improve tire performance and extend the lifespan of their fleet.

El problema: Many B2B buyers find themselves relying on outdated or incorrect information from printed materials regarding tire inflation standards. This is particularly concerning in regions where regulations and standards are evolving rapidly. For example, fleet operators in Africa or South America may not have immediate access to updated Michelin tire inflation charts, leading to compliance issues that could expose their businesses to liabilities, increased operational costs, and safety risks on the road.

La solución: To overcome this challenge, businesses should establish a reliable communication channel with Michelin or authorized dealers to receive the latest updates on tire inflation standards. Leveraging digital resources, such as Michelin’s online platforms, can provide immediate access to the most current tire inflation charts. Additionally, businesses can subscribe to newsletters or alerts that notify them of any changes in tire regulations or standards. Implementing a regular review process for all tire-related documents can ensure that all staff members are operating with the most accurate and up-to-date information. This proactive approach not only enhances compliance but also significantly mitigates risks associated with tire-related incidents.

When considering the materials used in tire inflation charts, particularly for Michelin products, several key materials stand out due to their unique properties and applications. These materials must meet specific performance criteria to ensure accuracy and reliability in various environmental conditions, especially for international B2B buyers.

Rubber is a primary material used in tire manufacturing and is crucial for the tire inflation process. Its key properties include excellent elasticity, temperature resistance (up to 100°C), and the ability to withstand high pressure (often exceeding 50 psi). Rubber is also resistant to wear and tear, making it suitable for various terrains.

Ventajas e inconvenientes: The durability of rubber contributes to the longevity of tires, but it can be susceptible to degradation from ozone and UV exposure. While rubber is relatively low-cost, its manufacturing complexity can increase when specialized compounds are required for specific applications.

Impacto en la aplicación: In regions with extreme temperatures, such as parts of Africa and the Middle East, the choice of rubber compounds can significantly impact tire performance. Buyers should ensure that the rubber used complies with local standards, such as ASTM or DIN.

Illustrative image related to michelin tire inflation chart

Nylon is another material frequently utilized in tire construction, particularly for the tire’s inner lining. Its properties include high tensile strength, resistance to abrasion, and excellent dimensional stability. Nylon can withstand temperatures up to 120°C and pressures of around 60 psi.

Ventajas e inconvenientes: The key advantage of nylon is its strength-to-weight ratio, making it ideal for heavy-duty applications. However, nylon can be more expensive than rubber, and its manufacturing process may require specialized techniques.

Impacto en la aplicación: In markets like Europe, where regulations on tire performance are stringent, nylon-reinforced tires may be preferred for their enhanced safety features. Buyers should consider compliance with European Union regulations when selecting tires.

Steel is often used in the belts and beads of tires, providing structural integrity and support. Its properties include high tensile strength and resistance to deformation, allowing tires to maintain their shape under high pressure.

Ventajas e inconvenientes: Steel belts enhance the durability and performance of tires, particularly for commercial vehicles. However, they can add weight to the tire, which may impact fuel efficiency. The cost of steel is moderate, but its addition can complicate the manufacturing process.

Illustrative image related to michelin tire inflation chart

Impacto en la aplicación: In South America, where road conditions can vary dramatically, steel-belted tires may be favored for their robustness. Buyers should be aware of local preferences for tire construction based on regional driving conditions.

Polyester is commonly used in tire construction for its lightweight and strong characteristics. It has a temperature tolerance of around 100°C and can handle pressures similar to nylon.

Ventajas e inconvenientes: The primary advantage of polyester is its cost-effectiveness and reduced weight, which can improve fuel efficiency. However, it may not provide the same level of durability as nylon or steel, making it less suitable for heavy-duty applications.

Impacto en la aplicación: In regions like Africa, where cost is a significant factor, polyester-reinforced tires can be an attractive option. Buyers should assess the trade-off between cost and performance when considering polyester-based tires.

| Material | Typical Use Case for michelin tire inflation chart | Ventajas clave | Principales desventajas/limitaciones | Coste relativo (Bajo/Medio/Alto) |

|---|---|---|---|---|

| Goma | Tire manufacturing and inflation | Excellent elasticity and durability | Susceptible to ozone and UV damage | Bajo |

| Nylon | Inner lining of tires | Alta resistencia a la tracción | More expensive than rubber | Med |

| Acero | Belts and beads in tires | Enhances structural integrity | Adds weight, impacting fuel efficiency | Med |

| Poliéster | Lightweight tire construction | Económico y ligero | Less durable than nylon or steel | Bajo |

This guide should assist international B2B buyers in understanding the various materials used in Michelin tire inflation charts, allowing for informed decisions based on performance requirements and regional conditions.

Understanding the manufacturing process of Michelin tire inflation charts is crucial for B2B buyers who prioritize quality and accuracy in their tire management systems. The production of these charts involves several key stages, each designed to ensure that the final product meets rigorous quality standards.

The first stage involves meticulous selection and preparation of raw materials. For Michelin tire inflation charts, this includes sourcing high-quality paper or digital formats that can withstand various environmental conditions, ensuring durability and readability. The choice of materials also extends to inks and printing technologies that provide clarity and longevity. This phase is critical, as the longevity and usability of the tire inflation chart depend heavily on the materials used.

Once materials are prepared, the forming process begins. This typically involves advanced printing techniques such as offset printing or digital printing, depending on the scale of production and the specific requirements of the charts. Each chart must be designed to display tire size, load capacities, and recommended inflation pressures clearly and accurately. Michelin utilizes software tools to create precise layouts that comply with international standards, ensuring that all necessary information is included.

The assembly stage includes compiling the printed charts into their final form. This could involve binding them into manuals or packaging them for distribution alongside tires. During this phase, Michelin ensures that each chart is correctly labeled and that supplementary materials, such as user guides, are included. Quality control checks are performed to confirm that each batch meets the required specifications before distribution.

The finishing stage involves final inspections and the application of any additional features, such as waterproof coatings or lamination for durability. This step is crucial, as it directly impacts the usability of the tire inflation charts in real-world conditions. Quality assurance teams conduct thorough checks to ensure that all charts meet Michelin’s stringent quality standards.

Quality assurance (QA) is integral to Michelin’s manufacturing process, ensuring that each tire inflation chart is accurate, reliable, and compliant with industry standards. Michelin adheres to various international quality standards, including ISO 9001, which outlines the criteria for a quality management system.

ISO 9001 is a key standard that Michelin follows to maintain consistency in quality. Additionally, other industry-specific certifications such as CE (Conformité Européenne) and API (American Petroleum Institute) may apply, depending on the target market. For B2B buyers, understanding these standards is vital, as they guarantee that the products meet established safety and performance benchmarks.

Quality control checkpoints are established throughout the manufacturing process to ensure that every aspect of production meets Michelin’s high standards. These checkpoints include:

These checkpoints help mitigate risks and ensure that the final product is both accurate and reliable.

B2B buyers must take proactive steps to verify the quality control measures of their suppliers, especially in international contexts where standards may vary. Here are some effective strategies:

Buyers should request detailed quality assurance reports and certifications from suppliers. These documents should outline the processes used in manufacturing and the quality checks performed at each stage. Regular audits can also be conducted to ensure compliance with agreed-upon standards.

Engaging third-party inspection services can provide an unbiased assessment of a supplier’s quality control processes. These inspections can verify that the products meet international standards and that the supplier adheres to best practices in manufacturing.

International B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, must navigate various certification requirements that can differ significantly across borders.

Different regions may have specific regulations regarding tire safety and inflation standards. For example, European buyers may prioritize compliance with EU regulations, while buyers in Africa or South America may require adherence to local standards that differ from those of Europe or North America. Understanding these nuances is crucial for ensuring that the products meet local market needs.

Challenges can include language barriers, varying interpretations of quality standards, and different manufacturing practices. B2B buyers should establish clear communication channels and develop strong relationships with suppliers to overcome these obstacles. Regular updates and training sessions can help ensure that all parties understand and comply with the necessary standards.

For B2B buyers, understanding the manufacturing processes and quality assurance practices behind Michelin tire inflation charts is essential for making informed purchasing decisions. By focusing on the stages of production, relevant quality standards, and verification methods, buyers can ensure they are sourcing high-quality, reliable products that meet their operational needs. Engaging with suppliers who prioritize quality and compliance not only enhances product safety but also contributes to the overall efficiency of tire management operations.

To assist B2B buyers in efficiently procuring Michelin tire inflation charts, this guide outlines essential steps to ensure the selection of the most appropriate and reliable resources. By following this checklist, buyers can enhance their understanding of tire maintenance requirements and improve operational efficiency.

Understanding your specific tire requirements is crucial before sourcing Michelin tire inflation charts. Consider factors such as vehicle type, tire size, and load capacities that are pertinent to your operations. This clarity will help you select the right charts that cater to your unique operational demands.

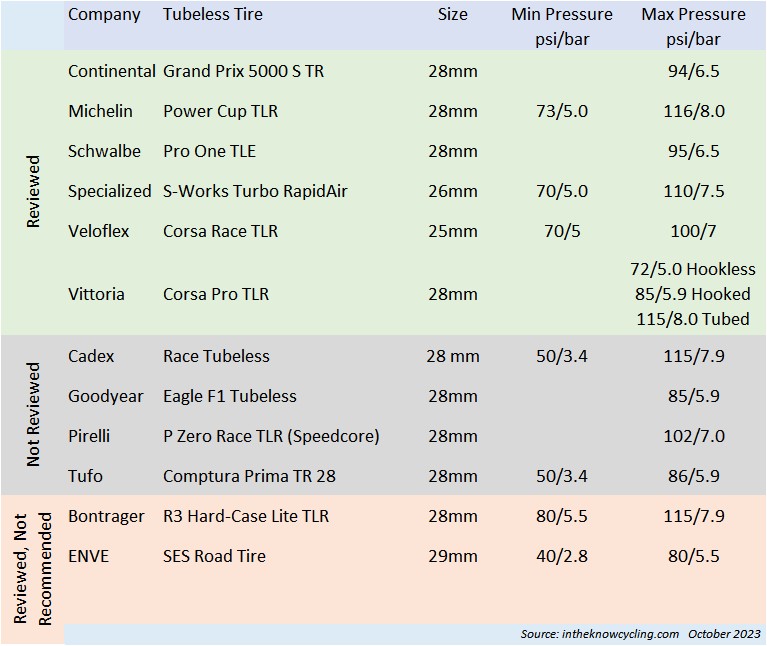

Familiarize yourself with the various Michelin tire inflation charts available for different tire sizes and configurations. Michelin provides detailed load and inflation tables for a range of vehicles, including RVs and commercial trucks. Ensure that the charts you evaluate are up-to-date and relevant to the specific tire models you are using in your fleet.

Before making a purchase, it is essential to confirm that your supplier is an authorized Michelin distributor. This ensures that the charts you receive are accurate and reflect the latest industry standards. Look for certifications, partnerships, or endorsements from Michelin that validate the supplier’s legitimacy.

Assess the technical accuracy of the Michelin tire inflation charts being offered. Check whether they include essential details such as recommended cold tire pressures, load capacities per axle, and any specific notes regarding tire configurations (single vs. dual). Accurate charts are vital for maintaining tire health and ensuring safety on the road.

If possible, request samples or trial access to the Michelin tire inflation charts from your supplier. This step allows you to evaluate the usability and comprehensiveness of the charts before committing to a larger order. Ensure that the format and presentation of the information meet your operational needs and are easy to interpret.

Consider the level of customer support provided by the supplier. A reputable supplier should offer assistance in understanding and utilizing the tire inflation charts effectively. Additionally, inquire about the availability of supplementary resources such as training materials or technical assistance, which can enhance your team’s knowledge and application of the charts.

Finally, review the pricing structure and terms of purchase associated with the Michelin tire inflation charts. Compare quotes from multiple suppliers to ensure you are getting competitive pricing. Pay attention to any additional costs, such as shipping fees or potential discounts for bulk purchases, which can significantly impact your overall procurement budget.

By following this practical sourcing checklist, B2B buyers can make informed decisions when procuring Michelin tire inflation charts, ultimately leading to improved tire maintenance practices and enhanced safety across their fleets.

Analyzing the cost structure and pricing for sourcing Michelin tire inflation charts is essential for international B2B buyers, especially in regions such as Africa, South America, the Middle East, and Europe. Understanding the various cost components and price influencers can lead to more informed purchasing decisions and better negotiations.

Materiales: The primary materials involved in producing tire inflation charts are high-quality paper or digital formats, which must be durable and resistant to wear. Consideration should be given to the environmental impact of these materials, as sustainability is increasingly important in global sourcing.

Trabajo: Labor costs encompass the personnel involved in design, production, and quality control. Skilled professionals are needed to ensure the charts are accurate and comply with regional specifications, particularly as tire standards can differ internationally.

Gastos generales de fabricación: This includes the costs of facilities, utilities, and equipment used in producing the charts. Efficient manufacturing processes can help reduce overhead costs, which may benefit the final pricing structure.

Herramientas: The creation of specialized tools for printing and cutting charts can add to initial costs. However, investing in high-quality tooling can enhance production efficiency and output quality.

Control de calidad: Ensuring the accuracy of tire inflation charts is critical. QC processes may involve rigorous testing and validation against industry standards, which can increase costs but are essential for maintaining credibility and safety.

Logística: Shipping and handling costs are significant, especially for international buyers. Factors such as distance, shipping method, and customs duties can all influence the total cost of acquiring these charts.

Margen: Suppliers typically add a profit margin to cover their costs and ensure sustainability. The margin can vary based on the supplier’s market position, reputation, and the complexity of the charts.

Volumen y cantidad mínima de pedido (MOQ): Pricing often improves with larger orders due to economies of scale. Buyers should consider their projected usage to negotiate better rates.

Especificaciones y personalización: Tailored charts to meet specific regional regulations or vehicle types may incur additional costs. Understanding local requirements can help buyers specify their needs effectively.

Calidad del material y certificaciones: Higher quality materials and compliance with international certifications (like ISO) can increase costs but also enhance the product’s reliability and acceptance in various markets.

Factores del proveedor: The reputation and reliability of suppliers can impact pricing. Established suppliers may charge a premium for their expertise and quality assurance.

Incoterms: Understanding Incoterms is crucial for international transactions. These terms define the responsibilities of buyers and sellers in shipping, which can influence overall costs.

Engage in Open Negotiation: Establishing a clear line of communication with suppliers can lead to better pricing agreements. Discussing potential long-term partnerships may yield discounts.

Centrarse en el coste total de propiedad (TCO): Consider not just the upfront costs but also the long-term implications of purchasing decisions, including the lifespan and accuracy of the charts.

Research Market Rates: Conducting market research can provide insights into standard pricing, enabling buyers to negotiate effectively.

Leverage Regional Differences: Pricing may vary across regions due to local demand and supply dynamics. Buyers should explore multiple suppliers across different regions to find the best deals.

Stay Informed on Industry Standards: Knowledge of current tire standards and regulations in your region can aid in selecting the right specifications and negotiating better pricing based on compliance needs.

Prices for Michelin tire inflation charts can vary widely based on the factors discussed above. It is essential for buyers to obtain tailored quotes from suppliers to understand the specific costs associated with their requirements. Always factor in potential fluctuations due to market conditions and currency exchange rates, especially in international transactions.

When it comes to maintaining optimal tire performance, the Michelin Tire Inflation Chart is a widely recognized tool. However, businesses often seek alternative methods or technologies that can complement or even replace traditional tire inflation charts. This section explores viable alternatives that cater to varying needs in the B2B sector, particularly for international buyers looking for efficient tire management solutions.

| Aspecto comparativo | Michelin Tire Inflation Chart | Tire Pressure Monitoring System (TPMS) | Inflador de neumáticos portátil |

|---|---|---|---|

| Rendimiento | High accuracy for tire pressure based on load | Real-time monitoring of tire pressure | Quick inflation, but less precise |

| Coste | Free to access online | Moderate (initial investment required) | Low to moderate (varies by model) |

| Facilidad de aplicación | Requires manual reference and calculations | Easy to use; automated alerts | Simple setup; requires power source |

| Mantenimiento | No ongoing maintenance needed | Requires occasional sensor checks | Minimal maintenance; check power supply |

| El mejor caso de uso | Ideal for static load calculations | Excellent for continuous monitoring of multiple vehicles | Convenient for on-the-go inflation needs |

The Tire Pressure Monitoring System (TPMS) is an advanced solution that offers real-time tire pressure data. TPMS sensors are installed on each tire, providing immediate alerts to drivers when tire pressure falls below or exceeds optimal levels.

Pros: This system enhances safety by preventing under-inflation and over-inflation, which can lead to tire blowouts and accidents. It also minimizes the risk of tire wear and improves fuel efficiency.

Contras: The initial investment can be substantial, particularly for fleets needing multiple systems. Additionally, TPMS requires periodic maintenance to ensure sensors remain functional and accurate.

A Portable Tire Inflator is a compact device that allows for quick inflation of tires at any location, making it a practical solution for businesses with mobile operations or those frequently on the road.

Pros: These devices are often affordable and easy to use, providing immediate inflation without the need for a gas station. They are highly portable, making them ideal for emergency situations.

Contras: However, portable inflators may not provide the same level of precision as a Michelin Tire Inflation Chart or TPMS. Their effectiveness can vary based on model and power source, and they may not be suitable for heavy-duty applications where precise tire pressure management is critical.

When selecting the right tire inflation management solution, B2B buyers should consider their specific operational needs, budget constraints, and the scale of their fleet. The Michelin Tire Inflation Chart offers a solid foundation for understanding tire pressure requirements based on load, but for businesses prioritizing real-time data and ease of use, TPMS may be the superior choice. Conversely, companies that require flexibility and immediate inflation capabilities may find portable tire inflators more beneficial. Ultimately, the right choice will depend on the unique circumstances and priorities of the business, ensuring optimal tire performance and safety in their operations.

Load rating refers to the maximum weight a tire can safely carry when properly inflated. This specification is crucial for B2B buyers as it directly influences vehicle performance and safety. Understanding load ratings helps businesses select appropriate tires for various applications, ensuring compliance with safety regulations and operational efficiency. In Michelin’s tire inflation chart, load ratings are often listed alongside tire sizes and recommended pressures.

Cold inflation pressure is the tire pressure measured when the tire is cold, meaning the vehicle has not been driven for at least three hours. This specification is vital for maintaining tire integrity and performance, as incorrect pressure can lead to tire blowouts or excessive wear. For B2B buyers, adhering to the recommended cold inflation pressure ensures optimal fuel efficiency and reduces the total cost of ownership for fleets.

Illustrative image related to michelin tire inflation chart

Tire size is a standardized numerical designation indicating the dimensions of the tire, including width, aspect ratio, and diameter. For example, a tire size of 225/75R16 indicates a width of 225 mm, an aspect ratio of 75%, and a diameter of 16 inches. Knowing the correct tire size is essential for compatibility with vehicles and ensures that the tires can handle the required loads and pressures, thereby enhancing overall safety.

The aspect ratio is the ratio of the tire’s height to its width, expressed as a percentage. A lower aspect ratio typically indicates a wider tire with improved handling characteristics, while a higher aspect ratio offers better comfort and fuel efficiency. For businesses, understanding aspect ratios helps in making informed decisions about tire performance in different driving conditions, such as off-road versus highway travel.

Tread depth is the measurement of the depth of the grooves in a tire’s tread. It is a critical property that affects traction, handling, and safety. In business contexts, maintaining adequate tread depth is essential for compliance with safety standards and for maximizing tire lifespan. Regularly monitoring tread depth can prevent accidents and reduce replacement costs.

OEM refers to the original manufacturer of a vehicle or its components, including tires. For B2B buyers, understanding OEM specifications is crucial when sourcing replacement parts or tires, as these components are designed to meet specific performance and safety standards.

MOQ is the minimum number of units a supplier requires for an order. This term is essential for B2B transactions, as it can affect inventory management and cash flow. Knowing the MOQ helps businesses plan their purchases effectively, ensuring they meet supplier requirements while optimizing stock levels.

An RFQ is a document used by buyers to solicit price quotes from suppliers for specific products or services. In the context of tire procurement, issuing an RFQ allows businesses to compare offers from different manufacturers, ensuring they obtain the best value while meeting quality and performance standards.

Incoterms are a set of international rules that define the responsibilities of buyers and sellers in international trade. Familiarity with these terms helps B2B buyers navigate shipping logistics, understand cost implications, and clarify liability in the event of damage or loss during transit. This knowledge is particularly important for companies importing tires from manufacturers like Michelin.

PSI is a unit of measurement for tire pressure, indicating the amount of air pressure in a tire. Understanding PSI is crucial for ensuring that tires are inflated to the correct levels, as improper inflation can lead to safety issues and increased operational costs. For B2B buyers, maintaining the correct PSI is vital for fleet management and overall vehicle performance.

By familiarizing themselves with these technical properties and trade terms, B2B buyers can make more informed decisions regarding tire procurement, ensuring safety, compliance, and cost-effectiveness in their operations.

The global tire industry is currently experiencing significant shifts driven by technological advancements, regulatory changes, and evolving consumer preferences. For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding these dynamics is crucial. Key trends include the adoption of digital tools for tire management, such as tire pressure monitoring systems (TPMS) and mobile apps that facilitate real-time data tracking. These technologies not only enhance tire performance but also reduce operational costs by preventing premature wear and optimizing fuel consumption.

Moreover, the market is increasingly influenced by the demand for electric vehicles (EVs) and the corresponding need for specialized tires. As manufacturers like Michelin develop tires tailored for EVs, they are also updating their inflation charts to reflect new specifications. Buyers must stay informed about these changes to ensure compliance with safety standards and enhance vehicle performance.

In terms of sourcing, there’s a noticeable shift towards partnerships with local suppliers to minimize logistics costs and ensure timely deliveries. This trend is particularly relevant in regions like Brazil and Germany, where local expertise can facilitate smoother operations. Additionally, international buyers are increasingly prioritizing transparency in the supply chain, demanding detailed information about sourcing practices and product specifications.

Sustainability is no longer just a buzzword; it’s a vital component of the B2B sourcing strategy in the tire industry. Buyers are becoming more conscious of the environmental impact of their purchases, leading to a growing demand for ethically sourced materials and sustainable manufacturing practices. For instance, Michelin is investing in innovative materials that minimize environmental footprints, such as bio-sourced and recycled materials in tire production.

Furthermore, the importance of ethical supply chains cannot be overstated. Companies that prioritize sustainability are often viewed more favorably by consumers and business partners alike. This shift is prompting many tire manufacturers to seek certifications that demonstrate their commitment to environmental responsibility, such as ISO 14001 for environmental management and Eco-Label certifications.

B2B buyers should actively seek suppliers who not only provide high-quality products but also align with their sustainability goals. This includes verifying the use of ‘green’ materials in tire production and understanding how a supplier’s practices impact the overall lifecycle of the product, including disposal and recycling options. By prioritizing sustainability, companies can not only enhance their brand reputation but also contribute to a more sustainable future.

The Michelin tire inflation chart has undergone significant evolution since its inception, reflecting advancements in tire technology and changing market needs. Initially, tire inflation guidelines were straightforward, primarily focused on standard vehicles. However, as vehicle design became more complex and specialized, Michelin expanded its charts to accommodate a wide range of applications, including RVs, commercial vehicles, and electric cars.

This evolution is indicative of broader trends in the automotive industry, where performance, safety, and efficiency are paramount. Michelin’s commitment to regularly updating its inflation charts ensures that buyers have access to the most accurate and relevant information, which is essential for maintaining optimal tire performance and safety.

As international B2B buyers navigate the complexities of tire sourcing, understanding the historical context of products like the Michelin tire inflation chart can provide valuable insights into current offerings and future innovations. This knowledge can empower businesses to make informed purchasing decisions that align with their operational needs and strategic objectives.

How do I determine the correct tire pressure for my Michelin tires?

To determine the correct tire pressure for your Michelin tires, refer to the specific load and inflation tables provided by Michelin. Start by locating your tire size in the chart and matching it with the appropriate sidewall markings. Weigh each axle end separately and use the heaviest weight to ascertain the cold inflation pressure. Regular checks and adjustments are crucial, as under-inflation can lead to increased wear and fuel consumption, while over-inflation can compromise safety.

What is the best way to source Michelin tire inflation charts for my fleet?

The best way to source Michelin tire inflation charts is to contact a Michelin distributor or dealer in your region. They can provide the latest charts tailored to your specific tire sizes and applications. Additionally, you can access Michelin’s online resources where the latest inflation tables are available. Ensure you verify the charts against your vehicle specifications to maintain compliance and safety standards.

What are the minimum order quantities (MOQs) for Michelin tires?

Minimum order quantities (MOQs) for Michelin tires can vary based on the product line and the distributor. Typically, larger orders may be required for commercial tires, while smaller quantities may be available for passenger tires. It’s advisable to discuss your requirements with your Michelin supplier to understand their specific MOQs and explore potential pricing benefits for bulk purchases.

How can I ensure quality assurance (QA) for my Michelin tire orders?

To ensure quality assurance for your Michelin tire orders, partner with authorized Michelin distributors who follow strict QA protocols. Request documentation such as certificates of authenticity and inspection reports. Regularly inspect the tires upon delivery for any damage or defects. Establish clear communication channels with your supplier for swift resolution of any quality issues.

What payment terms are typically offered for Michelin tire purchases?

Payment terms for Michelin tire purchases can vary by supplier and region but often include options such as net 30, net 60, or cash on delivery (COD). Some suppliers may offer financing or leasing options for larger fleets. It’s important to negotiate terms that align with your cash flow and operational needs while ensuring that your supplier is reputable and reliable.

How does international shipping work for Michelin tire orders?

International shipping for Michelin tire orders involves several steps, including customs clearance and compliance with local regulations. Work with a logistics partner experienced in handling automotive products to streamline the process. Ensure that all necessary documentation, including invoices and shipping labels, is accurate to avoid delays. Be aware of potential tariffs or duties that may apply in your destination country.

Can I customize my Michelin tire order based on specific needs?

Yes, many Michelin distributors allow for customization of tire orders based on specific fleet requirements. This may include selecting specific tire types, sizes, and tread patterns suitable for different terrains or applications. Discuss your needs with your supplier to explore customization options, as well as any associated costs or lead times.

What should I consider when vetting suppliers for Michelin tires?

When vetting suppliers for Michelin tires, consider their reputation, experience, and customer reviews. Check for certifications and partnerships with Michelin, which indicate their credibility. Evaluate their inventory levels, delivery timelines, and customer service responsiveness. It’s also wise to request samples or references from other businesses to gauge reliability and quality before making a commitment.

Dominio: business.michelinman.com

Matriculado: 2001 (24 años)

Introducción: Load and Inflation Tables for RV Tires: 1. Tire Sizes: 15″, 16″, 19.5″, 22.5″. 2. Tire Models: Agilis CrossClimate, Agilis HD Z, X MULTI Z, X LINE ENERGY Z, XRV. 3. Load and Inflation Table Terminology: Single (one tire per axle end), Dual (two tires per axle end). 4. Recommended Practice: Weigh each axle end separately, use the heaviest end weight for cold inflation tire pressure. 5. Ensure tire …

Dominio: michelinman.com

Matriculado: 2001 (24 años)

Introducción: Michelin offers a complete range of tires for various vehicles including passenger cars, SUVs, light commercial vehicles, electric and hybrid cars, motorcycles, and bicycles. The tire selection includes categories such as summer, all-season, winter, and specific product families like CrossClimate, Defender, Pilot Sport, Primacy, LTX, X Ice, Energy™, Latitude Sport, Pilot Alpin, and Premier. Michel…

Dominio: michelinb2b.com

Matriculado: 2000 (25 años)

Introducción: This company, Michelin – Tire Pressure Measurement Solutions, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

In conclusion, understanding the Michelin tire inflation chart is crucial for international B2B buyers, especially those operating in diverse markets such as Africa, South America, the Middle East, and Europe. Proper tire inflation not only ensures safety and enhances vehicle performance but also plays a significant role in optimizing operational costs through reduced fuel consumption and prolonged tire life. By utilizing Michelin’s comprehensive load and inflation tables, businesses can make informed decisions that align with the latest industry standards, thereby minimizing risks associated with incorrect tire pressure.

Strategic sourcing of tire products, particularly from reputable manufacturers like Michelin, facilitates access to reliable information and innovative solutions tailored to regional requirements. As the tire industry continues to evolve, staying updated on best practices and product specifications will empower B2B buyers to enhance their operational efficiencies and customer satisfaction.

Illustrative image related to michelin tire inflation chart

We encourage international buyers to actively engage with Michelin’s resources and consult with local dealers to ensure compliance with the latest load and inflation standards. By prioritizing tire maintenance and inflation accuracy, businesses can drive sustainable growth and reliability in their transportation operations.

La información facilitada en esta guía, incluido el contenido relativo a fabricantes, especificaciones técnicas y análisis de mercado, tiene únicamente fines informativos y educativos. No constituye asesoramiento profesional en materia de adquisiciones, asesoramiento financiero ni asesoramiento jurídico.

Aunque hemos hecho todo lo posible por garantizar la exactitud y actualidad de la información, no nos hacemos responsables de posibles errores, omisiones o información obsoleta. Las condiciones del mercado, los detalles de las empresas y las normas técnicas están sujetos a cambios.

Los compradores B2B deben llevar a cabo su propia diligencia debida independiente y exhaustiva antes de tomar cualquier decisión de compra. Esto incluye ponerse en contacto directamente con los proveedores, verificar las certificaciones, solicitar muestras y buscar asesoramiento profesional. El riesgo de confiar en la información contenida en esta guía es responsabilidad exclusiva del lector.