In the rapidly evolving global market, ensuring optimal tire inflation is a pivotal concern for B2B buyers seeking to maintain safety, efficiency, and cost-effectiveness in their fleet operations. Mismanagement of tire inflation not only poses safety risks but also leads to increased operational costs due to fuel inefficiency and premature tire wear. This comprehensive guide to tire inflation guidelines equips international buyers, particularly those in Africa, South America, the Middle East, and Europe—including key markets like Germany and Saudi Arabia—with the insights needed to navigate this critical aspect of vehicle maintenance.

This resource delves into various types of tire inflation systems, best practices for maintaining optimal tire pressure, and the implications of inflation levels on tire longevity and vehicle performance. It also addresses the importance of supplier vetting, helping buyers identify reputable sources for tire inflation equipment and maintenance services. Additionally, we cover cost considerations that can influence purchasing decisions, ensuring that buyers are well-informed and prepared to make choices that align with their operational needs and budget constraints.

By leveraging this guide, B2B buyers will gain the knowledge necessary to enhance their fleet safety and efficiency while minimizing costs, ultimately empowering them to make informed purchasing decisions that can lead to sustainable operational success in a competitive marketplace.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Recommended Tire Pressure | Manufacturer-specified PSI for optimal performance and safety. | Fleet management, automotive maintenance. | Pros: Enhances safety and tire longevity. Cons: May vary by vehicle type. |

| Maximum Tire Pressure | Highest safe pressure indicated on the tire sidewall. | Heavy-duty transport, specialized vehicles. | Pros: Allows for temporary adjustments under load. Cons: Increases risk of blowouts if misused. |

| Minimum Tire Pressure | Functional minimum based on recommended specifications. | Safety compliance, vehicle performance. | Pros: Prevents under-inflation issues. Cons: No specific value provided by manufacturers. |

| Cold Tire Pressure | Pressure measurement taken when tires are cold. | Routine inspections, pre-trip checks. | Pros: Ensures accurate readings. Cons: Requires timing and conditions for accuracy. |

| Tire Pressure Monitoring Systems (TPMS) | Automated system for continuous pressure monitoring. | Fleet operations, logistics. | Pros: Immediate alerts for pressure issues. Cons: Maintenance and calibration can be costly. |

Recommended tire pressure is the optimal PSI set by the vehicle manufacturer, ensuring safety and efficiency. This guideline is crucial for businesses managing fleets or automotive services, as adherence promotes tire longevity and fuel efficiency. For B2B buyers, understanding the specific PSI for different vehicle types is essential to prevent safety hazards and reduce operational costs.

Maximum tire pressure is the upper limit indicated on a tire’s sidewall, reflecting the maximum air pressure the tire can safely hold. This guideline is particularly relevant for businesses involved in heavy-duty transport or specialized vehicle operations, where load variations may necessitate temporary inflation adjustments. However, buyers must be cautious, as exceeding this pressure can lead to tire failure.

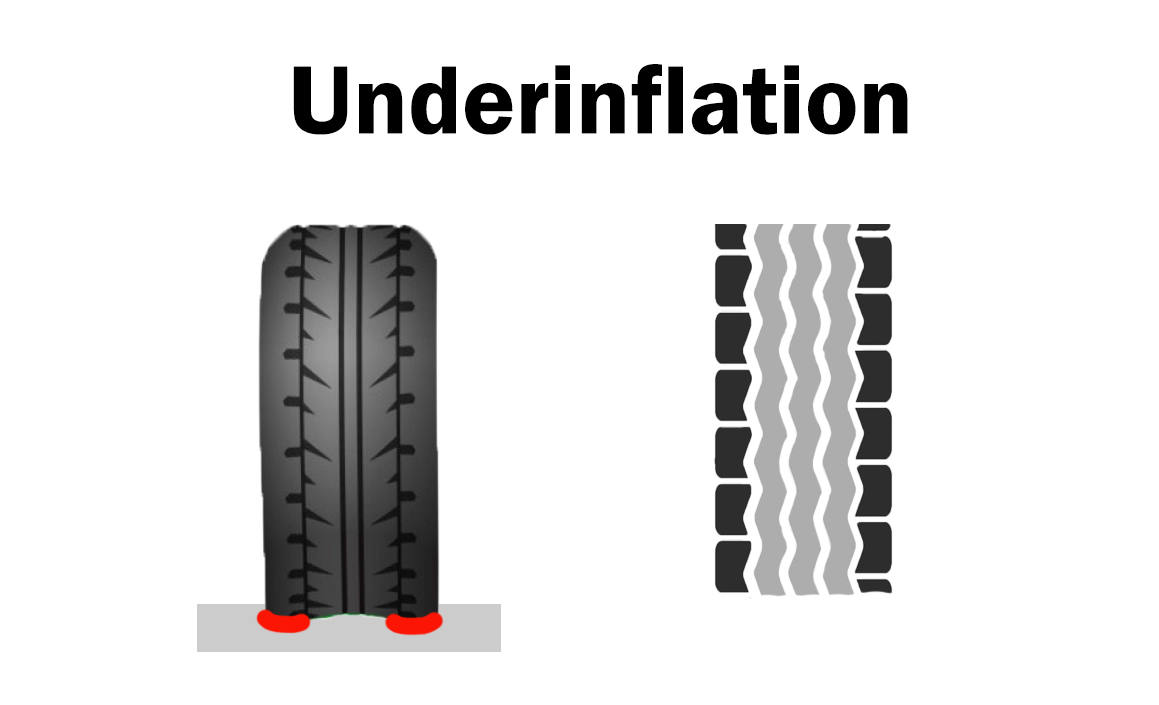

While manufacturers typically do not specify a minimum tire pressure, it is understood that any pressure below the recommended level compromises safety and performance. For B2B buyers, especially in industries reliant on safety compliance, maintaining at least the recommended PSI is critical. This understanding helps prevent accidents and reduces the frequency of tire replacements.

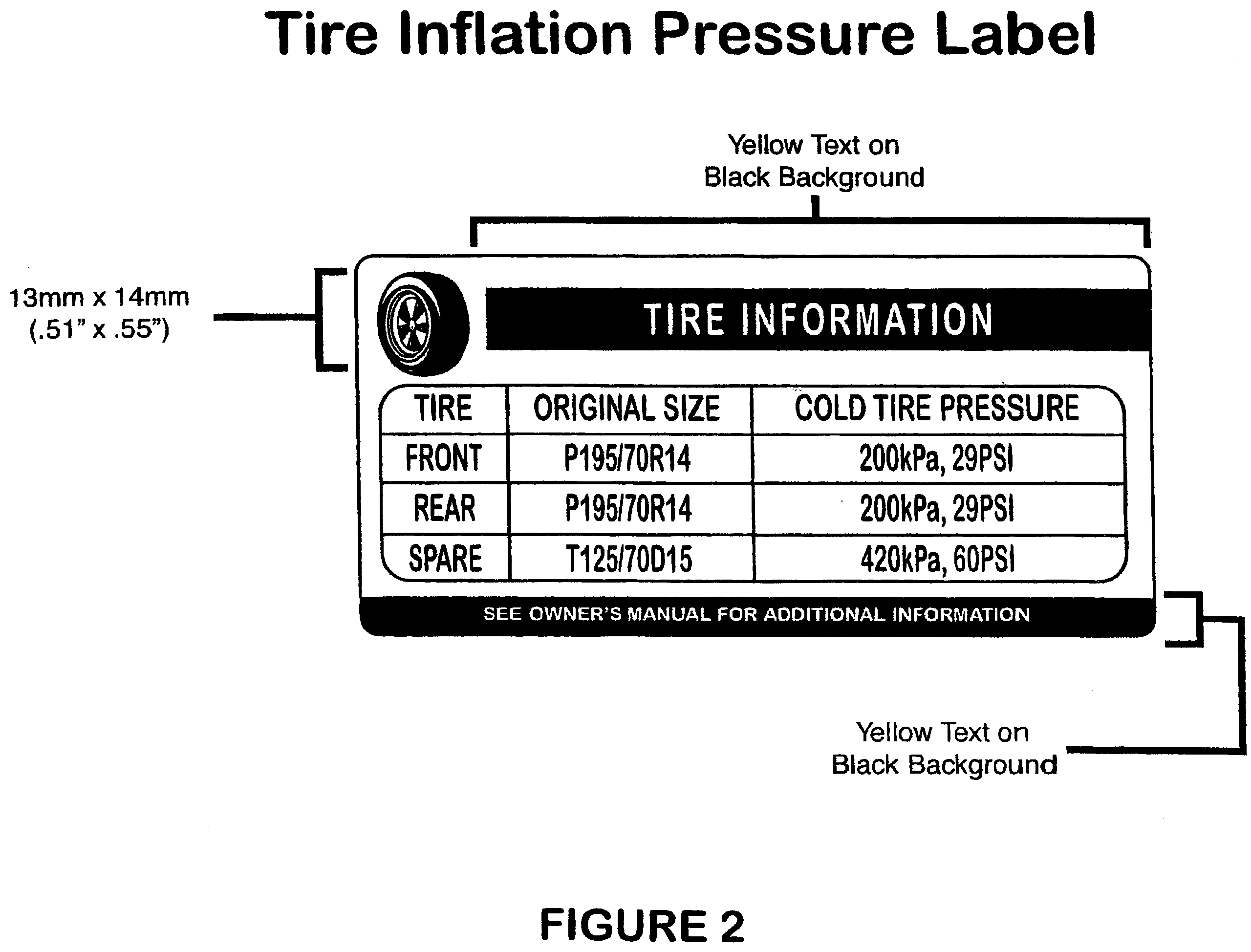

Cold tire pressure refers to the PSI measurement taken when tires are not heated from driving. Accurate cold pressure readings are vital for businesses performing routine inspections or pre-trip checks. This practice ensures that vehicles operate efficiently and safely, minimizing risks associated with inaccurate pressure readings that could lead to under- or over-inflation.

TPMS provides real-time monitoring of tire pressure, alerting drivers to any deviations from the safe range. This technology is increasingly adopted in fleet operations and logistics, offering significant benefits in terms of safety and operational efficiency. While the initial investment in TPMS can be high, the long-term savings from reduced tire wear and improved fuel efficiency make it a valuable consideration for B2B buyers.

| Industry/Sector | Specific Application of tire inflation guidelines | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Logistics and Transport | Regular tire pressure checks on delivery vehicles | Improved fuel efficiency and reduced tire wear | Durable pressure gauges, training on tire maintenance |

| Agriculture | Tire inflation for agricultural machinery | Enhanced operational safety and reduced downtime | Heavy-duty gauges, compatibility with diverse equipment |

| Construction | Tire management for heavy construction vehicles | Lower risk of accidents and improved productivity | Robust tire pressure monitoring systems, rugged tools |

| Mining | Inflation monitoring for mining trucks | Increased tire lifespan and reduced operational costs | Specialized equipment for extreme conditions, reliable suppliers |

| Automotive Services | Tire pressure services for fleet maintenance | Enhanced customer satisfaction and safety | Access to accurate gauges, training for technicians |

In the logistics and transport sector, maintaining optimal tire pressure is crucial for delivery vehicles. Regular checks can significantly improve fuel efficiency and extend tire life, leading to lower operational costs. Businesses should prioritize sourcing durable tire pressure gauges and ensure staff are trained in proper tire maintenance practices. This is particularly vital in regions with varying climates, where temperature fluctuations can affect tire pressure.

In agriculture, tire inflation guidelines are essential for the safe operation of heavy machinery like tractors and harvesters. Proper inflation ensures that equipment operates efficiently, reducing the risk of accidents and minimizing downtime. When sourcing equipment, businesses should consider heavy-duty gauges that can withstand rugged conditions and ensure compatibility with various machinery types. This is especially important in regions with diverse agricultural practices.

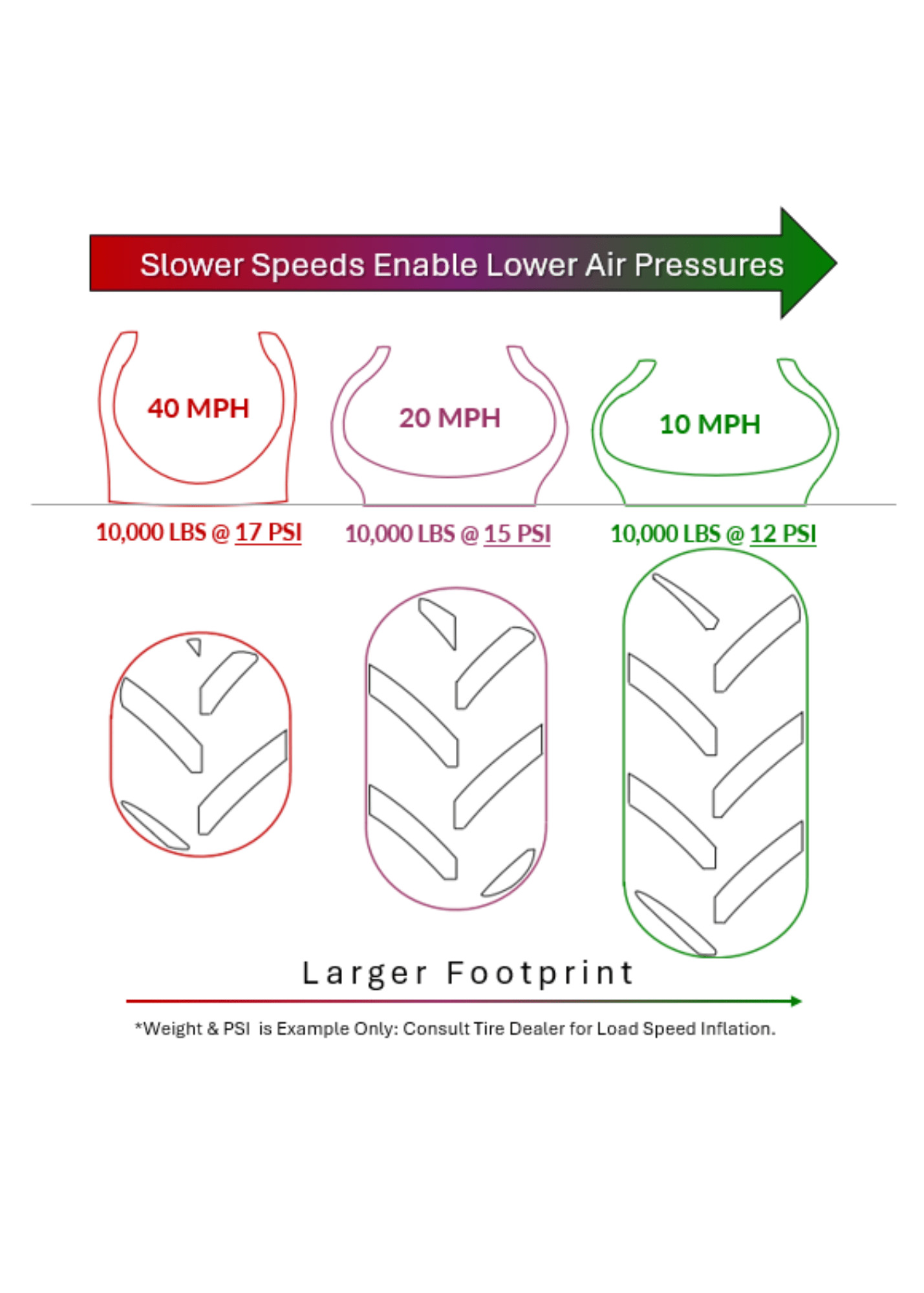

For the construction industry, managing tire pressure in heavy vehicles is vital for safety and productivity. Properly inflated tires reduce the likelihood of blowouts and accidents, which can halt operations and incur additional costs. Companies should invest in robust tire pressure monitoring systems and rugged tools that can endure the demanding conditions of construction sites. This is crucial for businesses operating in remote areas where access to service may be limited.

In the mining sector, tire inflation guidelines are necessary to ensure the longevity of tires used on massive trucks. Maintaining the correct pressure can significantly reduce operational costs by extending tire lifespan and minimizing the frequency of replacements. Businesses must source specialized equipment capable of functioning in extreme conditions, and reliable suppliers who understand the unique challenges of the mining industry are essential.

Automotive service providers can leverage tire inflation guidelines to enhance fleet maintenance services. Regular tire pressure checks not only ensure safety but also improve customer satisfaction by reducing the risk of roadside emergencies. Access to accurate gauges and technician training is crucial for maintaining service quality. This is particularly relevant for businesses in regions with high vehicle usage, where tire-related issues can lead to significant operational disruptions.

The Problem: Many B2B buyers, especially those managing fleets or automotive businesses, often struggle to understand the nuances between recommended tire pressure and maximum tire pressure. This confusion can lead to improper tire inflation practices, which may result in accidents or excessive tire wear. For instance, a logistics company in South America might inflate their vehicle tires to the maximum pressure indicated on the tire sidewall, thinking this provides better performance. In reality, this practice can impair vehicle handling and increase the risk of blowouts, endangering drivers and cargo.

Illustrative image related to tire inflation guidelines

The Solution: To address this issue, it is crucial to establish clear internal guidelines that differentiate between recommended and maximum tire pressures. B2B buyers should ensure that all vehicles in their fleet display the correct tire pressure specifications prominently, either through visible stickers on the driver’s door or in the vehicle manuals. Additionally, investing in training programs for staff responsible for vehicle maintenance can cultivate a culture of safety. Regular audits and checks should be scheduled to verify compliance with tire pressure guidelines. By ensuring that tire inflation adheres strictly to the manufacturer’s recommendations, businesses can enhance safety, improve fuel efficiency, and extend tire lifespan.

The Problem: Another common challenge faced by B2B buyers is inconsistent monitoring of tire pressures across their fleet. For example, a construction firm in Africa may operate a variety of heavy machinery and trucks, leading to varied tire pressure maintenance routines. This inconsistency can result in some vehicles being under-inflated or over-inflated, causing uneven wear, increased fuel costs, and potential equipment failure.

The Solution: To mitigate this risk, businesses should implement a standardized tire pressure monitoring system (TPMS) across their fleet. This system can either be a direct sensor system that measures tire pressure in real time or an indirect system that uses existing vehicle sensors. Establishing a routine for checking tire pressures—ideally once a month or before long trips—can be integrated into regular vehicle maintenance schedules. Additionally, companies should maintain detailed records of tire pressure checks and maintenance performed, allowing for data analysis to identify trends and improve practices. Training maintenance personnel on the importance of proper tire inflation and how to use TPMS effectively can also enhance overall fleet safety and efficiency.

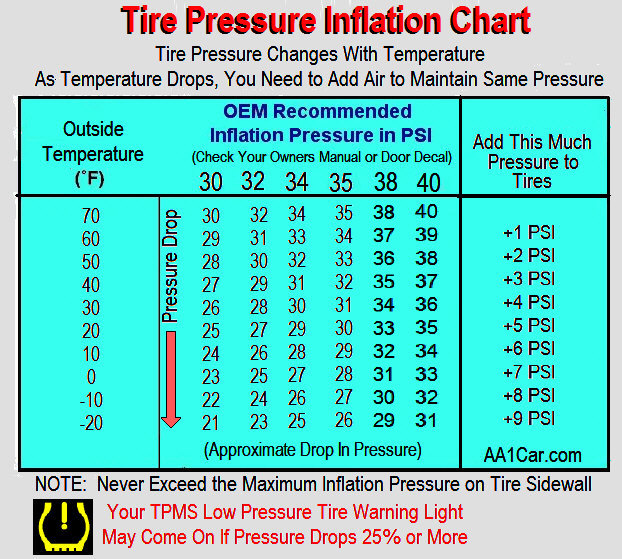

The Problem: Many B2B buyers do not account for seasonal changes affecting tire pressure. For instance, a delivery service operating in Europe may neglect to adjust tire pressure as temperatures drop in winter, leading to under-inflation. This oversight can not only increase fuel consumption but also compromise vehicle safety in adverse weather conditions, risking accidents and delays.

Illustrative image related to tire inflation guidelines

The Solution: To tackle this issue, B2B buyers should establish a seasonal tire maintenance protocol that includes regular assessments of tire pressure adjustments based on temperature variations. Educating staff about how temperature affects tire pressure—where a decrease of 10°F can lower tire pressure by about 1 PSI—can lead to proactive measures. Implementing a reminder system to check and adjust tire pressures at the start of each season can ensure that vehicles are always operating at optimal inflation. Furthermore, investing in high-quality tire pressure gauges and encouraging their use can empower drivers and maintenance teams to take charge of tire care. By fostering a culture of awareness regarding seasonal effects on tire performance, companies can enhance fleet safety and operational efficiency.

When selecting materials for tire inflation systems, it is essential to consider their properties, advantages, and limitations. This analysis will focus on four common materials: rubber, metal, plastic, and composite materials, evaluating their suitability for tire inflation applications from a B2B perspective.

Rubber is the primary material used in tire manufacturing due to its excellent elasticity and ability to withstand varying pressure and temperature conditions. Key properties include a high-temperature rating, typically between -40°C to 100°C, and good resistance to wear and tear.

Pros: Rubber is durable, cost-effective, and provides excellent sealing capabilities, making it ideal for maintaining tire pressure. Its flexibility allows it to adapt to different tire designs and applications.

Cons: However, rubber is susceptible to ozone and UV degradation, which can affect its longevity. Additionally, its performance can degrade in extreme temperatures, leading to potential failures.

For international buyers, especially in regions like Africa and the Middle East where temperatures can be extreme, selecting high-quality rubber that meets ASTM or DIN standards is crucial for ensuring product reliability.

Metal components, such as valves and fittings, are essential for tire inflation systems. They typically feature high-pressure ratings and excellent corrosion resistance, particularly when made from stainless steel or brass.

Pros: Metal is highly durable and can withstand significant mechanical stress, making it suitable for heavy-duty applications. It also has a long lifespan, reducing the need for frequent replacements.

Cons: The primary drawback is the higher cost compared to rubber and plastic. Additionally, metal can be prone to rust if not properly coated or maintained, especially in humid environments.

For B2B buyers in Europe, compliance with EU regulations on materials and safety standards is essential. Ensuring that metal components meet these regulations can prevent costly recalls and enhance product reliability.

Plastic materials, such as polyethylene and polypropylene, are increasingly used in tire inflation systems due to their lightweight nature and resistance to corrosion.

Pros: Plastics are cost-effective and can be molded into complex shapes, allowing for innovative designs in tire inflation systems. They also offer good chemical resistance, making them suitable for various environments.

Cons: However, plastics generally have lower temperature and pressure ratings compared to rubber and metal, which may limit their use in high-performance applications. They can also be less durable under mechanical stress.

For international buyers, particularly in South America and Africa, it is vital to consider the local climate and environmental conditions when selecting plastic components. Ensuring compliance with local standards can also enhance market acceptance.

Composite materials, which combine different substances to enhance performance, are gaining traction in tire inflation systems. These materials often provide a balance of strength, flexibility, and resistance to environmental factors.

Pros: Composites are lightweight and can be engineered to meet specific performance criteria, such as high-temperature resistance and low thermal expansion. They also offer excellent durability and can withstand harsh conditions.

Cons: The main limitation is the higher manufacturing complexity and cost associated with composite materials. Additionally, they may require specialized knowledge for proper installation and maintenance.

For buyers in regions like Germany and Saudi Arabia, understanding the specific performance benefits of composites can lead to better decision-making in selecting tire inflation systems that meet rigorous standards.

| Material | Typical Use Case for tire inflation guidelines | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Rubber | Tire manufacturing and sealing applications | Excellent elasticity and sealing capabilities | Susceptible to ozone and UV degradation | Low |

| Metal | Valves and fittings in tire inflation systems | Highly durable and long-lasting | Higher cost and potential rust issues | High |

| Plastic | Lightweight components in inflation systems | Cost-effective and resistant to corrosion | Lower temperature and pressure ratings | Med |

| Composite | Advanced tire inflation applications | Lightweight with tailored performance | Higher manufacturing complexity and cost | High |

This comprehensive analysis provides B2B buyers with actionable insights into material selection for tire inflation systems, ensuring that they can make informed decisions tailored to their specific regional needs and compliance requirements.

Illustrative image related to tire inflation guidelines

The manufacturing process of tire inflation guidelines involves several critical stages, each designed to ensure that the final product meets safety, performance, and durability standards. Understanding these stages can help B2B buyers assess the reliability of their suppliers.

Material Preparation: The first stage in manufacturing involves sourcing and preparing raw materials. High-quality rubber compounds, steel belts, and textiles are essential for tire performance. Suppliers often rely on international standards to ensure the quality of these materials. For instance, natural rubber must meet specific elasticity and durability criteria, while steel belts need to be corrosion-resistant.

Forming: During the forming stage, the prepared materials are shaped into tire components. This includes creating the tire body, tread, and sidewalls. Advanced techniques such as extrusion and molding are used to achieve precise dimensions. Automation plays a significant role in this stage, with computer-controlled machinery ensuring uniformity and reducing human error.

Assembly: After forming, the various components are assembled. This process involves layering the rubber and integrating steel belts, often employing specialized adhesives to bond these layers effectively. Quality assurance checks during this stage are crucial; any misalignment can lead to safety risks when the tire is in use.

Finishing: The final stage involves curing the assembled tire in a mold, which gives it its final shape and tread pattern. Curing also enhances the rubber’s durability and performance characteristics. Post-curing inspections are conducted to check for defects like air bubbles or uneven surfaces, which could compromise the tire’s integrity.

Quality control (QC) is integral to manufacturing tire inflation guidelines, ensuring that products meet rigorous safety and performance standards. B2B buyers should familiarize themselves with the various QC methodologies employed in the industry.

International Standards and Certifications: Compliance with international standards such as ISO 9001 is vital for manufacturers. This certification indicates that the manufacturer has established a quality management system (QMS) that meets global benchmarks. Additionally, industry-specific certifications like CE (Conformité Européenne) for products sold in Europe and API (American Petroleum Institute) standards for oil-related products provide an extra layer of assurance.

Quality Control Checkpoints:

– Incoming Quality Control (IQC): This checkpoint involves inspecting raw materials upon arrival at the manufacturing facility. Buyers can verify that materials meet specified standards before they are used in production.

– In-Process Quality Control (IPQC): During the manufacturing process, ongoing inspections ensure that each stage meets quality standards. This includes monitoring equipment calibration and process parameters.

– Final Quality Control (FQC): After finishing, each tire undergoes a final inspection to ensure it meets all specifications. This may include pressure tests and visual inspections for defects.

Common Testing Methods: Manufacturers utilize various testing methods to evaluate tire performance and safety. These may include:

– Tire Pressure Testing: Ensures that tires can withstand the recommended pressure without failure.

– Durability Tests: Simulate long-term use to assess how tires perform under different conditions.

– Dynamic Testing: Involves testing tires under real-world driving conditions to evaluate performance metrics like grip and handling.

For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, verifying a supplier’s quality control processes is essential to ensure product reliability.

Supplier Audits: Conducting regular audits of suppliers can provide insights into their manufacturing processes and QC practices. These audits should evaluate compliance with international standards and the effectiveness of their QMS.

Requesting QC Reports: Suppliers should be willing to share QC reports that detail their inspection results, testing methods, and any corrective actions taken. These reports serve as documentation of the supplier’s commitment to quality.

Third-Party Inspections: Engaging third-party inspection services can add an additional layer of assurance. These independent entities can verify that the products meet the required specifications and standards before they are shipped.

When dealing with international suppliers, B2B buyers must navigate various quality control nuances that can impact their procurement strategy.

Regulatory Compliance: Different regions have unique regulatory requirements for tire safety and performance. Buyers should ensure that their suppliers adhere to the relevant regulations in their target markets. For example, European buyers need to ensure compliance with the EU’s tire labeling regulations.

Cultural Considerations: Understanding the cultural context of suppliers can affect communication and expectations regarding quality. Establishing clear lines of communication about quality standards and expectations can mitigate misunderstandings.

Logistical Challenges: International shipping can introduce risks related to product integrity, such as damage during transit. Buyers should work with suppliers to ensure that appropriate packaging and handling protocols are in place.

Market Trends and Innovations: Keeping abreast of market trends and technological innovations in tire manufacturing can help buyers make informed decisions. This includes understanding advancements in tire pressure monitoring systems (TPMS) and how they integrate into the overall tire performance.

Understanding the manufacturing processes and quality assurance protocols for tire inflation guidelines is crucial for B2B buyers seeking reliable suppliers. By familiarizing themselves with the stages of manufacturing, quality control checkpoints, and verification methods, buyers can make informed decisions that enhance their procurement strategies and ensure the safety and performance of their tire products.

In the competitive landscape of tire procurement, having a clear understanding of tire inflation guidelines is essential for ensuring safety, optimizing performance, and minimizing costs. This checklist serves as a practical guide for B2B buyers, helping you navigate the complexities of tire inflation standards and supplier selection.

Recognizing the significance of maintaining the correct tire pressure is fundamental. Proper inflation enhances tire life, improves fuel efficiency, and ensures vehicle safety. Under- or over-inflation can lead to hazardous driving conditions and increased operational costs.

Establish the specific tire pressure requirements for your fleet or vehicles. Consult manufacturer guidelines to determine the optimal PSI (pounds per square inch) for different vehicle types. Consider factors such as load capacity and environmental conditions, as these can affect tire performance.

When sourcing tire inflation solutions, verify that potential suppliers hold the necessary certifications. Look for industry-standard certifications such as ISO or local regulatory approvals. These credentials demonstrate a supplier’s commitment to quality and compliance with safety regulations.

Ensure that you obtain comprehensive product specifications for tire inflation systems or gauges. This should include the range of PSI measurements, accuracy levels, and compatibility with various tire types. A reliable supplier will provide detailed datasheets and user manuals to aid in your decision-making.

Consider suppliers that offer advanced tire pressure monitoring systems (TPMS) which can automate pressure checks and provide real-time alerts. This technology can enhance operational efficiency and reduce the risk of tire-related accidents. Evaluate how well these systems integrate with existing fleet management software.

Review the warranty terms and after-sales support offered by suppliers. A strong warranty can protect your investment, while reliable customer service ensures you can address any issues promptly. Inquire about training for your team on the proper use and maintenance of tire inflation equipment.

Finally, perform a thorough cost-benefit analysis of the tire inflation solutions you are considering. Factor in initial costs, potential savings from improved fuel efficiency, and the longevity of tires under optimal inflation. This analysis will help you make informed purchasing decisions that align with your budget and operational goals.

Illustrative image related to tire inflation guidelines

By following this checklist, B2B buyers can confidently navigate the procurement of tire inflation guidelines, ensuring safety, efficiency, and cost-effectiveness in their operations.

When it comes to sourcing tire inflation guidelines, understanding the cost structure and pricing dynamics is crucial for international B2B buyers. The following analysis breaks down the essential cost components, pricing influencers, and provides actionable tips for buyers navigating this complex landscape.

The cost structure for tire inflation guidelines encompasses several key components:

Materials: The primary materials involved in tire manufacturing include rubber compounds, steel belts, and textile reinforcements. The quality of these materials significantly impacts both performance and cost. Higher-quality materials may lead to increased initial costs but can enhance durability and safety, reducing long-term expenses.

Labor: Labor costs can vary greatly depending on the region. For instance, manufacturers in developed countries may incur higher labor costs compared to those in emerging markets. Labor costs also encompass specialized expertise required for quality control and product testing.

Manufacturing Overhead: This includes costs associated with factory operations, such as utilities, maintenance, and administrative expenses. Efficient manufacturing processes can help minimize overhead, thereby impacting overall pricing.

Tooling: The production of tires requires specialized molds and machinery. Tooling costs are typically a significant upfront investment but can be amortized over high-volume production runs, affecting pricing models.

Quality Control (QC): Ensuring the safety and performance of tires requires rigorous QC processes, which involve testing and inspection. The costs associated with QC can impact the final pricing, particularly for manufacturers adhering to international standards.

Logistics: Transportation costs for raw materials and finished products can fluctuate based on fuel prices, distance, and trade regulations. Efficient logistics strategies can help mitigate these costs.

Margin: Manufacturers typically add a profit margin to their cost base. This margin can vary widely based on market conditions, competition, and brand positioning.

Several factors influence the pricing of tire inflation guidelines that buyers should consider:

Volume/MOQ: Minimum order quantities (MOQ) can significantly affect pricing. Purchasing in bulk often leads to lower per-unit costs, making it essential for buyers to assess their needs carefully.

Specifications and Customization: Tailoring tire specifications to meet specific vehicle requirements can increase costs. Customization options may include unique tread patterns or specialized rubber compounds.

Materials and Quality Certifications: The choice of materials impacts not only performance but also compliance with international standards. Certified products often command higher prices due to the assurance of quality and safety.

Supplier Factors: The reputation and reliability of suppliers can influence pricing. Established suppliers with a track record of quality may charge a premium, but they often provide better support and consistency.

Incoterms: Understanding shipping terms is crucial for international transactions. Incoterms dictate the responsibilities of buyers and sellers in shipping, which can impact overall costs and risk management.

International B2B buyers can leverage the following strategies to optimize their sourcing of tire inflation guidelines:

Negotiate Terms: Engage in negotiations with suppliers to achieve favorable pricing and terms. Discussing long-term relationships or bulk purchases can provide leverage.

Evaluate Total Cost of Ownership (TCO): Instead of focusing solely on the initial purchase price, consider the TCO, which includes maintenance, replacement, and fuel efficiency costs over the product’s lifespan.

Understand Pricing Nuances: Familiarize yourself with regional pricing variations, particularly when dealing with suppliers from Africa, South America, the Middle East, and Europe. Currency fluctuations and local economic conditions can impact pricing.

Conduct Supplier Audits: Regularly assess suppliers for quality, reliability, and compliance with standards. This practice helps ensure that you are getting the best value for your investment.

Stay Informed on Market Trends: Keep abreast of industry trends, regulatory changes, and advancements in tire technology. This knowledge can help you make informed decisions about sourcing and pricing.

Please note that prices for tire inflation guidelines can vary widely based on the factors outlined above. It is advisable to conduct thorough market research and obtain multiple quotes before making purchasing decisions. Always ensure that pricing reflects the latest market conditions and supplier capabilities.

In the realm of tire maintenance, adhering to proper tire inflation guidelines is crucial for safety, performance, and cost efficiency. However, B2B buyers may also consider alternative solutions that achieve similar goals, such as enhanced tire monitoring systems and automatic tire inflation technologies. This section delves into these alternatives, comparing them against traditional tire inflation guidelines to assist buyers in making informed decisions.

Illustrative image related to tire inflation guidelines

| Comparison Aspect | Tire Inflation Guidelines | Alternative 1: Tire Pressure Monitoring Systems (TPMS) | Alternative 2: Automatic Tire Inflation Systems (ATIS) |

|---|---|---|---|

| Performance | Ensures optimal tire performance and safety | Provides real-time tire pressure data, enhancing safety | Maintains optimal tire pressure automatically |

| Cost | Low initial cost (manual checks) | Moderate cost (installation and maintenance) | Higher upfront investment and maintenance costs |

| Ease of Implementation | Simple, requires manual checks | Requires installation but easy to use once set up | Complex installation, may require professional setup |

| Maintenance | Minimal, periodic checks required | Low, requires occasional sensor checks | Moderate, requires maintenance of the inflation system |

| Best Use Case | General vehicle use | Fleets and vehicles with frequent long-distance travel | Heavy-duty vehicles and fleets requiring constant pressure |

Tire Pressure Monitoring Systems (TPMS) offer a significant advantage by providing real-time data about tire pressure, allowing drivers to address issues proactively. This technology enhances safety by alerting users to under-inflation or over-inflation conditions, which can lead to accidents. However, TPMS can come with moderate costs, including installation and occasional sensor maintenance. While they simplify the monitoring process, they still require users to take corrective actions based on the alerts provided.

Automatic Tire Inflation Systems (ATIS) are designed for vehicles that require constant tire pressure management, such as those in logistics or construction. These systems automatically adjust tire pressure as needed, ensuring optimal performance without requiring manual checks. While ATIS can significantly reduce the risk of tire-related incidents and improve fuel efficiency, they come with a higher initial investment and ongoing maintenance costs. Additionally, the complexity of installation may necessitate professional assistance, which could be a deterrent for some businesses.

When selecting the appropriate tire maintenance solution, B2B buyers should consider their specific operational needs, budget constraints, and the types of vehicles in their fleet. For businesses with a focus on cost-effectiveness and simplicity, adhering to tire inflation guidelines remains a strong choice. Conversely, fleets that prioritize safety and efficiency in high-stakes environments may benefit from investing in TPMS or ATIS. By assessing these factors, buyers can make a strategic decision that aligns with their operational goals and enhances overall vehicle performance.

Illustrative image related to tire inflation guidelines

Recommended Tire Pressure (PSI/kPa)

Recommended tire pressure is expressed in pounds per square inch (PSI) or kilopascals (kPa). This specification indicates the optimal air pressure that ensures safe vehicle handling, fuel efficiency, and tire longevity. For B2B buyers, understanding the recommended pressure is crucial for maintaining fleet safety and minimizing operational costs. Regularly monitoring and adjusting tire pressure to this specification can prevent accidents and extend the lifespan of tires.

Maximum Tire Pressure

Maximum tire pressure is the highest pressure a tire can safely withstand, usually indicated on the tire’s sidewall. While it is important for manufacturers to specify this value, B2B buyers must be cautious not to inflate tires to this level under normal driving conditions. Over-inflation can lead to diminished vehicle control and increased wear. Knowing this specification helps businesses avoid costly tire replacements and enhances safety protocols.

Cold Tire Pressure

Cold tire pressure refers to the tire pressure measured when the tires are at ambient temperature, typically before the vehicle has been driven. For B2B operations, ensuring that tire pressure is checked when cold is vital to accurate readings. This practice prevents miscalculations caused by heat expansion after driving, which can lead to under- or over-inflation and compromise safety.

Tire Pressure Monitoring System (TPMS)

A Tire Pressure Monitoring System is an electronic system that alerts drivers when tire pressure falls below a certain threshold. For businesses managing vehicle fleets, having TPMS integrated into vehicles can significantly enhance safety by providing real-time data on tire health. This allows for proactive maintenance, reducing the risk of blowouts or accidents due to under-inflated tires.

Load Index

The load index indicates the maximum load a tire can carry at its specified pressure. Understanding the load index is critical for B2B buyers, especially those in logistics or transportation. Ensuring that tires are appropriate for the vehicle’s load requirements can prevent tire failure and enhance operational efficiency.

OEM (Original Equipment Manufacturer)

OEM refers to the original manufacturer of a vehicle or tire. In tire procurement, this term is significant as tires should match OEM specifications for optimal performance and safety. B2B buyers should ensure they source tires that meet OEM standards to maintain vehicle warranties and performance.

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. For businesses purchasing tires in bulk, understanding MOQ is essential for budgeting and inventory management. Negotiating favorable MOQs can lead to cost savings and better supply chain efficiency.

RFQ (Request for Quotation)

An RFQ is a document sent to suppliers requesting pricing information for specific products. In the context of tire procurement, issuing RFQs allows B2B buyers to compare prices and terms from different suppliers, ensuring they receive the best deal for tire purchases.

Incoterms (International Commercial Terms)

Incoterms are a set of predefined international trade terms that clarify the responsibilities of buyers and sellers in shipping goods. For tire imports and exports, understanding Incoterms is crucial for managing logistics, costs, and risks associated with transportation. Familiarity with these terms can enhance negotiation strategies and supply chain management.

Tread Depth

Tread depth refers to the measurement of the grooves on a tire’s surface, which affects traction and safety. For B2B buyers, monitoring tread depth is vital for compliance with safety regulations and ensuring optimal vehicle performance. Regular assessments can prevent accidents and unnecessary tire replacements.

By grasping these technical properties and trade terms, B2B buyers can make informed decisions that enhance operational efficiency, safety, and cost-effectiveness in tire management.

The tire inflation guidelines market is shaped by several global drivers, including the growing emphasis on vehicle safety, fuel efficiency, and environmental sustainability. With the automotive industry increasingly focused on optimizing performance and reducing operational costs, proper tire inflation has become a critical factor for vehicle maintenance. International B2B buyers, particularly in regions like Africa, South America, the Middle East, and Europe, are witnessing a surge in demand for reliable tire inflation systems and monitoring technologies, such as Tire Pressure Monitoring Systems (TPMS).

Emerging trends in sourcing technologies include the integration of IoT (Internet of Things) solutions that allow real-time monitoring of tire pressure and performance, enabling businesses to respond proactively to potential issues. Additionally, there is a growing preference for automated inflation systems that enhance operational efficiency in fleet management. Buyers are also increasingly interested in data analytics tools that provide insights into tire performance, helping them make informed decisions about maintenance and replacements.

Illustrative image related to tire inflation guidelines

Furthermore, the rise of e-commerce platforms is reshaping procurement strategies, allowing buyers to access a wider range of suppliers and products. This trend is particularly significant in regions like Africa and South America, where traditional supply chains may be less established. Overall, understanding these dynamics can help international B2B buyers navigate the complexities of the tire inflation guidelines market and leverage new technologies to optimize their operations.

Sustainability is becoming a paramount concern in the tire inflation guidelines sector, reflecting a broader shift towards environmentally responsible practices in B2B sourcing. The environmental impact of tire production and disposal is significant, prompting businesses to seek out ethical sourcing options and “green” certifications. Buyers are increasingly interested in suppliers that utilize sustainable materials and practices, such as recycled rubber and environmentally friendly manufacturing processes.

The importance of ethical supply chains is underscored by growing regulatory pressures and consumer demand for transparency. Companies that can demonstrate a commitment to sustainability are likely to gain a competitive edge in the marketplace. This trend is particularly pronounced in Europe, where stringent environmental regulations drive the adoption of sustainable practices across industries.

Incorporating sustainability into tire inflation guidelines also includes promoting proper tire maintenance practices that extend the lifespan of tires, thereby reducing waste and the frequency of replacements. By aligning sourcing strategies with sustainability goals, B2B buyers can not only enhance their brand reputation but also contribute to the broader effort of minimizing the environmental footprint of the automotive sector.

Illustrative image related to tire inflation guidelines

The evolution of tire inflation guidelines dates back to the early 20th century when the first pneumatic tires were introduced. Initially, tire pressure was managed through manual checks, which were often inconsistent and error-prone. The development of standardized tire pressure recommendations was driven by increasing awareness of vehicle safety and efficiency, leading to the establishment of industry norms.

As automotive technology advanced, so did the complexity of tire inflation systems. The introduction of TPMS in the late 1990s marked a significant milestone, enabling real-time monitoring and automatic alerts for under-inflation. This innovation not only improved safety but also contributed to enhanced fuel efficiency and reduced tire wear.

In recent years, the focus has shifted towards integrating digital solutions and data analytics into tire maintenance practices. This evolution reflects the growing recognition of the role that proper tire inflation plays in overall vehicle performance and the increasing demand for smart, connected solutions in the B2B sector. Understanding this historical context can provide valuable insights for buyers looking to optimize their tire management strategies today.

How do I ensure accurate tire pressure readings for my fleet vehicles?

To guarantee precise tire pressure readings, it’s essential to check tire pressure when the tires are cold, preferably before the vehicle has been driven or at least two hours after driving. Use a reliable tire pressure gauge and refer to the manufacturer’s specifications, which are usually found in the vehicle’s manual or on a sticker inside the driver’s door. Implement a routine check—ideally monthly or before long trips—to maintain optimal tire performance and safety, minimizing risks of blowouts or uneven wear.

What is the best tire pressure monitoring system (TPMS) for international fleets?

Selecting the best TPMS for international fleets involves considering factors such as compatibility with diverse vehicle models, ease of installation, and real-time monitoring capabilities. Advanced systems offer features like alerts for low or high pressure, integration with fleet management software, and data analytics for preventive maintenance. Research suppliers that provide robust customer support and training, especially in regions like Africa and South America, where technical assistance may be crucial.

How do I choose the right tire supplier for my business?

When vetting tire suppliers, prioritize those with a strong reputation for quality and reliability. Evaluate their product offerings, including tire types suitable for your fleet’s specific needs, such as all-season, winter, or specialty tires. Request samples, check certifications, and review customer testimonials. Additionally, consider their logistics capabilities, response times, and after-sales support to ensure they can meet your operational demands effectively.

What are the minimum order quantities (MOQs) for tire suppliers?

Minimum order quantities (MOQs) vary widely among tire suppliers and can depend on factors such as tire type, brand, and market demand. It’s advisable to discuss MOQs directly with potential suppliers to determine flexibility based on your business needs. Some suppliers may offer lower MOQs for first-time orders or allow for mixed orders across different tire types, facilitating a tailored approach to your inventory management.

What payment terms should I expect when sourcing tires internationally?

Payment terms for international tire sourcing can range from advance payments to net 30 or net 60 days, depending on the supplier’s policies and your relationship with them. It’s common to negotiate terms based on order size and payment history. Be mindful of currency fluctuations and potential transaction fees when dealing with international suppliers, and consider using secure payment methods such as letters of credit for larger transactions to mitigate risks.

How can I customize tire specifications for my fleet?

Customizing tire specifications involves collaborating closely with your supplier to ensure the tires meet your operational requirements. Provide detailed information on load capacities, tread patterns, and specific performance needs (e.g., off-road capability, fuel efficiency). Suppliers may offer options for branding or unique tread designs, particularly for larger orders. Always verify that any customizations comply with local regulations and standards in your operating regions.

What quality assurance measures should I look for in tire suppliers?

When evaluating tire suppliers, seek those that adhere to international quality assurance standards, such as ISO certifications. Inquire about their testing processes, including durability, performance, and safety tests. A reputable supplier should provide documentation of their quality control measures and be willing to share results from independent testing organizations. Regular audits and compliance checks are also indicators of a supplier’s commitment to quality.

What logistics considerations are important when importing tires?

Logistics plays a critical role in importing tires, including understanding shipping regulations and customs requirements in your destination country. Assess potential suppliers’ capabilities in managing shipping logistics, such as freight forwarding and warehousing. Consider the impact of delivery times on your operations and whether the supplier can provide tracking information. Additionally, ensure that the packaging meets international shipping standards to prevent damage during transit.

Domain: pirelli.com

Registered: 1995 (30 years)

Introduction: The recommended tire pressure is the optimal air pressure for your tires established by the car manufacturer, typically between 28 and 36 PSI. It can be found in the car’s operator manual or on a sticker inside the driver’s door. The pressure should be measured when the tire is cold. Maximum pressure is stated on the tire’s sidewall and should not be used for everyday driving as it can impair hand…

Domain: mastercrafttires.com

Registered: 1997 (28 years)

Introduction: This company, Mastercraft – Tire Inflation Guidelines, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

Domain: toyotires.com

Registered: 1997 (28 years)

Introduction: Load and Inflation Tables provide assistance for replacing tires with optional sizes, including plus sizes not listed on the vehicle’s tire information placard (T.I.P) or in the owner’s manual. For original equipment (OE) size inflation pressure, refer to the T.I.P., commonly found on the vehicle door jam, glove compartment, or near the gas cap. Important: Consult the vehicle’s owner’s manual for …

Domain: generaltire.com

Registered: 1996 (29 years)

Introduction: General Tire offers a variety of tire models including performance tires like G-MAX AS 07 and G-MAX RS, touring tires such as Alti MAX 365 AW and Alti MAX RT 45, all-terrain/mud-terrain options like Grabber APT and Grabber A/T X, and winter tires including Alti MAX Arctic 12 and Grabber Arctic LT. Proper tire pressure is crucial for vehicle performance, affecting driving comfort, stability, corner…

Domain: tirereview.com

Registered: 1996 (29 years)

Introduction: Proper tire inflation is influenced by temperature, altitude, and load weight. For every 10-degree Fahrenheit change, tire pressure shifts by about 2 PSI. Technicians should not lower a hot tire’s pressure to match cold inflation recommendations, and if a hot tire reads below recommended pressure, it should be inflated to the recommended PSI plus an extra 10 PSI. Altitude affects tire pressure as …

Domain: yournexttire.com

Registered: 2008 (17 years)

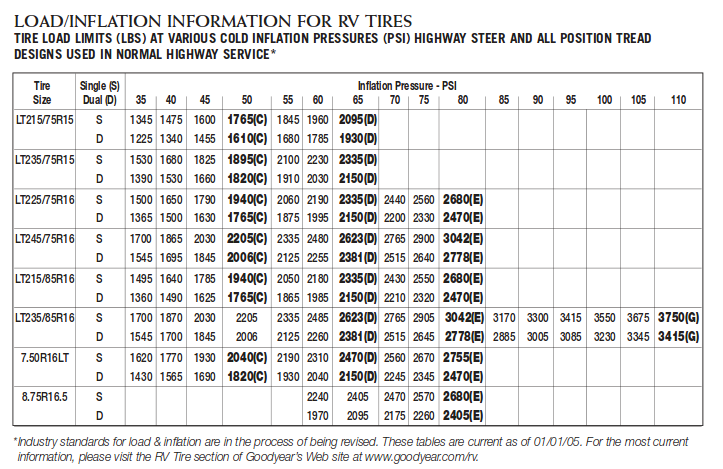

Introduction: Tire Inflation Chart: The chart provides a formula for calculating load capacity based on tire weight and tire pressure. For example, a 265/75R16 10-ply tire at 80 psi can carry 3,085 pounds, while at 60 psi, it can carry 2,314 pounds. At 65 psi, the capacity is 2,507 pounds. The formula used is Tire Weight / Tire Pressure = Load Capacity Pounds per PSI. A 265/75R16 6-ply tire inflated to 50 psi c…

In conclusion, maintaining optimal tire inflation is not just a matter of safety; it significantly impacts operational efficiency and cost management for businesses across various sectors. By adhering to manufacturer-recommended tire pressures, organizations can enhance fuel efficiency, extend tire lifespan, and reduce the likelihood of accidents. Strategic sourcing of tire maintenance solutions—such as quality tire pressure gauges and reliable inflation services—can further streamline these efforts, ensuring that businesses remain compliant with safety standards while optimizing their fleet performance.

International buyers from Africa, South America, the Middle East, and Europe should consider incorporating tire inflation best practices into their procurement strategies. This approach not only reinforces safety and compliance but also leads to long-term cost savings and operational resilience.

Illustrative image related to tire inflation guidelines

As the tire industry evolves, leveraging innovative technologies such as Tire Pressure Monitoring Systems (TPMS) and advanced inflation equipment can provide additional layers of efficiency and safety. We encourage B2B buyers to actively engage with suppliers who prioritize these innovations. By doing so, you position your organization to navigate future challenges while maximizing the value of your tire investments.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

Illustrative image related to tire inflation guidelines

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.