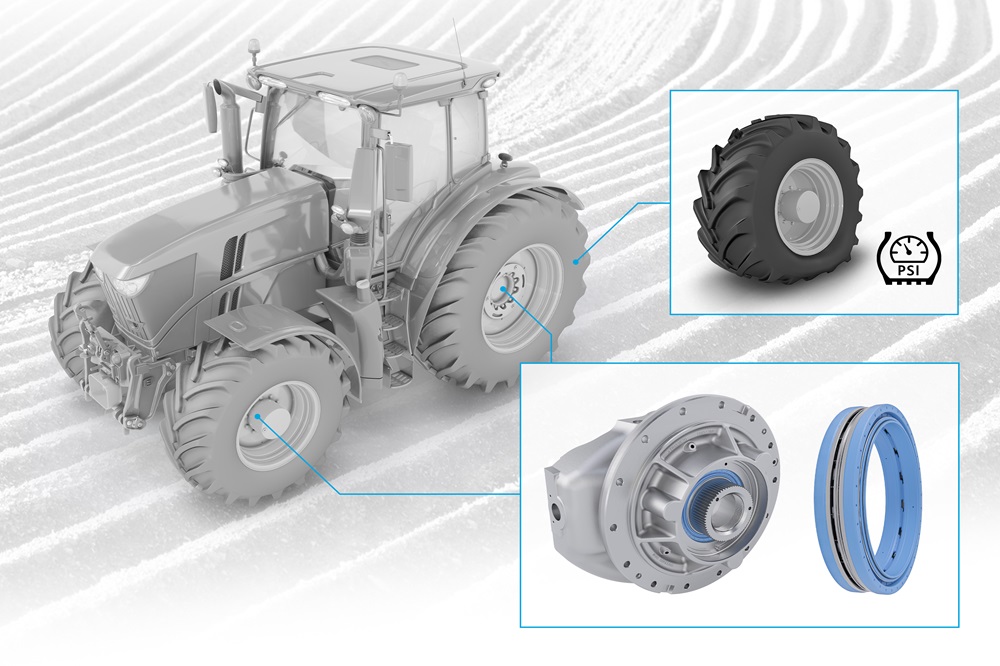

In today’s fast-paced global market, sourcing an effective Central Tire Inflation System (CTIS) can significantly enhance vehicle performance and operational efficiency. For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe—including countries like Saudi Arabia and Nigeria—navigating the complexities of tire management solutions is essential. A well-implemented CTIS not only improves traction and fuel efficiency but also reduces downtime caused by tire malfunctions, addressing a critical challenge faced by fleet operators.

This comprehensive guide delves into various types of central tire inflation systems, their applications across industries, and essential considerations for supplier vetting. It also provides insights into cost structures, potential ROI, and maintenance requirements, empowering decision-makers to make informed choices that align with their operational needs. By exploring the latest innovations and trends in CTIS technology, buyers will gain valuable knowledge on maximizing tire life and ensuring vehicle reliability.

Whether you are seeking solutions for construction, agriculture, or military applications, this guide serves as a vital resource for optimizing tire management strategies. With the right information at your fingertips, you can streamline procurement processes and drive greater efficiency in your fleet operations, ultimately contributing to your bottom line.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Automatic Central Tire Inflation System (ACTIS) | Automatically adjusts tire pressure based on load and terrain. | Mining, construction, military | Pros: Enhances mobility, reduces tire wear. Cons: Higher initial cost. |

| Manual Central Tire Inflation System (MCTIS) | Requires manual adjustment of tire pressure via onboard controls. | Agriculture, fleet management | Pros: Lower cost, simple installation. Cons: Labor-intensive, less efficient. |

| Hybrid Central Tire Inflation System (HCTIS) | Combines automatic and manual features for flexibility. | Off-road vehicles, emergency services | Pros: Versatile, adaptable to various conditions. Cons: Complexity can lead to maintenance challenges. |

| Portable Central Tire Inflation System (PCTIS) | Compact, mobile units for tire inflation on the go. | Overlanding, recreational vehicles | Pros: Convenient for remote areas, easy to transport. Cons: Limited to lower pressure adjustments. |

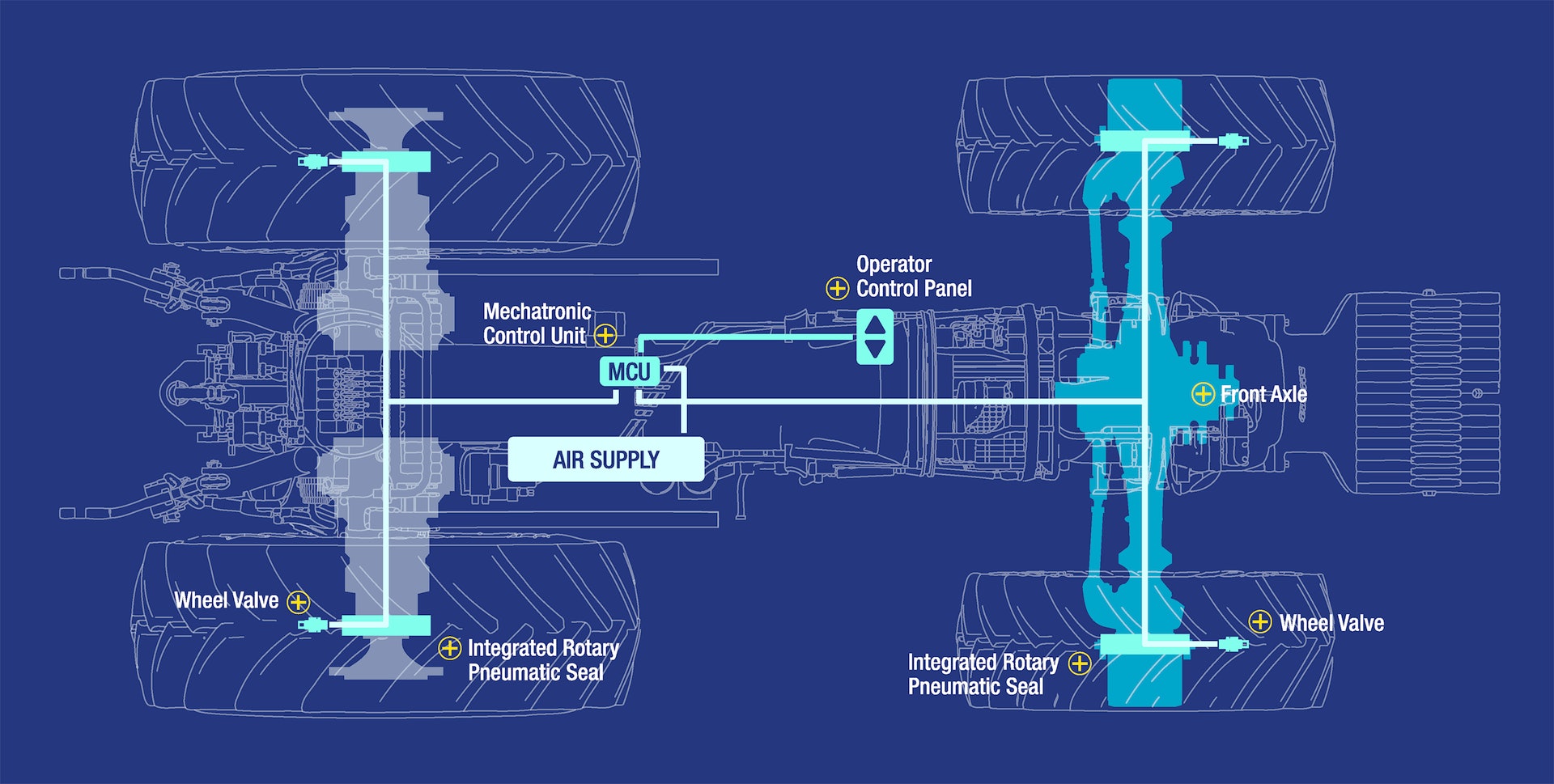

| Integrated Central Tire Inflation System (ICTIS) | Built into the vehicle’s existing air supply system. | Heavy-duty trucks, specialized vehicles | Pros: Seamless operation, minimal space required. Cons: May require specific vehicle compatibility. |

Automatic Central Tire Inflation Systems (ACTIS) are designed to optimize tire pressure automatically based on real-time load and terrain data. This technology is particularly beneficial in industries such as mining and construction, where heavy vehicles operate in challenging environments. B2B buyers should consider the enhanced mobility and reduced tire wear as significant advantages, although the higher initial investment may be a barrier.

Manual Central Tire Inflation Systems (MCTIS) require operators to manually adjust tire pressure using onboard controls. This system is often found in agriculture and fleet management applications, where budget constraints are a priority. While MCTIS is cost-effective and straightforward to install, it can be labor-intensive and less efficient compared to automated systems, making it essential for buyers to evaluate their operational needs.

Hybrid Central Tire Inflation Systems (HCTIS) offer a blend of automatic and manual functionalities, providing flexibility for diverse applications such as off-road vehicles and emergency services. This adaptability allows operators to respond effectively to varying conditions. However, the complexity of HCTIS may lead to increased maintenance requirements, which buyers must factor into their purchasing decisions.

Portable Central Tire Inflation Systems (PCTIS) are compact units that facilitate tire inflation in remote locations, making them ideal for overlanding and recreational vehicles. The convenience of these systems allows users to adjust tire pressure quickly and efficiently. However, their limitations in pressure adjustments mean they may not be suitable for all commercial applications, prompting buyers to assess their specific needs.

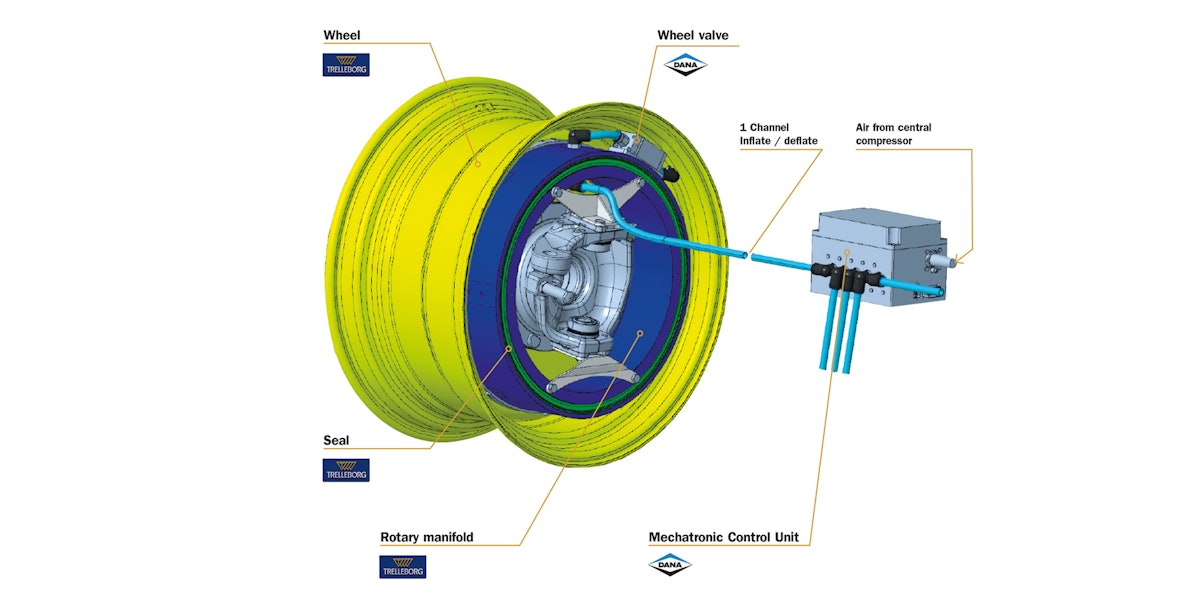

Integrated Central Tire Inflation Systems (ICTIS) are seamlessly built into the vehicle’s existing air supply system, making them suitable for heavy-duty trucks and specialized vehicles. This integration minimizes the space required for additional equipment and allows for smooth operation. However, buyers must ensure compatibility with their vehicles, as this can be a limitation in terms of implementation.

| Industry/Sector | Specific Application of Central Tire Inflation System | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Mining | Tire pressure management for heavy machinery | Enhanced tire life, reduced downtime, and improved safety | Compatibility with existing machinery and harsh operating conditions. |

| Agriculture | Inflation adjustment for agricultural vehicles | Increased traction in varying terrains, reduced soil compaction | Robustness in diverse environments and ease of operation. |

| Construction | Tire management for construction vehicles | Improved fuel efficiency, reduced operational costs | Durability in rugged conditions and ease of maintenance. |

| Military | Tactical mobility for military vehicles | Enhanced vehicle performance in challenging terrains | Reliability and quick response capabilities are crucial. |

| Logistics & Transport | Tire pressure optimization for fleet vehicles | Reduced tire wear and fuel consumption, increased uptime | Integration with fleet management systems and remote monitoring capabilities. |

In the mining sector, central tire inflation systems (CTIS) are crucial for managing the tire pressures of heavy machinery, such as haul trucks and excavators. These systems allow operators to adjust tire pressure on-the-fly according to the terrain, enhancing traction and stability on uneven surfaces. By reducing tire wear and preventing blowouts, CTIS minimizes downtime and enhances safety, which is paramount in high-risk mining environments. Buyers in this sector should prioritize systems that can withstand extreme conditions and offer compatibility with existing equipment.

In agriculture, CTIS is utilized in tractors and other farming equipment to optimize tire pressure based on load and field conditions. This adjustment not only improves traction on soft or uneven ground but also minimizes soil compaction, which is vital for crop health. Implementing CTIS can lead to significant fuel savings and extended tire life, providing a strong ROI for farmers. International buyers should consider systems that are easy to operate and maintain, especially in remote areas where agricultural activities often take place.

Construction vehicles, often operating in rugged terrains, benefit significantly from CTIS by allowing operators to modify tire pressure for maximum efficiency. This flexibility leads to improved fuel economy and reduced operational costs, as well as enhanced stability and safety on job sites. For construction companies, sourcing durable and reliable CTIS solutions that can withstand harsh conditions and provide quick adjustments is essential for maintaining project timelines and budgets.

In military operations, CTIS is vital for ensuring the mobility of tactical vehicles in diverse and challenging environments. The ability to rapidly adjust tire pressure allows military vehicles to navigate through mud, sand, and rough terrain, enhancing operational effectiveness and troop safety. Buyers in this sector must seek systems that offer quick deployment, reliability under pressure, and the ability to function in extreme conditions, as these factors can be critical in mission success.

For logistics and transport companies, implementing a central tire inflation system can lead to significant reductions in tire wear and fuel consumption, ultimately increasing vehicle uptime. By optimizing tire pressure across fleets, businesses can enhance the overall efficiency of their operations. When sourcing CTIS solutions, international buyers should look for systems that integrate seamlessly with fleet management software and provide real-time monitoring capabilities, ensuring proactive maintenance and operational efficiency.

The Problem: Many B2B buyers in the transportation and logistics sectors face the ongoing issue of inconsistent tire pressure across their fleet. This problem often results in increased tire wear, poor fuel efficiency, and unexpected breakdowns. For companies operating in regions with challenging terrains—like those in Africa or South America—this can lead to significant operational downtime, affecting delivery schedules and profitability. Drivers may not have the time or resources to manually check and adjust tire pressures, especially in remote areas.

Illustrative image related to central tire inflation system

The Solution: Implementing a Central Tire Inflation System (CTIS) can address this issue effectively. By choosing a system that allows for real-time monitoring and adjustment of tire pressure from the vehicle’s cab, companies can maintain optimal tire pressure for different loads and terrains. It’s essential to select a CTIS that features automatic pressure adjustments based on vehicle load and terrain type. Additionally, ensure that the system is equipped with diagnostic alerts that notify drivers of any potential tire issues, such as leaks or punctures. This proactive approach minimizes downtime and enhances overall fleet efficiency.

The Problem: In industries where vehicles are subjected to rigorous use, such as construction or agriculture, tire maintenance can become a significant cost factor. Many businesses struggle with high tire replacement costs due to accelerated wear and tear caused by improper inflation. This challenge is compounded in regions with varying climates and terrains, where maintaining optimal tire pressure manually can be labor-intensive and error-prone.

The Solution: A sophisticated CTIS can mitigate these costs by extending the life of tires through precise inflation control. When sourcing a CTIS, look for systems that allow for easy integration with existing vehicle setups and offer options for both on-road and off-road applications. Choose a system that can automatically adjust tire pressure based on specific conditions, which helps to reduce tire wear and improves fuel consumption. Additionally, consider investing in training for your drivers to effectively utilize the system’s features, ensuring they can respond promptly to alerts and make necessary adjustments. This investment not only saves costs in the long run but also enhances operational efficiency.

The Problem: Businesses operating in remote or rugged areas often find that their vehicles become immobilized due to inadequate tire pressure, particularly in muddy or uneven terrain. This scenario can lead to costly recovery efforts and delays in operations, which can be detrimental to project timelines and client satisfaction. B2B buyers need solutions that enable their vehicles to navigate challenging conditions without the constant risk of getting stuck.

Illustrative image related to central tire inflation system

The Solution: A Central Tire Inflation System specifically designed for off-road capabilities can provide the necessary flexibility. When evaluating options, prioritize CTIS models that allow for on-the-fly adjustments to tire pressure, enabling vehicles to operate effectively at lower pressures in tough conditions. This feature is particularly beneficial for companies in sectors such as mining or construction, where vehicle mobility is crucial. Furthermore, ensure the system includes robust emergency features that can assist drivers in handling sudden tire issues. Implementing a CTIS not only enhances vehicle performance in adverse conditions but also reduces the likelihood of immobilization, fostering greater confidence in challenging environments.

By addressing these common pain points with actionable solutions, B2B buyers can enhance operational efficiency, reduce costs, and improve overall vehicle performance in their respective industries.

Central Tire Inflation Systems (CTIS) are critical for maintaining optimal tire pressure in various conditions, enhancing vehicle performance and safety. The materials used in these systems significantly influence their functionality, durability, and overall effectiveness. Below, we analyze four common materials used in CTIS components, focusing on their properties, advantages, disadvantages, and considerations for international buyers.

Key Properties: Aluminum is lightweight, corrosion-resistant, and has excellent thermal conductivity. It can withstand moderate pressure and temperature variations, making it suitable for various environments.

Pros & Cons: The durability of aluminum is high, but it can be more expensive than other metals. Manufacturing complexity is relatively low, as aluminum can be easily extruded and machined. However, it may not be suitable for extremely high-pressure applications due to its lower tensile strength compared to steel.

Illustrative image related to central tire inflation system

Impact on Application: Aluminum components are often used in valve assemblies and air tanks where weight reduction is crucial. However, care must be taken to ensure compatibility with the media being transported, as certain chemicals may cause corrosion.

Considerations for International Buyers: Buyers in regions like Africa and the Middle East should ensure compliance with local standards (e.g., ASTM, DIN) regarding aluminum grades. Given its cost, buyers should evaluate the trade-off between weight savings and performance needs.

Key Properties: Steel offers high tensile strength and excellent durability, making it suitable for high-pressure applications. It is also resistant to deformation under load.

Pros & Cons: Steel is generally more cost-effective than aluminum and can be produced in various grades to meet specific performance requirements. However, it is heavier and susceptible to corrosion unless treated or coated.

Illustrative image related to central tire inflation system

Impact on Application: Steel is commonly used in high-pressure tubing and fittings within CTIS. Its robustness is advantageous in harsh environments, but it requires regular maintenance to prevent rust, especially in humid climates.

Considerations for International Buyers: Buyers in South America and Europe should consider the availability of corrosion-resistant coatings to enhance steel’s longevity. Compliance with international standards for pressure vessels is also critical.

Key Properties: Polyurethane is flexible, lightweight, and resistant to abrasion and chemicals. It can handle a range of temperatures and pressures, making it suitable for various applications.

Pros & Cons: The material is cost-effective and easy to manufacture into complex shapes. However, its long-term durability may be less than that of metals, particularly under extreme environmental conditions.

Impact on Application: Polyurethane is often used in hoses and seals within CTIS. Its flexibility allows for easy installation and movement, but it may degrade faster when exposed to UV light or extreme temperatures.

Illustrative image related to central tire inflation system

Considerations for International Buyers: Buyers in regions with high UV exposure, like Saudi Arabia, should ensure that the polyurethane used is UV-stabilized. Compliance with local chemical resistance standards is also important.

Key Properties: Nylon is a strong, lightweight synthetic polymer known for its excellent abrasion resistance and flexibility. It can operate effectively at moderate pressures and temperatures.

Pros & Cons: Nylon is relatively inexpensive and easy to mold into various shapes. However, it can be less durable than metals and may require protective coatings to enhance its lifespan.

Illustrative image related to central tire inflation system

Impact on Application: Nylon is often used in fittings and connectors within CTIS due to its lightweight nature. However, it may not be suitable for high-pressure applications without reinforcement.

Considerations for International Buyers: Buyers should verify that the nylon used meets specific international standards for mechanical properties. In regions with high humidity, moisture absorption can be a concern, which may affect performance.

| Material | Typical Use Case for central tire inflation system | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum | Valve assemblies and air tanks | Lightweight and corrosion-resistant | Lower tensile strength than steel | Medium |

| Steel | High-pressure tubing and fittings | High tensile strength and durability | Heavier and prone to corrosion | Low |

| Polyurethane | Hoses and seals | Flexible and cost-effective | Less durable under extreme conditions | Low |

| Nylon | Fittings and connectors | Lightweight and inexpensive | May require protective coatings | Low |

This strategic material selection guide provides insights into the materials used in Central Tire Inflation Systems, helping international B2B buyers make informed decisions based on their specific operational needs and environmental conditions.

The manufacturing process for Central Tire Inflation Systems (CTIS) involves several crucial stages that ensure the final product meets the rigorous standards required for performance and safety. Understanding these stages can help B2B buyers assess the reliability and quality of potential suppliers.

Illustrative image related to central tire inflation system

Material Preparation

The first step involves selecting high-quality materials that can withstand varying pressures and environmental conditions. Common materials include durable metals for valves and fittings, high-strength plastics for control components, and specialized rubber for hoses. Suppliers often conduct material testing to ensure compliance with industry standards.

Forming and Machining

Once materials are prepared, the forming and machining processes begin. This can include techniques such as:

– CNC Machining: Utilized for precision components such as valves and connectors, ensuring exact specifications.

– Injection Molding: Used for plastic parts, allowing for complex shapes and consistent quality.

– Stamping: Employed for creating flat metal components that will be further assembled.

Assembly

After forming, the components are assembled into a complete system. This stage often involves:

– Automated Assembly Lines: These lines enhance efficiency and ensure consistent quality through robotics.

– Manual Assembly: In some cases, skilled technicians may assemble complex components that require more intricate handling.

Finishing

The finishing stage may include surface treatments such as coating, painting, or anodizing to enhance corrosion resistance and durability. Final inspections are conducted during this phase to ensure that all parts meet quality standards and are free from defects.

Quality assurance (QA) is critical in manufacturing CTIS to ensure that the systems perform reliably under various conditions. B2B buyers should be aware of the standards and practices that suppliers implement to maintain quality.

Adherence to International Standards

Many manufacturers comply with international quality management standards such as ISO 9001, which provides a framework for consistent quality assurance practices. Additionally, industry-specific certifications like CE marking for European markets and API standards for oil and gas applications are also important indicators of quality.

Quality Control Checkpoints

Quality control (QC) checkpoints are established throughout the manufacturing process to monitor and verify the quality of components and assemblies:

– Incoming Quality Control (IQC): Materials are inspected upon arrival to ensure they meet specified standards.

– In-Process Quality Control (IPQC): Ongoing inspections during the manufacturing process help identify and rectify issues before final assembly.

– Final Quality Control (FQC): The final product undergoes rigorous testing to ensure it meets operational and safety standards.

Common Testing Methods for CTIS

Various testing methods are utilized to ensure the integrity and performance of the CTIS:

– Pressure Testing: Verifies the system can withstand the required pressure levels without leaking.

– Functional Testing: Ensures that all components operate as intended when the system is activated.

– Durability Testing: Simulates real-world conditions to assess the system’s performance over time.

For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, verifying the quality control processes of suppliers is essential to mitigate risks associated with product performance and compliance.

Supplier Audits

Conducting audits of potential suppliers is one of the most effective ways to assess their quality control measures. This can involve:

– On-Site Inspections: Visiting the manufacturing facility to observe processes and quality control practices in action.

– Document Reviews: Examining quality management documentation, including process maps, inspection records, and compliance certifications.

Requesting Quality Reports

Buyers should request quality assurance reports that detail the results of testing and inspections conducted throughout the manufacturing process. This documentation can provide insights into the consistency and reliability of the supplier’s products.

Engaging Third-Party Inspectors

Utilizing third-party inspection services can provide an unbiased assessment of a supplier’s quality control processes. These inspectors can conduct thorough evaluations of manufacturing practices, material quality, and compliance with international standards.

Navigating the nuances of quality control in international trade is crucial for B2B buyers, particularly in diverse markets like Africa, South America, the Middle East, and Europe.

Understanding Regional Standards

Each region may have specific regulations and standards that manufacturers must adhere to. For instance, CE marking is essential for products sold in Europe, while different certifications may apply in the Middle East or Africa. Buyers should familiarize themselves with these requirements to ensure compliance.

Cultural Considerations

Cultural differences can impact manufacturing practices and quality perceptions. It is essential for buyers to communicate clearly with suppliers about quality expectations and to establish a mutual understanding of standards.

Building Long-Term Relationships

Establishing long-term relationships with suppliers can foster better communication and collaboration on quality issues. Regular feedback loops and open discussions about quality improvements can enhance product reliability and supplier performance.

By understanding these manufacturing processes and quality assurance practices, B2B buyers can make informed decisions when sourcing Central Tire Inflation Systems. Prioritizing quality and compliance will not only enhance operational efficiency but also ensure safety and reliability in diverse applications.

Illustrative image related to central tire inflation system

In the quest for optimal vehicle performance and reduced operational costs, sourcing a Central Tire Inflation System (CTIS) is a critical decision for businesses involved in transportation, logistics, or heavy-duty applications. This step-by-step checklist will guide you through the essential considerations and actions needed to effectively procure a CTIS tailored to your operational needs.

Before initiating the procurement process, it’s vital to outline the specific technical requirements of the CTIS that align with your vehicle fleet and operational demands. Consider factors such as vehicle types, load capacities, and the terrains your vehicles will traverse.

– Key Considerations:

– Maximum and minimum tire pressure settings.

– Compatibility with existing vehicle systems.

Conduct thorough research to identify suppliers that specialize in CTIS products. Look for companies with a strong reputation in the industry, particularly those that have experience working in your geographical region.

– Where to Look:

– Online directories and industry publications.

– Recommendations from industry peers or associations.

Confirm that potential suppliers possess the necessary certifications and comply with international quality standards. This step ensures that the CTIS will be reliable and effective.

– Important Certifications to Verify:

– ISO certifications.

– Compliance with local regulations specific to your region (e.g., CE marking in Europe).

Engage suppliers to provide demonstrations or case studies of their CTIS in action. This hands-on assessment can offer insight into the system’s functionality and ease of use.

– What to Observe:

– User interface and control systems.

– Real-world performance metrics, such as tire pressure adjustments and diagnostic alerts.

Investigate the level of after-sales support offered by suppliers, including warranty terms and maintenance services. A robust support system can significantly reduce downtime and operational disruptions.

– Key Aspects to Confirm:

– Availability of technical support.

– Duration and coverage of warranties.

Beyond the initial purchase price, assess the total cost of ownership associated with the CTIS. Consider factors such as installation costs, maintenance expenses, and potential fuel savings due to improved tire performance.

– Cost Elements to Consider:

– Installation fees.

– Expected lifespan and durability of the system.

Once you have selected a supplier, engage in negotiations to secure favorable terms. Ensure that all aspects, including pricing, delivery schedules, and installation support, are clearly defined in the contract.

– Negotiation Tips:

– Be clear about your expectations for delivery timelines.

– Discuss potential volume discounts if purchasing multiple systems.

By following this checklist, you can streamline your procurement process for a Central Tire Inflation System, ensuring that you select a solution that enhances your fleet’s efficiency and operational reliability.

When sourcing a Central Tire Inflation System (CTIS), understanding the cost structure is crucial for B2B buyers aiming to optimize their procurement processes. This analysis will delve into the key cost components, price influencers, and provide actionable tips for buyers in international markets, particularly in Africa, South America, the Middle East, and Europe.

The cost structure of a CTIS typically consists of several components:

Materials: The primary materials used in CTIS include high-quality hoses, valves, and control systems. The choice of materials affects both durability and performance, impacting the overall cost.

Labor: Labor costs encompass the wages of skilled workers involved in the assembly and installation of the system. This can vary significantly based on geographical location and the complexity of the assembly process.

Manufacturing Overhead: This includes costs related to utilities, equipment maintenance, and facility expenses. Efficient manufacturing processes can help minimize these overheads, contributing to lower overall costs.

Tooling: Investment in specialized tools for production can also add to the initial costs. However, higher tooling costs may be justified by increased efficiency and lower defect rates.

Quality Control (QC): Rigorous QC processes are essential in ensuring the reliability of CTIS, especially given their application in demanding environments. The costs associated with QC can affect the final price but are necessary for maintaining product integrity.

Logistics: Transportation and handling costs can be significant, especially for international shipments. Factors such as distance, shipping methods, and import/export regulations play a critical role in logistics expenses.

Margin: Suppliers will typically add a profit margin to cover their costs and ensure profitability. This margin can vary widely based on market conditions and the competitive landscape.

Several elements can influence the pricing of CTIS:

Volume/MOQ: Buyers often benefit from reduced prices with larger orders due to economies of scale. Negotiating minimum order quantities (MOQ) can lead to significant savings.

Specifications and Customization: Customized systems tailored to specific requirements may incur additional costs. Buyers should evaluate whether standard products could meet their needs to avoid unnecessary expenses.

Materials: The quality and type of materials used directly affect pricing. Buyers should weigh the cost against performance and longevity to ensure a suitable return on investment.

Quality Certifications: Products that meet international quality standards may come at a premium but can offer greater reliability and safety, particularly for high-stakes applications.

Supplier Factors: Established suppliers with a reputation for quality may charge more than lesser-known brands. However, the reliability and service offered can justify the higher price.

Incoterms: Understanding the terms of delivery (such as FOB, CIF, etc.) is vital. These terms can significantly impact overall costs, including insurance and freight responsibilities.

To maximize cost efficiency when sourcing CTIS, buyers should consider the following strategies:

Negotiate Effectively: Engage in discussions with suppliers to explore volume discounts, payment terms, and other favorable conditions. Building a strong relationship can lead to better pricing and service.

Evaluate Total Cost of Ownership: Beyond the initial purchase price, consider long-term costs associated with maintenance, downtime, and fuel efficiency. A slightly higher upfront cost may be offset by lower operating costs over time.

Understand Pricing Nuances: International buyers should be aware of currency fluctuations, tariffs, and import duties that can affect the total cost. Staying informed about market conditions in the supplier’s country can provide negotiation leverage.

Conduct Thorough Market Research: Analyze competitors’ offerings and pricing structures. Understanding the market landscape can help in negotiating better deals and identifying the best suppliers.

In conclusion, a comprehensive understanding of the cost components, price influencers, and strategic negotiation techniques is essential for B2B buyers sourcing Central Tire Inflation Systems. By applying these insights, buyers can achieve cost-effective solutions that enhance operational efficiency and reliability.

The choice of tire management systems is critical for businesses that rely on vehicle mobility and efficiency. Central Tire Inflation Systems (CTIS) are known for their capability to adjust tire pressure dynamically, enhancing performance across various terrains. However, several alternatives exist that may suit different operational needs or budget constraints. This analysis compares CTIS with other viable options to help B2B buyers make informed decisions.

| Comparison Aspect | Central Tire Inflation System | Overland Vehicle Systems Gen2 Air Delivery System | Manual Tire Inflation System |

|---|---|---|---|

| Performance | High performance with real-time adjustments for optimal traction and fuel efficiency. | Good for simultaneous inflation and deflation but lacks real-time adjustments. | Basic functionality; dependent on manual labor for adjustments. |

| Cost | Higher initial investment due to advanced technology. | Moderate cost, typically around $350. | Low upfront cost but may incur higher long-term labor costs. |

| Ease of Implementation | Requires professional installation and integration with vehicle systems. | User-friendly installation; compatible with various compressors. | Simple to implement; requires no specialized tools. |

| Maintenance | Minimal; integrated diagnostics alert users to issues, but repairs can be complex. | Low maintenance; straightforward components. | High maintenance; often requires frequent checks and manual adjustments. |

| Best Use Case | Ideal for military, construction, and off-road applications where performance is paramount. | Suitable for off-road enthusiasts and casual users who need flexibility. | Best for low-volume operations or personal use where cost is a primary concern. |

The Overland Vehicle Systems Gen2 Air Delivery System offers a moderate-cost solution for users who want to manage tire pressures without the complexity of a CTIS. Its ability to inflate or deflate all four tires simultaneously is a significant advantage, particularly for off-road enthusiasts who need quick adjustments in varying terrains. However, it lacks the sophisticated real-time monitoring and adjustment features of CTIS, which may be a drawback for operations requiring high performance and reliability.

Manual Tire Inflation Systems are the simplest and most cost-effective option available. They require no specialized equipment and can be easily implemented by anyone. However, this simplicity comes at a cost; manual systems are labor-intensive and can lead to inconsistent tire pressure management, ultimately affecting vehicle performance and safety. While they may be suitable for personal use or low-volume applications, they are not recommended for businesses that depend on efficiency and reliability.

When selecting a tire management system, B2B buyers should consider their specific operational needs, including the type of terrain their vehicles will encounter, the volume of usage, and budget constraints. For businesses engaged in high-stakes environments, such as military or heavy construction, the investment in a Central Tire Inflation System may yield significant returns in performance and reduced downtime. Conversely, for companies with limited budgets or those operating in less demanding conditions, alternatives like the Overland Vehicle Systems Gen2 or manual systems may provide adequate support without the higher costs associated with advanced technology. Ultimately, aligning the choice of system with operational needs will ensure optimal vehicle performance and cost efficiency.

In the context of Central Tire Inflation Systems (CTIS), several technical properties are crucial for ensuring optimal performance and reliability. Understanding these specifications can help B2B buyers make informed purchasing decisions.

Illustrative image related to central tire inflation system

The materials used in CTIS components, such as valves, hoses, and regulators, must meet specific industry standards for durability and resistance to environmental factors. Typically, high-grade alloys and reinforced rubber are utilized to withstand harsh operating conditions. Selecting components with superior material grades can significantly reduce wear and tear, leading to lower maintenance costs and longer service life.

CTIS systems are designed to operate within specific pressure ranges, often between 0 to 150 PSI. This tolerance is vital for maintaining tire integrity and optimizing performance based on varying load conditions and terrain types. Understanding pressure tolerance helps businesses ensure that the system can accommodate their operational requirements without risking tire damage or failure.

The flow rate, measured in cubic feet per minute (CFM), indicates how quickly the CTIS can inflate or deflate tires. A higher flow rate reduces downtime and enhances operational efficiency, especially in industries where time is critical, such as construction or agriculture. Buyers should assess their operational needs and choose a system that offers an appropriate flow rate for their applications.

CTIS components must function effectively across a range of temperatures, from extreme heat in desert environments to freezing conditions in mountainous regions. The specified temperature range ensures that the system remains reliable and responsive, no matter the climate. This property is particularly important for international buyers operating in diverse geographical locations.

Modern CTIS units often come equipped with integrated diagnostic features that alert operators to potential issues, such as leaks or pressure anomalies. These capabilities enhance safety and minimize the risk of unexpected breakdowns, thus reducing operational downtime. Buyers should consider systems with robust diagnostic features for improved maintenance and reliability.

Illustrative image related to central tire inflation system

Ease of installation can significantly impact the overall cost and time involved in deploying a CTIS. Compatibility with existing vehicle systems and straightforward installation procedures are essential properties that can streamline the setup process. Buyers should evaluate the installation requirements and ensure they align with their operational capabilities.

Understanding industry jargon is essential for effective communication and negotiation in B2B transactions. Here are some common terms relevant to CTIS.

OEM refers to companies that produce parts or systems that are used in another company’s end products. In the context of CTIS, choosing OEM components can ensure compatibility and reliability, as these parts are specifically designed for the vehicles they are intended for.

MOQ is the smallest number of units that a supplier is willing to sell. Understanding MOQ is crucial for businesses looking to manage inventory and costs effectively. It can affect pricing and the ability to stock essential parts for maintenance.

An RFQ is a formal document issued by a buyer to solicit price proposals from suppliers. For B2B buyers of CTIS, issuing an RFQ can lead to competitive pricing and better terms, ensuring that they receive the best value for their investment.

Incoterms are a set of international rules that define the responsibilities of buyers and sellers in international transactions. Familiarity with Incoterms helps B2B buyers understand shipping costs, risk management, and delivery responsibilities, which are crucial when sourcing CTIS from global suppliers.

Lead time refers to the time between placing an order and receiving it. For companies relying on CTIS for critical operations, knowing the lead time can help in planning and minimizing disruptions.

The aftermarket refers to the market for parts and accessories that are not supplied by the OEM. Understanding the aftermarket can provide B2B buyers with additional options for maintenance and upgrades, ensuring that their CTIS remains operational and effective over time.

In summary, grasping the essential technical properties and trade terminology associated with Central Tire Inflation Systems empowers B2B buyers to make strategic decisions that enhance operational efficiency and cost-effectiveness.

The Central Tire Inflation System (CTIS) market is witnessing transformative growth driven by the increasing demand for enhanced vehicle performance across various terrains. This demand is particularly pronounced in regions such as Africa, South America, the Middle East, and Europe, where diverse environmental conditions necessitate adaptive vehicle technologies. Key trends include the integration of advanced sensors and IoT technologies that facilitate real-time monitoring and adjustments of tire pressure. These innovations not only improve vehicle mobility but also enhance safety by alerting drivers to potential tire issues, thereby reducing the likelihood of accidents.

Additionally, the emphasis on fuel efficiency and reduced operational costs is propelling businesses to adopt CTIS solutions. By allowing for optimal tire pressure adjustments based on load and terrain, companies can significantly extend tire lifespan and improve fuel consumption. As international B2B buyers evaluate suppliers, they should look for manufacturers that offer customizable CTIS solutions tailored to specific applications, whether for military, construction, or agricultural use. The growing focus on automation in vehicle systems is also noteworthy, with push-button operations becoming a standard feature in modern CTIS offerings.

Sustainability is a critical consideration in the sourcing of Central Tire Inflation Systems, as the automotive industry increasingly prioritizes environmental impact. The adoption of eco-friendly materials in the manufacturing of CTIS components is becoming more prevalent. Buyers should seek suppliers that utilize sustainable practices and materials, such as recycled plastics and low-emission manufacturing processes, to minimize their carbon footprint.

Ethical sourcing is equally important; companies are expected to ensure that their supply chains adhere to fair labor practices and contribute positively to local economies. Certifications such as ISO 14001 for environmental management and ISO 9001 for quality management can serve as indicators of a supplier’s commitment to sustainability and ethical practices. B2B buyers, particularly from regions like Europe and the Middle East, are increasingly inclined to partner with manufacturers who demonstrate a commitment to sustainability, as this aligns with their corporate responsibility goals and enhances their brand reputation.

The concept of Central Tire Inflation Systems originated in military applications, where vehicles required adaptability to various terrains and conditions. Over the decades, the technology has evolved significantly, transitioning from basic manual systems to sophisticated automated solutions equipped with sensors and real-time monitoring capabilities. This evolution reflects broader trends in the automotive industry toward enhanced safety, efficiency, and performance.

In the commercial sector, the adoption of CTIS has been accelerated by the growing recognition of its benefits in reducing downtime and operational costs. Today, CTIS is not only a feature of specialized vehicles but is increasingly being integrated into standard commercial fleets, demonstrating its importance in modern logistics and transportation. As the market continues to evolve, buyers should remain informed about technological advancements and their implications for operational efficiency and cost savings.

How do I solve tire pressure issues in remote locations?

Maintaining optimal tire pressure in remote areas can be challenging. A Central Tire Inflation System (CTIS) offers real-time adjustments, allowing drivers to inflate or deflate tires based on terrain and load conditions, enhancing mobility and reducing the risk of tire damage. Ensure you choose a CTIS that features automatic diagnostics to alert drivers of potential issues, such as leaks or punctures. This proactive approach minimizes downtime and enhances operational efficiency, especially in hard-to-reach locations.

What is the best Central Tire Inflation System for heavy-duty vehicles?

The best CTIS for heavy-duty vehicles is one that combines reliability, durability, and advanced features. Look for systems that provide automatic pressure adjustments based on vehicle load and terrain type. Additionally, features like emergency modes for handling tire leaks and intuitive controls for easy operation are crucial. Brands that have a proven track record in military and industrial applications often offer robust solutions that can withstand harsh conditions, making them ideal for heavy-duty use.

What customization options are available for Central Tire Inflation Systems?

Most manufacturers offer customization options to cater to specific operational needs. This may include varying pressure settings, integration with existing vehicle systems, and tailored installation kits. When sourcing a CTIS, discuss your unique requirements with suppliers, such as the types of vehicles in your fleet and the terrains you operate in. Custom solutions can enhance system performance and ensure compatibility with your operational protocols.

What is the minimum order quantity (MOQ) for Central Tire Inflation Systems?

The MOQ for CTIS can vary significantly between suppliers, often influenced by factors such as manufacturing processes and the specific model requested. Typically, bulk orders may secure better pricing and terms. It’s advisable to inquire with multiple suppliers to compare their MOQs and negotiate terms that align with your purchasing strategy, especially if you plan to outfit an entire fleet.

What payment terms should I expect when purchasing a Central Tire Inflation System?

Payment terms for CTIS purchases can differ based on the supplier and your relationship with them. Common terms include upfront payments, partial deposits, or net payment options after delivery. It’s essential to discuss and clarify these terms before finalizing any agreement. Additionally, consider the implications of international transactions, such as currency exchange rates and potential tariffs, which could affect overall costs.

How can I ensure quality assurance for the Central Tire Inflation Systems I purchase?

To ensure quality assurance, select suppliers who adhere to international standards and certifications for manufacturing. Request documentation that demonstrates compliance with safety and performance standards. Additionally, inquire about warranty terms and post-sale support, as these can be indicators of a supplier’s commitment to quality. Conducting thorough due diligence, including checking references and previous customer feedback, can further safeguard your investment.

What logistics considerations should I be aware of when importing Central Tire Inflation Systems?

Logistics play a crucial role in importing CTIS, particularly regarding shipping methods, customs clearance, and delivery timelines. It’s important to work with suppliers who can provide comprehensive logistics support, including documentation for customs and any necessary certifications. Consider the shipping routes to your location, potential delays, and the reliability of carriers. Collaborating with experienced logistics partners can help streamline the process and mitigate risks associated with international shipping.

How do I vet suppliers for Central Tire Inflation Systems?

Vetting suppliers involves a multi-faceted approach. Start by assessing their reputation in the industry, which can include customer reviews and case studies. Request references and follow up with previous clients to gauge satisfaction and reliability. Additionally, evaluate their manufacturing capabilities, quality control processes, and after-sales support. Engaging in direct communication to discuss your specific needs and observing their responsiveness can also provide insights into their professionalism and reliability.

Domain: ti.systems

Introduction: CTIS | Central Tire Inflation System

– Precise tire pressure adjustment on the go

– Mechanically operating system

– Immediate inflating and deflating after turning ON

– No restrictions regarding tire pressure and driving speed

– Pressureless when turned OFF

– Adjust tire pressure while vehicle is moving with internal air lines through axles (prepared axles required)

**ti.systems Wheel Valve (TISW…

Domain: spicerparts.com

Registered: 2004 (21 years)

Introduction: Product Name: Central Tire Inflation System (CTIS™) – Axle

Key Features:

– Automatic emergency mode to handle leaks

– Allows adjustment of tire pressure based on vehicle load

– Enhances traction, tire life, and reduces fuel consumption

– Convenient push-button operation for optimum pressure selection

– Integrated diagnostics for tire problems and system status

– Reduces downtimes associated with …

Domain: ftl.technology

Introduction: Central Tire Inflation System (CTIS) allows precise tire pressure adjustment on the move, enhancing vehicle mobility and performance in demanding conditions. Key features include:

– Adjusts tire pressure to improve traction, eliminate tire leaks, and reduce soil compaction.

– Remote operation from within the vehicle cab.

– Continuously checks and maintains optimum tire pressure.

– Reduces oper…

Domain: dana.com

Registered: 1993 (32 years)

Introduction: Central Tire Inflation System (CTIS) enhances mobility for government defense and vocational vehicles. Key features include: reliability and performance for military applications, sealed wheel valves, remote wheel-end venting, pressure maintenance at selected intervals, selectable operating modes based on terrain and load, integrated diagnostics for tire problems and system status, and a lightweig…

Domain: werewolftech.com

Registered: 2020 (5 years)

Introduction: {“product_name”: “WEREWOLF Centralized Tire Inflation System”, “price”: “$3,000”, “product_code”: “Not specified”, “availability”: “In Stock”, “warranty”: “2 years”, “payment_options”: [“Invoice”, “Cash”], “shipping”: “Worldwide”, “features”: [“Change tire pressure during movement”, “Create programs for different surface types using remote control”, “Adjust air pressure in each wheel separately”, …

In summary, Central Tire Inflation Systems (CTIS) offer substantial advantages for businesses operating in diverse terrains across Africa, South America, the Middle East, and Europe. By enhancing tire performance through precise pressure adjustments, CTIS not only prolongs tire life but also improves fuel efficiency and reduces operational costs. The automated diagnostic features further mitigate downtime by alerting drivers to potential tire issues, ensuring uninterrupted mobility in challenging environments.

Illustrative image related to central tire inflation system

Strategic sourcing of CTIS is essential for maximizing value. By partnering with reputable manufacturers and suppliers, businesses can secure high-quality systems that align with their operational needs. This approach also facilitates access to ongoing support and maintenance, which is critical for optimizing system performance over time.

As the demand for advanced tire management solutions grows, now is the opportune time for international B2B buyers to invest in CTIS technology. By incorporating these systems into your fleet, you can enhance operational efficiency and ensure safety across various terrains. Take the next step—engage with trusted suppliers, explore the latest innovations in CTIS, and position your business for sustained success in a competitive market.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.