Underinflated tires present a critical challenge in the automotive industry, posing risks not only to vehicle safety but also to operational efficiency and cost management. For international B2B buyers, particularly those sourcing tires across diverse markets in Africa, South America, the Middle East, and Europe, understanding the implications of underinflated tires is essential. This guide delves into the multifaceted aspects of underinflated tires, covering types, applications, supplier vetting processes, and cost considerations.

By equipping buyers with the knowledge to identify the symptoms and dangers associated with underinflation, this guide empowers informed purchasing decisions. Buyers will learn how to assess tire performance metrics and recognize the impact of tire pressure on overall vehicle safety and fuel efficiency. Additionally, we provide insights into how to establish relationships with reliable suppliers who prioritize quality and safety compliance, ensuring that the tires sourced meet regional standards and expectations.

Navigating the complexities of the global tire market can be daunting, but this comprehensive guide serves as a roadmap, helping B2B buyers mitigate risks and enhance their procurement strategies. With actionable insights and expert advice, you will be better positioned to make strategic decisions that optimize your fleet’s performance and safety on the roads.

| Nome del tipo | Caratteristiche distintive principali | Applicazioni primarie B2B | Brevi pro e contro per gli acquirenti |

|---|---|---|---|

| Total Tire Failure | Complete loss of tire integrity leading to blowouts; often caused by prolonged under-inflation | Fleet management, transportation | Pro: Immediate safety awareness. Contro: High repair costs and potential liability. |

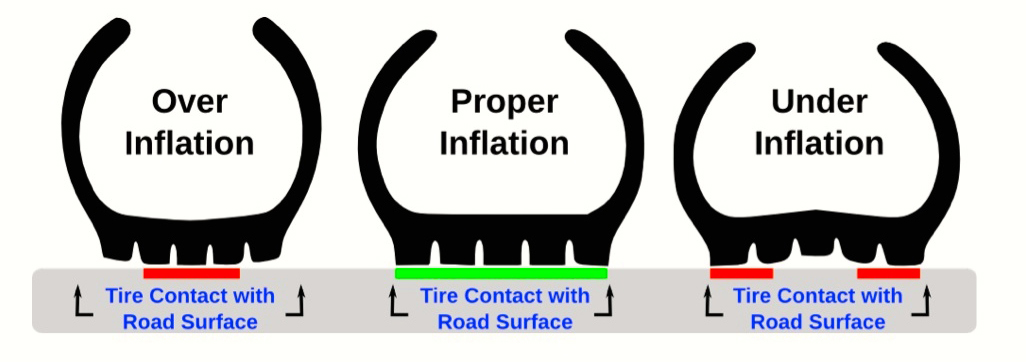

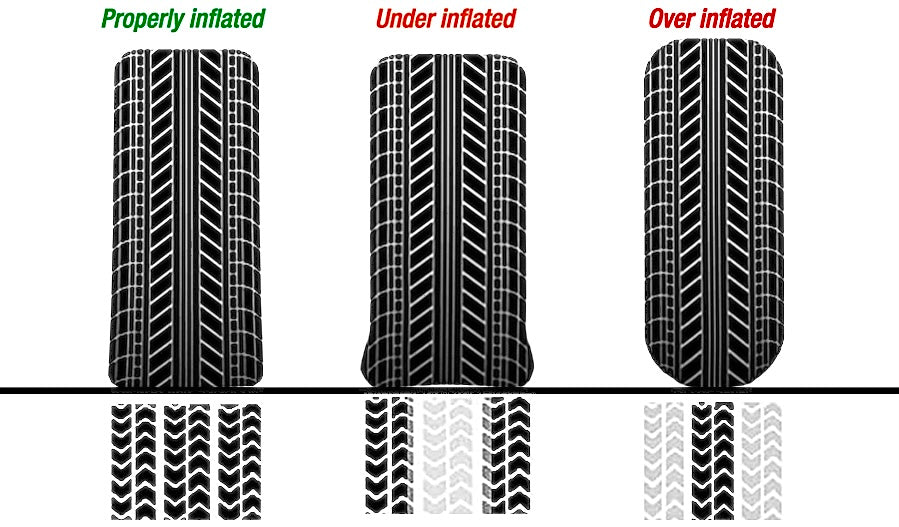

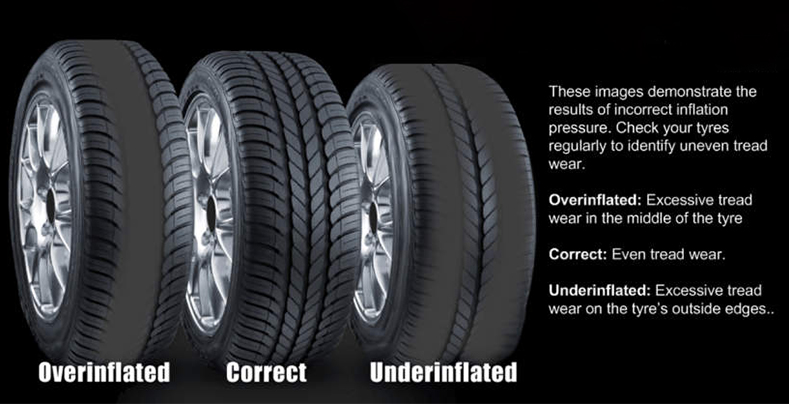

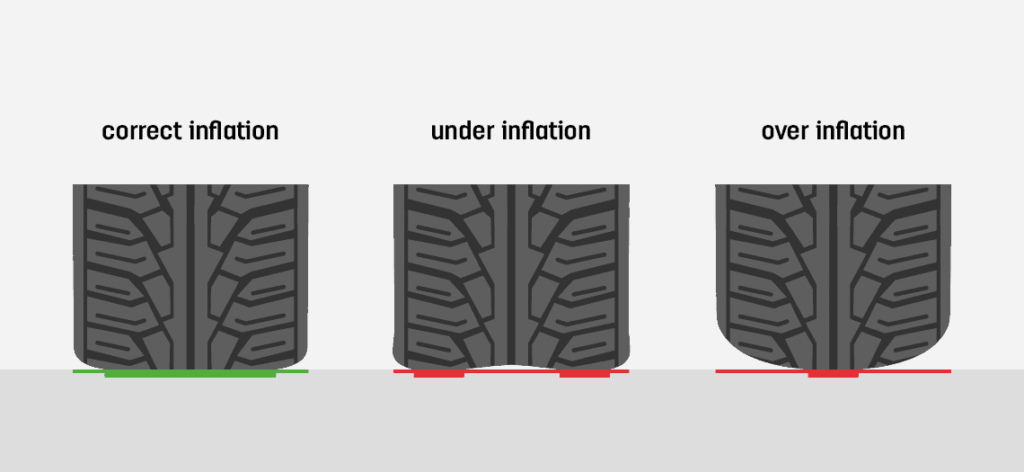

| Uneven Tread Wear | Tread wears more on outer edges due to excess flexing; can lead to reduced tire lifespan | Logistics, delivery services | Pro: Early detection can lead to proactive maintenance. Contro: Increased operational costs due to frequent replacements. |

| Reduced Vehicle Control | Impaired handling and steering response; increased risk of accidents | Construction, heavy equipment | Pro: Awareness can enhance driver safety. Contro: Risk of accidents can lead to insurance claims. |

| Increased Fuel Consumption | Higher rolling resistance results in more fuel being consumed | Transportation, shipping companies | Pro: Fuel savings can be significant with proper inflation. Contro: Long-term under-inflation leads to higher operational costs. |

| Compromised Safety in Wet Conditions | Poor traction in wet conditions due to improper tire shape; increases hydroplaning risk | Public transportation, emergency services | Pro: Understanding risks aids in fleet safety. Contro: Potential for accidents during adverse weather conditions. |

Total tire failure is characterized by a complete loss of tire integrity, often leading to blowouts. This situation typically arises from prolonged under-inflation, which increases tire flexing and friction. For B2B buyers in fleet management or transportation, recognizing the signs of total tire failure is crucial. Investing in regular tire inspections and maintaining optimal pressure can prevent costly repairs and enhance safety on the road.

Uneven tread wear manifests as excessive wear on the outer edges of the tire, resulting from under-inflation. This condition can significantly reduce the lifespan of tires, leading to more frequent replacements, which is a concern for logistics and delivery services. B2B buyers should prioritize regular tire pressure checks and consider investing in tire monitoring systems to detect wear patterns early, thus optimizing their maintenance budgets.

Reduced vehicle control occurs when under-inflated tires impair handling and steering response, increasing the likelihood of accidents. This is particularly relevant for businesses operating construction or heavy equipment, where safety is paramount. Understanding this risk can help B2B buyers implement better training programs for drivers and invest in tire maintenance solutions, ultimately reducing the risk of accidents and associated liabilities.

Increased fuel consumption is a direct consequence of higher rolling resistance from under-inflated tires. For transportation and shipping companies, this can translate into significant operational costs over time. B2B buyers should consider the long-term savings associated with maintaining proper tire pressure, as this can lead to improved fuel efficiency and lower overall transportation costs.

Compromised safety in wet conditions arises from improper tire shape due to under-inflation, leading to poor traction and an increased risk of hydroplaning. This is particularly critical for public transportation and emergency services, where safety is non-negotiable. B2B buyers must prioritize tire maintenance and education on the dangers of under-inflation to ensure safety during adverse weather conditions, thereby protecting both their assets and their reputation.

| Industria/Settore | Specific Application of Under Inflated Tires Will | Valore/Beneficio per l'azienda | Considerazioni chiave sull'approvvigionamento per questa applicazione |

|---|---|---|---|

| Trasporto e logistica | Gestione della flotta | Enhanced safety and reduced maintenance costs | Reliability of tire performance and local support |

| Agricoltura | Agricultural Machinery | Improved traction and fuel efficiency | Availability of specialized agricultural tires |

| Costruzione | Heavy Equipment | Decreased risk of tire blowouts and operational downtime | Compatibility with various terrains |

| Mining | Mining Vehicles | Enhanced durability and reduced operational costs | Resistance to harsh environments and punctures |

| Riparazione di autoveicoli | Tire Retail and Service Centers | Increased customer satisfaction and repeat business | Access to quality tire monitoring systems |

In the transportation and logistics industry, fleet management relies heavily on the performance of vehicles. Under inflated tires can significantly compromise safety, leading to increased accident risks and vehicle downtime. By ensuring proper tire inflation, companies can enhance safety, reduce maintenance costs, and improve fuel efficiency. International buyers, particularly from regions like Africa and South America, must consider the reliability of tire performance in varying climates and road conditions, as well as the availability of local tire service support.

Illustrative image related to under inflated tires will

Agricultural machinery often operates in challenging terrains, making tire performance critical. Under inflated tires can provide better traction in muddy or uneven fields, leading to improved operational efficiency. This is especially beneficial in regions with diverse agricultural practices, such as Europe and the Middle East. Buyers should prioritize sourcing specialized agricultural tires that can withstand the demands of their specific crops and soil conditions, ensuring durability and performance.

In the construction sector, heavy equipment is subjected to rigorous use, and under inflated tires can lead to blowouts or increased wear, resulting in costly downtime. Proper tire inflation ensures better stability and handling, which is vital for safety on construction sites. Companies should focus on sourcing tires that are compatible with various terrains and can endure the stresses of heavy loads, especially in regions with diverse construction environments, such as Saudi Arabia and Germany.

Mining vehicles operate in some of the most demanding conditions, and under inflated tires can enhance durability and reduce the risk of tire-related failures. This is crucial for minimizing operational costs and ensuring continuous productivity. Buyers in the mining industry should consider sourcing tires specifically designed for harsh environments, focusing on puncture resistance and longevity to withstand the rigors of mining operations, especially in remote areas of Africa and South America.

Tire retail and service centers can enhance customer satisfaction by providing services that monitor and manage tire inflation. Under inflated tires can lead to uneven wear, which can be costly for customers in the long run. By offering proactive tire maintenance services, repair shops can foster repeat business and build trust with clients. International buyers should look for quality tire monitoring systems that can easily integrate into their service offerings, ensuring they meet customer needs effectively.

Il problema: B2B buyers managing fleets often face the challenge of rising operating costs, particularly due to fuel inefficiency caused by under inflated tires. When tire pressure is low, the rolling resistance increases, forcing the engine to work harder and consume more fuel. This can lead to significant budget overruns, especially for companies that rely on transportation for their business operations. For example, a logistics company operating a fleet of delivery trucks may notice that their fuel expenses have surged, directly impacting their bottom line.

La soluzione: To combat this issue, B2B buyers should implement a proactive tire maintenance program that includes regular tire pressure checks. Establishing a routine schedule for tire inspections—ideally once a month—can help maintain optimal tire pressure and improve fuel efficiency. Additionally, equipping vehicles with Tire Pressure Monitoring Systems (TPMS) can provide real-time alerts when tire pressure drops below recommended levels. This enables fleet managers to address issues promptly and avoid unnecessary fuel costs. Furthermore, collaborating with tire suppliers who offer comprehensive maintenance packages can ensure that all tires are regularly inspected and maintained, ultimately leading to better fuel economy and reduced operating expenses.

Il problema: Safety is a paramount concern for businesses operating vehicles, and under inflated tires significantly increase the risk of accidents. Low tire pressure can lead to compromised vehicle control, longer stopping distances, and a higher likelihood of blowouts. For instance, a construction company relying on heavy-duty vehicles to transport equipment may face heightened liability if an accident occurs due to tire failure. Such incidents not only jeopardize employee safety but also expose the company to potential legal repercussions and insurance claims.

La soluzione: B2B buyers should prioritize safety by implementing stringent tire management policies. This includes regular training for drivers on the importance of checking tire pressure before starting their shifts. Providing easy access to tire pressure gauges and creating a checklist for pre-trip inspections can help ensure that tire conditions are monitored consistently. Additionally, partnering with tire manufacturers that emphasize safety features in their products, such as reinforced sidewalls and advanced tread designs, can further mitigate risks. By maintaining a rigorous inspection schedule and investing in quality tires, businesses can enhance safety, reduce liability, and protect their workforce.

Il problema: Fleet managers often encounter the issue of increased vehicle downtime due to tire-related maintenance challenges. Under inflated tires can lead to uneven wear, resulting in the need for more frequent tire replacements and repairs. This can disrupt operations, as vehicles may be out of service for extended periods while awaiting tire maintenance or replacements. For example, a delivery service may face delays if multiple vehicles require tire replacements simultaneously, negatively impacting customer satisfaction and service reliability.

La soluzione: To minimize downtime caused by tire issues, B2B buyers should adopt a data-driven approach to tire management. Implementing a tire management software system can help track tire performance, wear patterns, and maintenance schedules. This technology allows fleet managers to analyze data and predict when tires may need servicing or replacement. Additionally, establishing relationships with local tire service providers can ensure quick turnaround times for repairs and replacements. By utilizing predictive maintenance strategies and leveraging technology, businesses can keep their fleets operational, reduce unexpected downtime, and enhance overall efficiency.

When addressing the issue of under-inflated tires, the choice of materials plays a crucial role in performance, durability, and safety. Here, we analyze four common materials used in tire manufacturing, focusing on their properties, advantages, disadvantages, and implications for international B2B buyers.

Proprietà chiave: Rubber compounds used in tire manufacturing are designed to withstand varying temperature and pressure conditions. They typically have a high tensile strength and elasticity, allowing them to absorb shocks and maintain shape under load.

Illustrative image related to under inflated tires will

Pro e contro: Rubber is durable and provides excellent traction, but it can degrade over time due to exposure to UV light and ozone. The manufacturing process for rubber tires can be complex, involving multiple layers and types of rubber for different performance characteristics. While rubber tires are generally cost-effective, high-performance variants can be more expensive.

Impatto sull'applicazione: Rubber’s flexibility allows it to conform to the road surface, which can help mitigate the effects of under-inflation. However, if the rubber compound is not optimized for the local climate, it may lead to premature wear or failure.

Considerazioni per gli acquirenti internazionali: Compliance with local standards, such as ASTM in the United States or DIN in Germany, is essential. Buyers should also consider the climatic conditions of their region, as rubber performance can vary significantly.

Proprietà chiave: Steel belts are used in tires to provide structural support and enhance durability. They have a high tensile strength and resistance to deformation under load.

Pro e contro: Steel belts improve the tire’s resistance to punctures and enhance handling. However, they can increase the overall weight of the tire, which may negatively impact fuel efficiency. The manufacturing complexity is higher due to the need for precise alignment and bonding with rubber.

Impatto sull'applicazione: Steel belts help maintain tire shape and performance even when under-inflated, reducing the risk of blowouts. However, they can also lead to uneven wear if the tire is consistently under-inflated.

Considerazioni per gli acquirenti internazionali: Buyers should ensure that steel belts meet local manufacturing standards and consider the potential for corrosion in humid or coastal environments, which could affect tire longevity.

Proprietà chiave: Fabric layers, often made from polyester or nylon, are incorporated into tires to provide flexibility and comfort. They have good tensile strength and are lightweight.

Illustrative image related to under inflated tires will

Pro e contro: Fabric layers enhance ride comfort and help absorb shocks, making them ideal for passenger vehicles. However, they may not provide the same level of durability as steel belts, leading to potential issues with punctures. Manufacturing fabric-reinforced tires can be less complex than steel-belted variants.

Impatto sull'applicazione: While fabric layers can help mitigate the effects of under-inflation by allowing for some flexibility, they may not provide the necessary support for heavy loads, increasing the risk of damage.

Considerazioni per gli acquirenti internazionali: Buyers should be aware of local preferences for tire comfort versus durability, as these can vary by region. Compliance with fabric quality standards is also essential.

Proprietà chiave: Specialty compounds, including silica and other additives, are designed to enhance grip, reduce rolling resistance, and improve fuel efficiency. They can also offer better performance in wet conditions.

Pro e contro: These compounds can significantly enhance tire performance and safety but often come at a higher cost. The manufacturing process can be complex due to the need for precise formulations.

Impatto sull'applicazione: Specialty compounds can help maintain tire performance under various conditions, including when under-inflated. However, they may require more frequent monitoring and maintenance.

Considerazioni per gli acquirenti internazionali: Buyers should evaluate the cost-benefit ratio of specialty compounds, particularly in regions where fuel efficiency is a priority. Compliance with international standards for chemical safety may also be necessary.

| Materiale | Typical Use Case for under inflated tires will | Vantaggio chiave | Svantaggi/limitazioni principali | Costo relativo (Basso/Medio/Alto) |

|---|---|---|---|---|

| Rubber Compounds | General tire construction | Excellent traction and shock absorption | Si degrada nel tempo | Medio |

| Steel Belts | High-performance and heavy-duty tires | Enhanced durability and puncture resistance | Increases tire weight | Alto |

| Fabric Layers | Passenger vehicle tires | Improved ride comfort | Less durable than steel belts | Basso |

| Specialty Compounds | Performance and fuel-efficient tires | Enhanced grip and reduced rolling resistance | Maggiore complessità di produzione | Alto |

This analysis provides a comprehensive overview of materials relevant to addressing under-inflated tire issues, offering valuable insights for international B2B buyers looking to make informed decisions in their procurement processes.

The manufacturing of tires, particularly those that may become under-inflated, involves several critical stages: material preparation, forming, assembly, and finishing. Each stage incorporates specific techniques designed to enhance performance and durability, ensuring that tires can withstand various driving conditions.

The first stage, material preparation, is crucial for producing high-quality tires. Manufacturers utilize a blend of natural and synthetic rubber, along with reinforcing agents like carbon black and silica, to enhance strength and wear resistance. The materials undergo rigorous testing to confirm they meet industry standards, ensuring consistency in performance.

Additionally, manufacturers often incorporate advanced materials such as aramid or nylon for added strength and flexibility. This ensures the tire can better manage heat and stress, reducing the risk of under-inflation-related failures. The preparation phase also includes the precise measurement of materials, which is essential for maintaining uniformity across batches.

The forming stage involves shaping the prepared materials into tire components. This typically includes the tread, sidewalls, and inner linings. Key techniques in this stage include extrusion for the tread and calendering for the inner linings, ensuring a perfect fit and optimal adhesion between layers.

Manufacturers also utilize advanced molding techniques, often employing high-pressure presses to ensure that all components are tightly bonded. This is vital because any imperfections can lead to air leaks or structural weaknesses, which are common causes of under-inflation.

During the assembly stage, the formed components are combined into a complete tire. This process involves placing the inner liner, body plies, and tread in a precise sequence to ensure structural integrity. Manufacturers often use automated systems to reduce human error and enhance precision.

Quality assurance is integrated into this stage through real-time monitoring of assembly processes. Automated systems can detect discrepancies, ensuring that each tire meets strict specifications before proceeding to the finishing stage.

The finishing stage includes curing, where the assembled tires are heated in molds to enhance their physical properties. This vulcanization process is critical, as it transforms the rubber into a more durable material. Manufacturers may also apply surface treatments to improve resistance to environmental factors, such as UV exposure and ozone.

Post-curing inspections are mandatory, where tires are checked for uniformity, visual defects, and adherence to dimensional specifications. This step is vital for ensuring that the final product can withstand the rigors of daily use.

Illustrative image related to under inflated tires will

Quality control (QC) is a cornerstone of tire manufacturing, particularly to mitigate the risks associated with under-inflated tires. Manufacturers adhere to international standards such as ISO 9001, which emphasizes a systematic approach to quality management.

B2B buyers should be familiar with various international standards that govern tire manufacturing. Beyond ISO 9001, certifications such as the European CE mark signify compliance with health, safety, and environmental protection standards. In markets like the Middle East and Africa, adherence to local regulations, such as GCC and SANS standards, can also be critical.

Quality checkpoints are integrated throughout the manufacturing process, including:

Controllo qualità in entrata (CQI): This involves inspecting raw materials before they enter the production line, ensuring that only high-quality components are used.

Controllo di qualità in corso d'opera (IPQC): During the manufacturing stages, IPQC monitors the production processes and parameters to catch any deviations in real-time.

Controllo finale della qualità (CQC): After finishing, the tires undergo comprehensive testing, including pressure tests and performance evaluations, to confirm that they meet or exceed safety standards.

Common testing methods include dynamic balancing, uniformity testing, and durability assessments under various load conditions. Manufacturers may also employ advanced technologies like X-ray and ultrasonic testing to detect internal defects that could lead to failures.

B2B buyers should conduct thorough due diligence when selecting tire suppliers. This includes:

Audit dei fornitori: Regular audits can ensure that manufacturers comply with established quality standards. Buyers can request documentation of past audits and corrective actions taken.

Rapporti sulla qualità: Suppliers should provide detailed quality reports that outline their QC processes, testing methodologies, and results. This transparency builds trust and confidence in the supplier’s capabilities.

Ispezioni di terzi: Engaging third-party inspection services can offer an unbiased assessment of the supplier’s manufacturing processes and quality assurance measures.

International buyers, especially from diverse regions such as Africa, South America, the Middle East, and Europe, should be aware of specific nuances in quality control. Variations in local regulations, market expectations, and environmental conditions can influence tire performance.

Illustrative image related to under inflated tires will

For example, in regions with extreme temperatures, tires may require specialized compounds to maintain performance and safety. Buyers should ensure that suppliers are well-versed in these regional requirements and can provide tires that meet local standards.

Moreover, understanding the logistics involved in transporting tires across international borders is crucial. Compliance with export regulations and ensuring that the tires maintain their integrity during transit can significantly impact the overall quality.

For B2B buyers, understanding the manufacturing processes and quality assurance measures for tires prone to under-inflation is essential. By focusing on the key stages of production, relevant international standards, and effective quality control practices, buyers can make informed decisions that enhance safety and performance in their vehicle fleets. As the global market for tires continues to evolve, staying abreast of these insights will prove invaluable in navigating supplier relationships and ensuring compliance with quality expectations.

Illustrative image related to under inflated tires will

This practical sourcing guide is designed for B2B buyers seeking to procure solutions related to the risks and management of under-inflated tires. Understanding the implications of under-inflated tires is critical for maintaining vehicle safety, reducing operational costs, and ensuring optimal performance. This checklist will help you navigate the procurement process efficiently and effectively.

Begin by evaluating the specific requirements of your fleet or vehicles. Consider factors such as vehicle type, load capacity, and typical driving conditions.

– Considerazioni chiave: Identify whether your vehicles operate primarily on highways, urban areas, or rough terrains, as this influences tire selection.

Clearly outline the technical specifications for the tires you need, including size, load index, and speed rating.

– Importance: This ensures compatibility with your vehicles and helps suppliers provide accurate options.

– Tip: Refer to the manufacturer’s recommendations for each vehicle to avoid mismatches.

Illustrative image related to under inflated tires will

Conduct thorough research to identify potential suppliers who specialize in tire solutions.

– Perché è importante: A reliable supplier can significantly impact your operations and safety.

– Action Items: Look for suppliers with strong reputations, positive reviews, and proven experience in your region.

Check that your chosen suppliers have the necessary certifications and quality assurances.

– Importance of Compliance: This ensures that the tires meet international safety standards and regulations, which is particularly crucial when operating in diverse markets like Africa and the Middle East.

– Documentazione: Request copies of certifications such as ISO or local regulatory compliance documents.

Request samples or detailed specifications of the tires to assess their quality and performance.

– Why This Step is Vital: High-quality tires can prevent issues related to under-inflation, such as blowouts and uneven wear, which can lead to costly repairs.

– Criteria to Review: Look for features such as tread design, warranty options, and performance ratings in various conditions.

Discuss the after-sales services offered by the supplier, including maintenance, warranty coverage, and customer support.

– Importance of Support: Strong after-sales support can help address any issues that arise post-purchase and ensure long-term satisfaction.

– Considerations: Ask about the availability of technical support and the process for handling claims related to product defects.

Once you have gathered all necessary information, engage in negotiations to secure favorable terms and pricing.

– Why Negotiate: Effective negotiation can lead to better pricing, extended warranties, or additional services, ultimately lowering your total cost of ownership.

– Key Points to Discuss: Include payment terms, delivery schedules, and bulk purchase discounts to optimize your procurement strategy.

By following this checklist, B2B buyers can make informed decisions regarding the procurement of tire solutions, ensuring both safety and efficiency in their operations.

When analyzing the cost structure for sourcing under inflated tires, several components play a crucial role in determining the overall pricing. The primary cost components include:

I materiali: The quality and type of rubber, additives, and other materials significantly influence the base cost of tires. Premium materials may enhance performance and durability but will raise initial costs.

Lavoro: Labor costs vary by region and can affect the overall price. In regions with higher labor costs, such as parts of Europe, tire manufacturing may be more expensive compared to lower-cost regions in Africa or South America.

Spese generali di produzione: This includes the costs associated with factory operations, utilities, and administrative expenses. Efficient manufacturing processes can reduce these costs, impacting pricing.

Utensili: The initial investment in molds and machinery for tire production can be substantial. The amortization of these costs over production volumes is crucial for pricing strategies.

Controllo qualità (CQ): Rigorous quality control processes ensure safety and performance but add to the overall cost. Certifications for quality assurance can also influence pricing, especially in markets with strict regulations.

Logistica: Transportation costs can vary significantly based on the distance from manufacturing sites to end-users. International shipping, customs duties, and freight charges must be factored into the total cost.

Margine: Suppliers typically include a profit margin in their pricing. This can vary based on market conditions and competition.

Several factors can influence the pricing of under inflated tires, impacting sourcing decisions for international B2B buyers:

Volume e quantità minima d'ordine (MOQ): Bulk purchases can lead to significant discounts, making it essential for buyers to evaluate their needs and negotiate MOQs that align with their purchasing strategies.

Specifiche e personalizzazione: Customized tires designed for specific applications may incur additional costs. Buyers should assess whether standard options meet their requirements to optimize spending.

Qualità dei materiali e certificazioni: The presence of quality certifications, such as ISO or local safety standards, can justify higher prices but also ensure better performance and safety. Buyers should weigh the benefits against costs.

Fattori di fornitura: The reputation, reliability, and experience of suppliers can affect pricing. Established suppliers with a track record of quality may command higher prices but can also offer better assurance in terms of product performance and service.

Incoterms: Understanding international commercial terms is crucial. Different Incoterms can shift responsibility and cost implications for shipping and logistics, affecting the total landed cost of the tires.

For international B2B buyers, especially those from regions such as Africa, South America, the Middle East, and Europe, effective negotiation and sourcing strategies can significantly impact costs:

Sfruttare il costo totale di proprietà (TCO): Focus on the long-term costs associated with under inflated tires, including maintenance, fuel efficiency, and safety. A higher initial investment may yield better performance and lower overall costs.

Negoziare termini e condizioni: Don’t hesitate to negotiate payment terms, delivery schedules, and after-sales support. Favorable terms can improve cash flow and reduce risk.

Explore Local Suppliers: Sourcing from local manufacturers can minimize shipping costs and lead times. Building relationships with local suppliers may also provide opportunities for better pricing.

Rimanete informati sulle tendenze del mercato: Keeping abreast of global tire market trends can provide leverage during negotiations. Awareness of price fluctuations, material shortages, or new technologies can inform sourcing strategies.

Consider Alternative Materials: Inquire about alternative materials that may offer cost savings without compromising performance. Innovations in tire technology can lead to more economical solutions.

Pricing for under inflated tires is subject to various dynamic factors, and it is essential for buyers to approach sourcing strategically. The insights provided here serve as a guide for navigating the complexities of tire sourcing in an international context. However, prices can vary widely based on local market conditions, supplier negotiations, and global economic factors. Therefore, always seek multiple quotes and conduct thorough due diligence to ensure the best pricing for your specific needs.

Under inflated tires present significant challenges, including safety risks, increased operational costs, and reduced vehicle performance. However, various alternative solutions exist that can help mitigate these issues. By comparing ‘under inflated tires will’ with other viable methods, B2B buyers can make informed decisions about the best approach for their fleet or transportation needs.

Illustrative image related to under inflated tires will

| Aspetto di confronto | Under Inflated Tires Will | Tire Pressure Monitoring Systems (TPMS) | Automatic Tire Inflation Systems (ATIS) |

|---|---|---|---|

| Prestazioni | Decreased control, increased wear | Enhanced safety and performance through real-time monitoring | Consistent optimal pressure maintenance |

| Costo | Higher fuel costs and repair expenses | Moderate initial investment, potential savings on fuel and repairs | Higher upfront costs, long-term savings on tire wear and fuel |

| Facilità di implementazione | Minimal effort to check; often overlooked | Easy to install, requires user training | Complex installation, requires maintenance |

| Manutenzione | Requires regular manual checks | Low maintenance; alerts users when pressure is low | Moderate maintenance; needs periodic checks and recalibration |

| Il miglior caso d'uso | General vehicles in regions with fluctuating temperatures | Fleets needing enhanced safety features | Commercial fleets needing consistent tire performance |

TPMS provides real-time monitoring of tire pressure, alerting drivers when levels drop below safe thresholds. This proactive approach helps prevent the dangers associated with under inflated tires, such as blowouts and poor handling. The main advantage of TPMS is its ability to enhance safety without requiring significant user intervention. However, it does have a moderate initial investment and necessitates some training for effective use. Overall, TPMS is ideal for fleets operating in diverse conditions where tire safety is paramount.

ATIS is a more advanced solution that automatically maintains tire pressure within optimal ranges. This technology continuously adjusts the pressure based on real-time data, ensuring that tires are neither overinflated nor underinflated. While the initial installation costs are higher compared to other solutions, ATIS offers substantial long-term savings through reduced tire wear and improved fuel efficiency. The complexity of installation and the requirement for regular maintenance can be a drawback, making ATIS best suited for commercial fleets with high operational demands.

For B2B buyers evaluating solutions to combat the challenges posed by under inflated tires, the decision should hinge on specific operational requirements and budget considerations. If immediate safety and monitoring are priorities, investing in TPMS could be beneficial. Conversely, for organizations seeking a long-term solution that enhances efficiency and reduces costs over time, ATIS might prove to be the better choice. Assessing the unique needs of your fleet, including the types of vehicles, average operating conditions, and maintenance capabilities, will guide you in selecting the most effective solution for tire management.

Understanding the technical specifications of under inflated tires is crucial for B2B buyers, as these properties directly impact performance, safety, and cost. Here are some essential specs to consider:

Tire Pressure Specification (PSI)

The recommended tire pressure, measured in pounds per square inch (PSI), is a critical specification. Under inflated tires typically operate below this threshold, leading to increased rolling resistance and potential vehicle control issues. For B2B buyers, adhering to PSI specifications is vital for maintaining fleet safety and operational efficiency, reducing the risk of accidents and costly repairs.

Load Index

The load index indicates the maximum weight a tire can support at a specified pressure. Under inflation can cause tires to bear excess loads, leading to uneven wear and increased risk of blowouts. Buyers should ensure that their tire selections meet or exceed the load index requirements for their vehicles to avoid operational disruptions and enhance safety.

Tread Depth

Tread depth affects a tire’s grip on the road. Under inflated tires may wear unevenly, leading to reduced tread depth, especially on the outer edges. Monitoring tread depth is essential for B2B buyers to ensure optimal vehicle handling and safety, especially in diverse driving conditions.

Heat Resistance

Tires generate heat during operation, and under inflation increases friction and heat generation, leading to premature tire failure. Understanding the heat resistance properties of tires helps buyers select products that can withstand operational demands, particularly in hotter climates or heavy-duty applications.

Composizione del materiale

The materials used in tire construction affect durability and performance. High-quality rubber compounds can withstand the rigors of under inflation better than lower-grade materials. B2B buyers should prioritize tires made from superior materials to minimize maintenance costs and enhance longevity.

Familiarity with industry jargon is essential for effective communication and negotiation in the B2B space. Here are some common terms:

OEM (Original Equipment Manufacturer)

OEM refers to products made by the original manufacturer of the vehicle. Buyers often prefer OEM tires for their compatibility and reliability, ensuring optimal performance and safety standards are met.

MOQ (quantità minima d'ordine)

MOQ indicates the smallest number of units a supplier is willing to sell. Understanding MOQ helps buyers plan their procurement strategies, especially when purchasing tires in bulk for fleets.

RFQ (Richiesta di offerta)

An RFQ is a document issued by buyers to solicit price quotes from suppliers. This process is crucial for B2B transactions, allowing buyers to compare prices and terms before making purchasing decisions.

Incoterms (Termini commerciali internazionali)

Incoterms define the responsibilities of buyers and sellers in international trade, including shipping, insurance, and tariffs. Knowledge of Incoterms is essential for B2B buyers engaged in cross-border transactions, ensuring clarity in logistics and risk management.

TPMS (Tire Pressure Monitoring System)

TPMS is a safety feature that alerts drivers when tire pressure is below the recommended level. For fleet operators, understanding TPMS technology can enhance maintenance practices and improve overall vehicle safety.

Rolling Resistance

This term refers to the energy lost as a tire rolls, influenced by its inflation level. Under inflated tires have higher rolling resistance, leading to increased fuel consumption. Buyers should consider rolling resistance when selecting tires to optimize fuel efficiency and reduce operating costs.

By grasping these technical properties and trade terms, B2B buyers can make informed decisions regarding tire procurement, ultimately enhancing fleet safety and operational efficiency.

The global market for tires, particularly concerning under inflated tires, is influenced by several key drivers. Growing awareness of vehicle safety and efficiency is propelling demand for proper tire maintenance. Under inflated tires can lead to increased fuel consumption and reduced vehicle performance, which are critical concerns for businesses managing fleets. Emerging technologies, such as tire pressure monitoring systems (TPMS) and automated tire inflation systems, are becoming prevalent in the B2B sector. These innovations are helping companies monitor tire health in real-time, thus minimizing the risks associated with under inflated tires.

Market dynamics indicate a shift towards integrated solutions that combine tire management with broader fleet management systems. International buyers, especially in Africa, South America, the Middle East, and Europe, are seeking suppliers that offer not just tires, but comprehensive maintenance packages that include monitoring and inflation services. The emphasis is on reducing operational costs and enhancing safety, which can be particularly beneficial for logistics and transportation companies. Additionally, regulatory pressures in regions like Europe are driving businesses to adopt better tire management practices to comply with safety and environmental standards.

Sustainability is becoming a critical factor in the sourcing of tires, including those that address issues related to under inflation. The environmental impact of tire disposal and manufacturing processes cannot be overlooked. Under inflated tires not only degrade faster, leading to increased waste, but they also contribute to higher carbon emissions due to reduced fuel efficiency. B2B buyers are increasingly prioritizing suppliers who demonstrate a commitment to sustainable practices, such as using recycled materials and minimizing waste in their production processes.

Ethical sourcing is also gaining traction, with businesses looking for suppliers that adhere to fair labor practices and environmental standards. Certifications such as ISO 14001 for environmental management and Fair Trade can serve as benchmarks for assessing potential partners. By choosing suppliers who prioritize sustainability, companies can enhance their brand image and meet the growing consumer demand for environmentally responsible products. This trend is particularly pronounced in Europe, where green certifications are often prerequisites for market entry.

The evolution of tire technology has been marked by significant advancements that directly impact the management of tire inflation. Initially, tire technology focused primarily on durability and performance, but as vehicle safety became a priority, the industry began to integrate features that monitor and maintain optimal tire pressure. The introduction of TPMS in the early 2000s marked a pivotal moment, allowing for real-time monitoring of tire pressure and alerting drivers to potential issues.

As the industry continues to evolve, the focus is shifting toward smart technology that not only informs users about tire conditions but also automates inflation processes. This evolution is essential for B2B buyers who manage fleets, as it offers the potential for reduced operational costs, enhanced safety, and improved vehicle performance. Understanding these historical shifts allows buyers to make informed decisions when sourcing products and services related to tire management.

How do I identify under inflated tires before purchasing?

To identify under inflated tires before making a purchase, conduct a thorough inspection of the tire’s sidewall and tread. Look for signs of uneven wear, such as excessive wear on the outer edges, which may indicate under inflation. Additionally, consider utilizing a tire pressure gauge to check the PSI levels against the manufacturer’s specifications. If the tire pressure monitoring system (TPMS) is available, ensure it is functioning correctly, as it alerts you to any significant pressure discrepancies.

What are the risks associated with under inflated tires in commercial fleets?

Under inflated tires can pose significant risks to commercial fleets, including increased fuel consumption due to higher rolling resistance, which can lead to higher operational costs. They also heighten the risk of tire blowouts, which can result in accidents and costly downtime. Furthermore, under inflated tires can lead to uneven tread wear, necessitating more frequent replacements and impacting the vehicle’s handling and overall safety, potentially jeopardizing both cargo and driver.

What should I look for when vetting suppliers for tires?

When vetting suppliers for tires, prioritize their reputation, industry experience, and quality certifications. Request references from previous clients to gauge reliability and customer service. Additionally, assess their capacity to provide tires that meet specific international standards and regulations, particularly for your target market. It’s also beneficial to inquire about their warranty and after-sales support to ensure a seamless purchasing experience.

What are the minimum order quantities (MOQ) for under inflated tires?

Minimum order quantities for under inflated tires can vary significantly based on the supplier and the type of tire. Some manufacturers may require MOQs ranging from 50 to 100 units, while others may offer more flexibility for smaller businesses. It’s advisable to discuss your needs with potential suppliers to negotiate terms that align with your purchasing capacity while ensuring competitive pricing.

How can I customize tires to meet my specific business needs?

To customize tires for your business, communicate your specific requirements to the supplier, including size, tread pattern, and material preferences. Many manufacturers offer customization options to meet unique performance needs, such as enhanced durability for rough terrains or improved fuel efficiency. Additionally, ensure that the supplier can accommodate any branding needs, such as adding your company logo to the tire sidewall.

What payment terms are typically offered by tire suppliers?

Payment terms offered by tire suppliers can vary widely, often ranging from upfront payments to net-30 or net-60 terms. Some suppliers may also provide discounts for early payments or bulk purchases. When negotiating payment terms, consider your cash flow requirements and the supplier’s willingness to accommodate flexible arrangements. Always ensure that the terms are clearly outlined in the contract to avoid potential disputes.

How do I ensure quality assurance for imported tires?

To ensure quality assurance for imported tires, establish clear criteria and standards that align with international regulations. Request documentation of quality control processes from your supplier, including test results and compliance certificates. Additionally, consider conducting third-party inspections before shipment to verify the tires meet your specifications. Establishing a solid return policy can also help mitigate risks associated with defective products.

What logistics considerations should I keep in mind when sourcing tires internationally?

When sourcing tires internationally, logistics considerations include shipping methods, customs regulations, and lead times. Select a reliable freight forwarder experienced in handling tire shipments to navigate complex logistics efficiently. Ensure you are aware of any import duties and tariffs that may apply to your shipment, as these can significantly impact total costs. Lastly, plan for potential delays by allowing adequate lead time for shipping and customs clearance processes.

Dominio: reddit.com

Registrato: 2005 (20 anni)

Introduzione: 2010 Nissan Versa; Tire pressure light activated; Front driver’s side tire pressure at 19 psi (should be 33 psi); Other tires low by 5-7 psi.

Dominio: eastcoasttoyota.com

Registrato: 2000 (25 anni)

Introduzione: The text discusses the hidden risks associated with overinflated and underinflated tires, emphasizing the importance of maintaining proper tire pressure for vehicle performance and safety. Key points include: 1. Uneven Tread Wear: Overinflated tires wear faster in the center, while underinflated tires wear on the outer edges. 2. Reduced Vehicle Control: Improperly inflated tires affect grip and re…

Dominio: guerrallp.com

Registered: 2024 (1 years)

Introduzione: The dangers of driving on underinflated tires include increased likelihood of tire-related accidents, overheating, tire failure, longer stopping distances, and adverse effects on handling and tread life. Underinflated tires can cause an estimated 11,000 crashes annually and lead to faster aging of tires (32% faster than properly inflated ones). They also affect gas mileage and maneuverability due …

Dominio: michelinman.com

Registrato: 2001 (24 anni)

Introduzione: Under-inflated tires reduce tread life through increased treadwear on the outside edges (or shoulders) of the tire.

Dominio: freeway.com

Registrato: 1998 (27 anni)

Introduzione: Freeway Insurance offers a variety of insurance products including vehicle insurance (auto, motorcycle, RV/motorhome, boat, ATV, snowmobile, SR-22, classic car), property insurance (renters, homeowners, mobile/manufactured home), personal protection (health, dental, telemedicine, pet, life), travel club services (AD&D, identity theft protection, hospital indemnity), business insurance (landlord, c…

In summary, understanding the implications of under inflated tires is crucial for international B2B buyers. The dangers associated with under inflation—such as increased fuel consumption, reduced vehicle control, and the risk of tire blowouts—underscore the necessity for regular monitoring and maintenance. Strategic sourcing of high-quality tires and tire maintenance services not only mitigates these risks but also extends the lifespan of your fleet and optimizes operational efficiency.

Investing in reliable suppliers who prioritize quality and safety can lead to significant long-term savings, as well as improved vehicle performance. Establishing partnerships with trusted tire manufacturers and service providers ensures that your fleet is consistently equipped with the best products and services, tailored to the unique demands of various markets, including those in Africa, South America, the Middle East, and Europe.

As the global market evolves, the importance of proper tire maintenance becomes increasingly paramount. Engage with suppliers and service providers who understand local conditions and can offer tailored solutions. By prioritizing strategic sourcing, you position your business to enhance safety, reduce costs, and improve overall fleet management. Take action today to safeguard your investments and ensure the longevity of your operations.

Le informazioni fornite in questa guida, compresi i contenuti relativi ai produttori, alle specifiche tecniche e all'analisi di mercato, hanno uno scopo puramente informativo ed educativo. Non costituiscono una consulenza professionale in materia di acquisti, né una consulenza finanziaria o legale.

Pur avendo compiuto ogni sforzo per garantire l'accuratezza e la tempestività delle informazioni, non siamo responsabili di eventuali errori, omissioni o informazioni non aggiornate. Le condizioni di mercato, i dettagli aziendali e gli standard tecnici sono soggetti a modifiche.

Gli acquirenti B2B devono condurre una due diligence indipendente e approfondita. prima di prendere qualsiasi decisione di acquisto. È necessario contattare direttamente i fornitori, verificare le certificazioni, richiedere campioni e chiedere una consulenza professionale. Il rischio di affidarsi alle informazioni contenute in questa guida è esclusivamente a carico del lettore.