Under-inflated tire wear presents a significant challenge for businesses operating in the global market. For international B2B buyers, particularly those in regions such as Africa, South America, the Middle East, and Europe, understanding the implications of tire wear is essential for maintaining vehicle safety, optimizing operational efficiency, and reducing costs. This guide delves into the complexities of under-inflated tire wear, exploring various types of tire wear patterns, their causes, and the critical role of proper maintenance.

Through comprehensive insights, this resource will equip buyers with the knowledge to assess tire conditions effectively and make informed purchasing decisions. We will cover essential topics including the identification of wear patterns, the applications of different tire types, supplier vetting processes, and cost considerations. Additionally, we will highlight the long-term benefits of proactive tire management, such as improved fuel efficiency and enhanced vehicle performance, which are crucial for businesses looking to reduce operational risks and expenses.

By the end of this guide, B2B buyers will be empowered to navigate the intricate landscape of tire sourcing and maintenance, ensuring that their fleets are not only safe but also cost-effective. Understanding under-inflated tire wear is not just about compliance; it’s about leveraging best practices that drive business success in a competitive global marketplace.

| Название типа | Ключевые отличительные особенности | Основные приложения B2B | Краткие плюсы и минусы для покупателей |

|---|---|---|---|

| Edge Wear | Significant wear on the outer edges of the tire tread. | Fleet management, transportation services | Плюсы: Early detection of inflation issues. Конс: Reduced tire lifespan; increased replacement costs. |

| Cup Wear | Uneven wear creating a cupped appearance on tread. | Heavy-duty vehicles, construction equipment | Плюсы: Indicates alignment or suspension issues. Конс: Can lead to noise and vibration; costly repairs. |

| Patchy Wear | Irregular patches of wear across the tire surface. | Logistics companies, delivery services | Плюсы: Highlights multiple potential issues. Конс: Difficult to diagnose; may require extensive inspections. |

| Sidewall Damage | Cracks or bulges on the tire sidewalls due to under-inflation. | Agricultural vehicles, mining equipment | Плюсы: Visual cue for immediate action needed. Конс: Potential for sudden blowouts; safety risks. |

| Center Wear | Although typically associated with over-inflation, can occur with significant under-inflation due to improper load distribution. | Commercial transport, automotive fleets | Плюсы: Signals need for pressure checks. Конс: Misleading; requires careful inspection to confirm. |

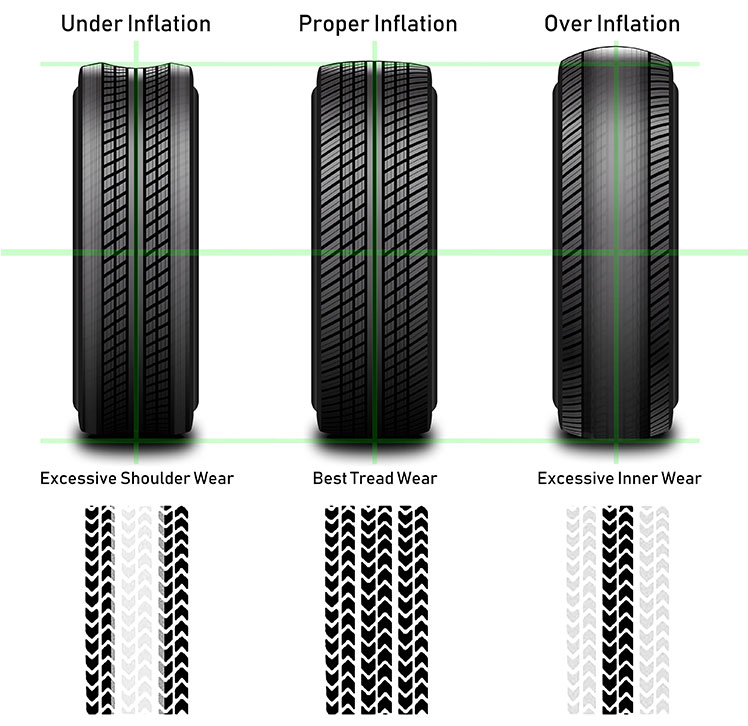

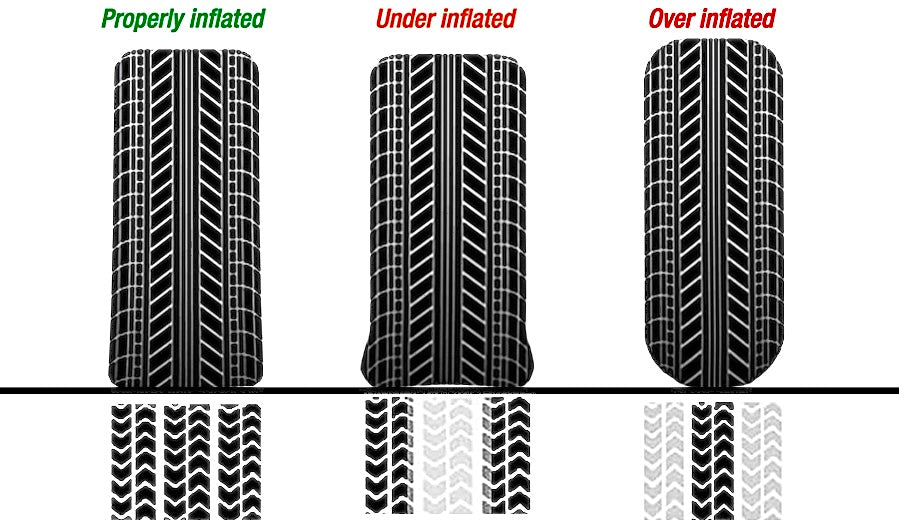

Edge wear is characterized by significant deterioration on the outer edges of the tire tread. This type of wear occurs when tires are under-inflated, causing the outer shoulders to bear most of the vehicle’s weight. For B2B buyers managing fleets or transportation services, recognizing edge wear is crucial for maintaining safety and operational efficiency. Early detection can prevent further damage and extend tire life, although the downside includes potentially increased replacement costs due to the accelerated wear rate.

Cup wear manifests as uneven, cupped indentations on the tire surface, often caused by a combination of under-inflation and misalignment. This type of wear is particularly relevant for businesses operating heavy-duty vehicles or construction equipment, as it can lead to significant performance issues, including noise and vibration. B2B buyers should consider regular alignment checks and tire rotations to mitigate this issue. However, the downside is that addressing cup wear may require costly repairs to suspension systems if left unaddressed.

Patchy wear presents as irregular patches across the tire surface, which can stem from various factors, including improper inflation, misalignment, or even suspension problems. For logistics companies and delivery services, this type of wear can indicate multiple underlying issues that may require comprehensive inspections. The advantage of identifying patchy wear early is that it allows for timely interventions, but the cons include the potential for extensive diagnostic efforts, which can be resource-intensive.

Sidewall damage, including cracks or bulges, is a serious issue often linked to prolonged under-inflation. This type of wear is particularly pertinent for industries using agricultural or mining vehicles, where tire integrity is crucial for safety. The visual cues provided by sidewall damage prompt immediate action, but the risks of sudden blowouts can pose significant safety hazards. B2B buyers must prioritize regular tire inspections to prevent such dangers.

While center wear is typically associated with over-inflation, it can also occur in under-inflated tires due to improper load distribution. This type of wear can be misleading for commercial transport and automotive fleets, as it may not directly indicate an inflation issue. B2B buyers should maintain a rigorous tire pressure monitoring system to ensure optimal performance. However, the potential for misdiagnosis can lead to unnecessary maintenance costs if not correctly evaluated.

| Промышленность/сектор | Specific Application of under inflated tire wear | Ценность/выгода для бизнеса | Ключевые соображения по поиску источников для данного приложения |

|---|---|---|---|

| Transportation & Logistics | Fleet management and vehicle maintenance | Reduces costs associated with tire replacements and enhances vehicle safety | Suppliers must provide reliable tire pressure monitoring systems and maintenance services. |

| Сельское хозяйство | Agricultural machinery operations | Increases efficiency and reduces downtime from tire failures | Buyers should consider suppliers that offer durable tires suited for off-road conditions. |

| Строительство | Heavy equipment and machinery | Minimizes operational risks and extends the lifespan of machinery tires | Look for suppliers who offer specialized tires for construction vehicles and regular maintenance options. |

| Mining | Mining equipment and haulage vehicles | Enhances safety and operational efficiency while reducing maintenance costs | Ensure suppliers can provide heavy-duty tires that withstand harsh conditions and offer monitoring services. |

| Public Transport | Bus and taxi services | Improves fuel efficiency and passenger safety, reducing overall operational costs | Suppliers should offer comprehensive tire management solutions, including regular pressure checks and replacements. |

In the transportation and logistics sector, under-inflated tire wear can significantly impact fleet management. Companies often face high costs due to frequent tire replacements and the increased risk of accidents caused by poor tire performance. By implementing tire pressure monitoring systems, businesses can maintain optimal tire inflation, thus enhancing safety and reducing costs. International buyers should prioritize suppliers that offer reliable monitoring solutions and maintenance services to ensure the longevity of their fleet.

In agriculture, under-inflated tire wear is a common issue that affects the performance of machinery such as tractors and harvesters. When tires are not properly inflated, they can suffer from uneven wear, leading to frequent replacements and increased operational downtime. By sourcing durable, high-quality tires specifically designed for agricultural use, businesses can enhance efficiency and minimize disruptions. Buyers should seek suppliers who understand the unique demands of agricultural machinery and can provide tailored solutions.

For the construction industry, under-inflated tire wear presents serious risks to heavy machinery and equipment. Insufficient tire pressure can lead to increased wear and tear, resulting in costly repairs and potential safety hazards on job sites. By investing in specialized tires designed for construction vehicles, companies can extend the lifespan of their equipment and improve safety. Buyers should consider suppliers that offer comprehensive tire solutions, including regular maintenance and monitoring, to ensure optimal performance.

Illustrative image related to under inflated tire wear

In mining operations, under-inflated tire wear can lead to catastrophic failures and safety incidents. The harsh conditions in mining require heavy-duty tires that can withstand significant stress. Maintaining proper tire pressure not only enhances safety but also improves operational efficiency and reduces maintenance costs. Buyers in this sector should partner with suppliers who provide robust tire solutions and monitoring systems tailored for the unique challenges of mining environments.

Public transport systems, including buses and taxis, face unique challenges related to under-inflated tire wear. Poorly maintained tires can compromise passenger safety and increase fuel consumption, leading to higher operational costs. By sourcing comprehensive tire management solutions, public transport operators can improve safety and efficiency. It is essential for buyers to work with suppliers who offer regular tire pressure checks and replacement services to maintain optimal performance and safety standards.

Проблема: A logistics company operating a fleet of delivery trucks in Africa is grappling with excessive tire replacements due to under-inflated tire wear. The financial burden is compounded by the need for frequent repairs, downtime, and the logistical challenges of sourcing new tires in remote areas. The company’s fleet manager recognizes that under-inflation leads to uneven tread wear, particularly on the outer edges of the tires, resulting in shorter tire life and higher overall operational costs.

Решение: Implement a comprehensive tire maintenance program that includes regular pressure checks and tire rotations. Fleet managers should invest in tire pressure monitoring systems (TPMS) that provide real-time data on tire conditions. This technology can alert drivers when tire pressure drops below the recommended levels, allowing for immediate corrective actions. Additionally, educating drivers on the importance of maintaining proper tire pressure and scheduling routine inspections can significantly extend tire lifespan and reduce replacement frequency. Investing in training programs for drivers will ensure they understand how to identify signs of under-inflation, such as uneven wear patterns, thus minimizing long-term costs.

Проблема: A transportation company in Brazil is facing increased incidents of road accidents attributed to compromised vehicle control from under-inflated tires. With the nature of their work requiring swift deliveries across diverse terrains, the safety of their drivers and cargo is paramount. Drivers report that under-inflated tires result in reduced grip and handling, especially during adverse weather conditions, leading to a heightened risk of accidents.

Illustrative image related to under inflated tire wear

Решение: To mitigate safety risks, the company should adopt a proactive tire management strategy that emphasizes preventive maintenance. This includes implementing a routine tire inspection schedule and utilizing advanced tire inflation systems that automatically adjust pressure according to load conditions. Additionally, providing drivers with comprehensive training on the dangers of driving with under-inflated tires will empower them to perform visual inspections and report issues before they escalate. Collaborating with tire suppliers to establish a quick-response service for tire maintenance can also ensure that any detected issues are addressed promptly, enhancing overall vehicle safety.

Проблема: An international logistics firm operating in the Middle East is experiencing significant drops in fuel efficiency, directly linked to under-inflated tires across their fleet. The operational costs are rising as the vehicles require more fuel to compensate for the increased rolling resistance caused by improper tire inflation. This inefficiency not only affects the company’s bottom line but also impacts its sustainability goals, as higher fuel consumption translates to increased carbon emissions.

Решение: To address fuel inefficiency, the logistics firm should conduct a thorough analysis of their tire management practices and adopt a data-driven approach to tire maintenance. This includes utilizing telematics to monitor tire pressure and performance metrics in real-time. Additionally, the firm can negotiate bulk purchasing agreements with tire manufacturers for high-efficiency tires designed to minimize rolling resistance. Regular training sessions on the importance of tire maintenance for fleet operators can help instill a culture of accountability, ensuring that tire pressure is checked before each trip. By implementing these measures, the company can improve fuel efficiency, reduce operational costs, and enhance its commitment to environmental sustainability.

When it comes to mitigating the effects of under-inflated tire wear, selecting the right materials for tire manufacturing and maintenance is crucial. This guide analyzes four common materials used in tire production and maintenance, focusing on their properties, advantages, disadvantages, and considerations for international B2B buyers.

Основные свойства: Rubber compounds used in tires are engineered for flexibility, durability, and heat resistance. They typically have a temperature rating that can withstand extreme conditions, while also being resistant to ozone and UV degradation.

Плюсы и минусы: The primary advantage of rubber is its excellent grip and shock absorption, which enhances vehicle handling and comfort. However, rubber can be susceptible to wear and tear over time, especially in harsh environments. The manufacturing complexity varies depending on the specific formulation, impacting production costs.

Влияние на применение: Rubber compounds are compatible with various media, including air and moisture, which are essential in tire applications. However, improper inflation can lead to accelerated wear, making it vital to monitor tire pressure regularly.

Соображения для международных покупателей: Buyers in regions such as Africa and South America should consider local climate conditions, which can affect rubber performance. Compliance with standards like ASTM D2000 for rubber materials is essential for ensuring quality and safety.

Основные свойства: Steel belts provide added strength and stability to tires, with high tensile strength and resistance to deformation under pressure. They can withstand significant loads and have excellent fatigue resistance.

Плюсы и минусы: The primary advantage of steel belts is their ability to enhance tire durability and performance, especially under heavy loads. However, they can increase the overall weight of the tire, potentially impacting fuel efficiency. The manufacturing process is more complex, often leading to higher costs.

Влияние на применение: Steel belts are crucial for maintaining tire shape under varying loads and pressures, which is vital for preventing uneven wear due to under-inflation.

Соображения для международных покупателей: In regions like Europe, compliance with EU regulations for tire safety and performance standards is critical. Buyers should also consider the availability of steel and manufacturing capabilities in their local markets.

Illustrative image related to under inflated tire wear

Основные свойства: Nylon and polyester fabrics are commonly used as reinforcement layers within tires, providing flexibility and strength. They have good resistance to abrasion and can handle high temperatures.

Плюсы и минусы: These fabrics enhance the tire’s structural integrity while allowing for some degree of flexibility, which is beneficial for ride comfort. However, they may not provide the same level of strength as steel belts, potentially leading to reduced durability under extreme conditions.

Влияние на применение: The use of nylon or polyester fabrics can help improve the tire’s ability to maintain its shape, even when under-inflated, thus reducing the risk of catastrophic failure.

Illustrative image related to under inflated tire wear

Соображения для международных покупателей: Buyers should ensure that the materials meet local safety and performance standards, such as JIS in Japan or DIN in Germany. Additionally, the availability of these materials can vary by region, impacting supply chain logistics.

Основные свойства: Tire sealants are typically made from a combination of latex and other polymers, designed to seal punctures and leaks effectively. They can maintain effectiveness across a wide temperature range.

Плюсы и минусы: The primary advantage of tire sealants is their ability to prevent air loss, thereby reducing the risk of under-inflation. However, they can add weight and may not be suitable for all tire types, particularly those with specific performance requirements.

Влияние на применение: Sealants can significantly enhance tire longevity by maintaining optimal pressure, which is crucial in preventing uneven wear patterns associated with under-inflation.

Illustrative image related to under inflated tire wear

Соображения для международных покупателей: Buyers should verify that sealants comply with local regulations and are compatible with the specific tire materials used in their region.

| Материал | Typical Use Case for under inflated tire wear | Ключевое преимущество | Основные недостатки/ограничения | Относительная стоимость (низкая/средняя/высокая) |

|---|---|---|---|---|

| Rubber Compounds | Primary tire construction | Excellent grip and shock absorption | Susceptible to wear in harsh conditions | Средний |

| Steel Belts | Structural reinforcement | Enhances durability and performance | Increases tire weight | Высокий |

| Nylon/Polyester Fabrics | Tire reinforcement | Provides flexibility and strength | Менее долговечны в экстремальных условиях | Средний |

| Tire Sealants | Preventative maintenance | Prevents air loss | May not suit all tire types | Низкий |

This strategic material selection guide provides a comprehensive overview for B2B buyers looking to optimize tire performance and longevity, especially in regions with diverse environmental challenges.

The manufacturing process of tires, particularly those that are prone to under-inflation, involves several critical stages: material preparation, forming, assembly, and finishing. Each stage plays a vital role in ensuring the durability and performance of the tire.

Подготовка материалов: The tire manufacturing process begins with the careful selection of raw materials, including natural rubber, synthetic rubber, carbon black, and steel. These materials must meet stringent quality standards to ensure optimal performance. High-quality rubber compounds are formulated to enhance durability and flexibility, which are crucial for tires that may experience under-inflation.

Формирование: Once the materials are prepared, the next step involves forming the tire components. This includes creating the tire’s tread, sidewalls, and inner linings. Advanced techniques such as extrusion and calendering are employed to shape the rubber into the required profiles. This stage is critical for creating a uniform structure that can withstand varying pressure levels.

Сборка: After forming, the individual components are assembled. This process involves layering the different parts, including the inner liner, body plies, belts, and tread. Manufacturers often utilize automated machinery to ensure precision and consistency. Proper alignment and adhesion are vital to prevent premature wear, especially in tires that may be under-inflated.

Отделка: The final stage involves curing the assembled tires in a mold under heat and pressure. This vulcanization process enhances the rubber’s strength and elasticity. Post-curing inspections are conducted to identify any defects that could lead to uneven wear patterns associated with under-inflation.

Quality assurance (QA) is integral to the tire manufacturing process, ensuring that the final product adheres to international safety and performance standards. For B2B buyers, understanding these QA processes is crucial for selecting reliable suppliers.

Соответствие международным стандартам: Many tire manufacturers adhere to ISO 9001 standards, which emphasize quality management systems. Compliance with these standards ensures a systematic approach to quality control, minimizing defects and improving overall tire performance.

Industry-Specific Standards: In addition to ISO standards, manufacturers often comply with industry-specific certifications, such as CE marking in Europe and API standards in the oil and gas sector. These certifications indicate that the tires meet rigorous safety and environmental requirements.

Контрольные точки контроля качества: Effective QA involves multiple checkpoints throughout the manufacturing process:

– Входящий контроль качества (IQC): This stage verifies the quality of raw materials before production begins. It ensures that only high-quality inputs are used, reducing the likelihood of defects.

– Внутрипроцессный контроль качества (IPQC): During manufacturing, real-time inspections are conducted to monitor the production process. This helps identify and rectify any issues immediately, preventing defects from advancing to the next stage.

– Окончательный контроль качества (ОКК): After the tires are finished, a comprehensive inspection is performed to assess their performance, safety, and durability. This includes testing for uniformity, balance, and tread wear patterns.

Tire manufacturers employ various testing methods to ensure that the products meet safety and performance criteria. These methods are essential for preventing issues associated with under-inflation, such as uneven tread wear.

Dynamic Testing: This involves evaluating the tire’s performance under different load conditions and speeds. Dynamic tests simulate real-world driving scenarios, allowing manufacturers to assess how well the tires handle pressure fluctuations.

Tread Wear Testing: Specific tests are conducted to measure tread wear over time. These tests simulate prolonged use and assess how different inflation levels affect wear patterns. Understanding these patterns helps manufacturers develop tires that are less susceptible to uneven wear.

Heat Generation Testing: Tires generate heat during operation, especially when under-inflated. Testing for heat generation helps manufacturers ensure that tires can withstand temperature increases without compromising safety.

For international B2B buyers, verifying the quality control practices of tire suppliers is crucial for ensuring product reliability. Here are some strategies to confirm supplier QC:

Аудиты поставщиков: Conducting regular audits of potential suppliers allows buyers to evaluate their manufacturing processes and quality assurance systems. This includes reviewing compliance with ISO standards and industry-specific certifications.

Отчеты по обеспечению качества: Requesting detailed quality assurance reports can provide insight into a supplier’s QC processes, including their testing methodologies and results. Buyers should look for transparency in these reports, as they reflect the supplier’s commitment to quality.

Проверки третьих сторон: Engaging third-party inspection agencies can provide an unbiased evaluation of a supplier’s manufacturing and quality control practices. These agencies can perform assessments based on international standards, ensuring that the tires meet the necessary safety and performance criteria.

International B2B buyers, particularly from Africa, South America, the Middle East, and Europe, should be aware of specific quality control nuances when selecting tire suppliers:

Regional Standards and Regulations: Different regions may have varying standards and regulations governing tire manufacturing. Buyers should familiarize themselves with local requirements to ensure compliance and avoid potential legal issues.

Культурные соображения: Understanding cultural differences in business practices can enhance communication with suppliers. Building strong relationships can lead to better collaboration in quality assurance and product development.

Логистика и управление цепями поставок: International buyers must consider the logistics of sourcing tires from different regions. Ensuring that suppliers have robust supply chain management practices in place is essential for timely delivery and maintaining product quality.

In conclusion, the manufacturing processes and quality assurance practices for tires susceptible to under-inflation are critical for ensuring safety and performance. By understanding these processes, B2B buyers can make informed decisions when selecting suppliers, ultimately leading to better product outcomes and reduced risks associated with uneven tire wear.

This guide serves as a practical sourcing checklist for B2B buyers focused on managing under-inflated tire wear. Proper tire maintenance is crucial not only for safety but also for reducing operational costs. Understanding how to source solutions effectively can ensure optimal tire performance, extending their lifespan and enhancing overall vehicle safety.

Begin by evaluating the specific tire requirements for your fleet or operations. Different vehicles and applications may require distinct tire types and specifications.

Finding trustworthy suppliers is critical to securing quality tires that meet your specifications. Look for suppliers with a proven track record in your region.

Ensure that the tires you consider have specifications aligned with your operational needs, particularly regarding pressure requirements.

Before making bulk purchases, request samples or demonstrations of the tires you are considering. This can provide firsthand insight into their performance.

A robust maintenance plan is essential for managing tire health and preventing under-inflation issues.

Once you have selected potential suppliers, engage in negotiations to secure favorable terms and conditions.

After procurement, continuously monitor the performance of the tires to ensure they are functioning as expected.

By following this checklist, B2B buyers can effectively manage under-inflated tire wear, ensuring safety and cost efficiency in their tire procurement process.

In the context of under inflated tire wear, understanding the cost structure is essential for international B2B buyers. The main cost components include materials, labor, manufacturing overhead, tooling, quality control (QC), logistics, and profit margin.

Материалы: The type and quality of rubber, steel belts, and other components directly influence costs. Premium materials may incur higher upfront costs but can reduce long-term expenses due to enhanced durability and performance.

Труд: Labor costs vary based on location, skill level, and manufacturing practices. Countries with lower labor costs may offer competitive pricing, but it’s essential to consider the potential trade-offs in quality and service.

Производственные накладные расходы: This encompasses utilities, rent, and equipment depreciation. Efficient manufacturing processes can help minimize overhead costs, allowing for more competitive pricing.

Инструментальная оснастка: The initial investment in tooling can be substantial, especially for custom tire designs. Buyers should assess whether these costs can be amortized over larger order volumes.

Контроль качества (QC): Implementing stringent QC measures adds to costs but is critical for ensuring product reliability and safety. Buyers should inquire about QC certifications and practices to gauge the quality assurance processes of potential suppliers.

Логистика: Transporting tires from manufacturing facilities to distribution centers or end-users involves significant logistics costs. Factors such as distance, shipping mode, and customs duties affect overall pricing.

Маржа: Suppliers will add a margin to cover their operational costs and profit. Understanding typical margins in the industry can help buyers negotiate better deals.

Several factors influence pricing strategies in the sourcing of tires prone to under inflation:

Объем и минимальное количество заказа (MOQ): Bulk purchases often lead to discounts. Buyers should negotiate MOQs to ensure they receive the best pricing based on their purchasing capacity.

Технические характеристики и персонализация: Customized tire designs or specific performance characteristics may increase costs. Buyers should clearly define their requirements to avoid unexpected charges.

Сертификация материалов и качества: Tires made with high-quality materials or those that meet specific industry certifications (e.g., ISO) may command higher prices but offer better performance and longevity.

Факторы поставщика: The reputation, reliability, and geographical location of suppliers can impact pricing. Established suppliers may offer premium products but at a higher cost, while newer companies might provide lower prices with varying quality assurances.

Инкотермс: Understanding Incoterms is crucial for international transactions. Terms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) define who bears the cost at different stages, influencing overall procurement expenses.

For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe, several strategies can enhance negotiation outcomes:

Повышение совокупной стоимости владения (TCO): When evaluating offers, consider not just the purchase price but also long-term costs associated with maintenance, fuel efficiency, and replacement frequency due to tire wear patterns.

Negotiate for Better Terms: Engage suppliers in discussions about payment terms, delivery schedules, and warranties. Flexible terms can enhance cash flow and reduce risks.

Проведите исследование рынка: Understanding the market landscape allows buyers to benchmark pricing and negotiate effectively. Gathering insights on competitor pricing can provide leverage in discussions.

Focus on Quality Assurance: Prioritize suppliers who offer robust QC measures and certifications, even if their prices are slightly higher. This can lead to cost savings in the long run through reduced tire wear and fewer replacements.

Будьте внимательны к нюансам ценообразования: Different regions may have unique pricing challenges due to tariffs, local economic conditions, or logistics costs. Tailor your approach based on these factors for optimal negotiations.

Prices for under inflated tire wear sourcing can vary significantly based on the factors discussed. This analysis provides a framework for understanding potential costs but does not represent fixed pricing. Buyers are encouraged to conduct thorough market research and engage with multiple suppliers to obtain accurate quotes tailored to their specific needs.

Understanding under inflated tire wear is crucial for businesses that rely on vehicle fleets or transportation services. However, there are alternative solutions to manage tire health and performance. This analysis compares under inflated tire wear against two viable alternatives: regular tire maintenance programs and advanced tire pressure monitoring systems (TPMS). By evaluating these options, B2B buyers can make informed decisions that enhance safety, reduce costs, and extend tire life.

| Сравнительный аспект | Under Inflated Tire Wear | Regular Tire Maintenance Programs | Advanced Tire Pressure Monitoring Systems (TPMS) |

|---|---|---|---|

| Производительность | Decreased traction and increased wear on tire edges | Improved tire lifespan and vehicle safety | Continuous monitoring ensures optimal tire pressure |

| Стоимость | Higher long-term costs due to frequent replacements | Moderate upfront cost; potential savings over time | Initial investment in technology, but cost-effective in the long run |

| Простота реализации | Requires regular manual checks | Relies on scheduled maintenance; needs a service provider | Installation can be complex; requires staff training |

| Техническое обслуживание | High due to frequent tire replacements | Moderate; involves regular inspections and adjustments | Low; automated alerts reduce manual checks |

| Лучший пример использования | Awareness of tire wear patterns | Businesses with a routine maintenance schedule | Fleets needing real-time tire pressure data for safety and efficiency |

Regular tire maintenance programs involve scheduled checks and services such as rotations, alignments, and pressure adjustments. This proactive approach helps in identifying issues before they escalate, thereby extending tire life and enhancing vehicle safety.

Плюсы:

– Reduces the likelihood of tire-related incidents.

– Can be tailored to fit the specific needs of a fleet or business.

Конс:

– Requires a reliable service provider, which can vary in quality.

– May incur ongoing costs, though it can save money in the long term by preventing premature tire wear.

Advanced TPMS are electronic systems that continuously monitor tire pressure and alert drivers to any deviations from optimal levels. This technology can significantly enhance safety by preventing issues related to under or over-inflation.

Плюсы:

– Provides real-time data, allowing for immediate corrective actions.

– Reduces the need for manual tire pressure checks, saving time and labor.

Конс:

– Initial setup costs can be high, and systems may require technical expertise to install and maintain.

– Dependence on technology may lead to challenges if systems fail or malfunction.

Selecting the appropriate solution for managing tire health involves considering factors like cost, performance, and ease of implementation. For businesses with a robust maintenance culture, regular tire maintenance programs may provide a balanced approach, reducing costs while ensuring safety. However, companies looking for cutting-edge technology to enhance operational efficiency may find that investing in advanced TPMS is worthwhile. Ultimately, B2B buyers should assess their specific needs, fleet size, and operational budget to determine the best path forward for tire management and safety.

Understanding the technical specifications related to under-inflated tire wear is essential for B2B buyers in the automotive and transportation industries. Here are some critical specifications that impact tire performance and longevity:

Tire Pressure (PSI)

Tire pressure, measured in pounds per square inch (PSI), is crucial for maintaining optimal tire performance. Under-inflated tires typically have a pressure below the manufacturer’s recommended range, leading to uneven wear on the tire’s outer edges. Regular monitoring and adherence to recommended PSI levels can prevent costly replacements and enhance safety.

Tread Depth

Tread depth indicates the amount of rubber remaining on the tire. Insufficient tread depth, often exacerbated by under-inflation, compromises traction and increases the risk of hydroplaning. For B2B buyers, understanding tread depth specifications is vital for ensuring safety and compliance with regulations, especially in regions with varying weather conditions.

Load Index

The load index is a numerical value indicating the maximum weight a tire can safely carry. Under-inflated tires can significantly reduce their load-carrying capacity, leading to potential blowouts or tire failure under heavy loads. Buyers must ensure that tires meet the appropriate load index specifications for their vehicles to avoid operational disruptions.

Temperature Resistance

Tires are designed to operate within specific temperature ranges. Under-inflation can cause increased heat buildup due to excessive flexing, leading to premature tire degradation. Understanding temperature resistance specifications helps buyers select tires that perform optimally in their specific operational environments, reducing the likelihood of wear-related failures.

Sidewall Composition

The sidewall material affects a tire’s ability to withstand impacts and flex during operation. Under-inflated tires tend to flex more than intended, which can lead to sidewall damage. Buyers should consider tires with robust sidewall compositions to mitigate the risks associated with under-inflation.

Uniformity Specifications

Uniformity refers to the consistency of a tire’s construction, which affects balance and wear patterns. Poor uniformity can exacerbate the effects of under-inflation, leading to uneven wear. B2B buyers should prioritize tires that meet strict uniformity specifications to enhance vehicle performance and tire longevity.

Familiarizing yourself with industry jargon is essential for effective communication and decision-making in the tire market. Here are some common trade terms relevant to under-inflated tire wear:

OEM (Original Equipment Manufacturer)

OEM refers to tires that are manufactured by the same company that produces the vehicle. These tires are often designed specifically to meet the performance standards of the vehicle, making them a reliable choice for B2B buyers seeking quality replacements that minimize wear issues.

MOQ (минимальное количество заказа)

MOQ is the smallest quantity of tires that a supplier is willing to sell. Understanding MOQ is crucial for buyers, as it can impact inventory management and cost efficiency. Suppliers often set MOQs based on production costs and logistics.

RFQ (запрос котировок)

An RFQ is a formal request to suppliers for pricing and terms on specific products, including tires. Submitting an RFQ helps buyers gather essential information to compare different suppliers and make informed purchasing decisions.

Инкотермс

Incoterms (International Commercial Terms) define the responsibilities of buyers and sellers regarding shipping and delivery. Understanding these terms helps B2B buyers in managing logistics and anticipating potential costs associated with tire imports and exports, particularly important in global markets.

Treadwear Warranty

A treadwear warranty guarantees a certain mileage or wear performance for tires. This term is essential for buyers to consider when evaluating the long-term value and reliability of tires, especially those that are at risk of premature wear due to under-inflation.

Alignment

Tire alignment refers to adjusting the angles of the tires to ensure they are set to the vehicle manufacturer’s specifications. Proper alignment helps prevent uneven tire wear, making it a critical consideration for B2B buyers concerned about the longevity of their tire investments.

Understanding these technical properties and trade terms can empower B2B buyers to make informed decisions that enhance operational efficiency and safety in their vehicle fleets.

The global market for under inflated tire wear is increasingly shaped by various drivers, including rising fuel prices, heightened safety concerns, and advancements in tire technology. Buyers in Africa, South America, the Middle East, and Europe are particularly focused on cost efficiency and performance, leading to a growing demand for high-quality tires that can withstand the rigors of diverse terrains and climates. In regions like Germany and Brazil, regulatory standards on vehicle safety and emissions are prompting businesses to prioritize tire maintenance and monitoring systems.

Emerging B2B technologies, such as smart tire sensors and telematics, are revolutionizing how companies monitor tire pressure and wear. These innovations enable real-time data collection, allowing businesses to proactively manage tire conditions and reduce the risks associated with under inflated tires. As these technologies become more accessible, international buyers are increasingly seeking suppliers that offer integrated solutions that combine tire products with monitoring systems.

Moreover, sustainability is becoming a key consideration in sourcing decisions. Companies are now more aware of the environmental impact of tire disposal and the importance of selecting suppliers committed to sustainable practices. This shift is driving demand for products that not only meet performance criteria but also adhere to eco-friendly standards.

Environmental impact is a critical concern for the tire industry, particularly regarding under inflated tire wear, which can lead to increased fuel consumption and emissions. Businesses are now recognizing that poorly maintained tires contribute significantly to carbon footprints, prompting a shift toward sustainable practices. Ethical sourcing is essential in this context, as companies are increasingly held accountable for their supply chain’s environmental and social impact.

Incorporating ‘green’ certifications and materials into sourcing strategies is becoming a standard expectation among international B2B buyers. Certifications such as ISO 14001 (Environmental Management) and adherence to sustainable manufacturing practices are crucial for suppliers aiming to capture the growing segment of environmentally-conscious businesses. Additionally, innovations in tire recycling and the use of sustainable materials, such as natural rubber and recycled compounds, are gaining traction, aligning with global efforts to reduce waste.

As buyers prioritize sustainability, they are also looking for suppliers who offer transparency in their supply chains. This includes detailed reporting on material sourcing, production processes, and end-of-life tire management. Companies that embrace these practices not only enhance their marketability but also contribute positively to the environment and society.

Historically, the under inflated tire wear issue has been a concern for the automotive industry, particularly as vehicles became more prevalent in the 20th century. The introduction of tire pressure monitoring systems (TPMS) in the early 2000s marked a significant shift in how tire maintenance was approached. Initially mandated for new vehicles in many regions, these systems have evolved, providing real-time feedback to drivers and fleet managers about tire conditions.

Over the years, the recognition of the direct link between tire maintenance and safety has led to greater regulatory scrutiny and the implementation of best practices in the industry. Today, the focus has expanded from merely addressing tire wear to adopting comprehensive tire management strategies that consider environmental impact, safety, and cost efficiency. This evolution reflects a broader trend in the B2B sector, where sustainability and technology are increasingly intertwined in shaping market dynamics and sourcing decisions.

How do I solve issues related to under-inflated tire wear?

To address under-inflated tire wear, start by regularly checking tire pressure using a reliable gauge. Ensure that tires are inflated to the manufacturer’s recommended psi, which can typically be found in the vehicle’s manual or on a sticker inside the driver’s door. Additionally, conduct routine inspections for signs of uneven wear and schedule professional alignments and rotations as necessary. Implementing a systematic tire maintenance program can significantly extend tire lifespan and improve vehicle safety, ultimately reducing costs associated with frequent replacements.

What is the best practice for monitoring tire pressure in a fleet?

For fleet management, the best practice for monitoring tire pressure is to utilize a Tire Pressure Monitoring System (TPMS). This technology provides real-time data on tire pressure, alerting drivers to any deviations from the optimal levels. Regular training for drivers on the importance of tire maintenance, combined with scheduled pressure checks, can enhance safety and fuel efficiency. Additionally, integrating tire maintenance into routine vehicle inspections ensures that any issues are identified and addressed proactively, minimizing the risk of under-inflated tires.

How can I assess the quality of a supplier for tires?

To assess the quality of a tire supplier, begin by checking their certifications and compliance with international standards, such as ISO or local regulatory requirements. Request references from other B2B clients to gauge their reliability and service quality. Evaluate their production capabilities, including technology used and quality control measures in place. It’s also beneficial to inquire about their experience in handling international shipments and their ability to meet specific customization requests, ensuring they can cater to your unique business needs.

What are the minimum order quantities (MOQ) for tire purchases?

Minimum order quantities (MOQ) for tires can vary significantly by supplier and product type. Typically, MOQs may range from a few dozen to several hundred units, depending on the manufacturer’s production capabilities and the specific tire model. When negotiating with suppliers, it’s essential to clarify the MOQ upfront and explore options for lower MOQs if your business requires smaller batches, especially for new or trial products. Some suppliers may offer flexible terms for established clients or bulk orders, so it’s worth discussing your needs.

What payment terms should I expect when sourcing tires internationally?

Payment terms for international tire sourcing can vary widely. Common terms include payment in advance, letters of credit, or net 30/60/90 days after shipment. It’s important to negotiate terms that align with your cash flow and risk management strategies. Ensure to understand any potential currency exchange implications and additional fees that might arise from international transactions. Building a strong relationship with your supplier can also facilitate more favorable payment terms over time.

What logistics considerations should I keep in mind for tire imports?

When importing tires, consider logistics factors such as shipping methods, customs regulations, and potential tariffs. Choose a reliable freight forwarder experienced in handling tire shipments to navigate the complexities of international transport. Ensure compliance with local regulations regarding tire specifications and environmental standards. Additionally, plan for potential delays in customs and factor in storage solutions for tires upon arrival, particularly if your business operates in regions with fluctuating demand.

How can I ensure the tires meet quality standards before purchase?

To ensure tires meet quality standards, request detailed product specifications and certifications from the supplier. Conduct pre-shipment inspections, either in-house or through third-party quality assurance services, to verify compliance with safety and performance criteria. Consider sourcing samples for testing before committing to larger orders. Establish clear quality expectations in your contracts, and maintain open communication with suppliers to address any quality concerns promptly.

What are the common signs of under-inflated tires to watch for?

Common signs of under-inflated tires include uneven wear patterns, particularly on the outer edges, a noticeably softer feel when driving, and reduced fuel efficiency. Additionally, vehicles may exhibit poor handling or increased stopping distances. Regular tire inspections should include checking tread depth and visual assessments for bulges or cracks. Educating your team on these signs can help prevent costly repairs and enhance overall vehicle safety and performance.

Домен: eastcoasttoyota.com

Зарегистрирован: 2000 (25 лет)

Введение: The text discusses the hidden risks associated with overinflated and underinflated tires, emphasizing the importance of maintaining proper tire pressure for vehicle performance and safety. Key points include: 1. Uneven Tread Wear: Overinflated tires wear the center faster, while underinflated tires wear the outer edges, leading to costly replacements. 2. Reduced Vehicle Control: Improperly inflate…

Домен: reddit.com

Зарегистрирован: 2005 (20 лет)

Введение: Tire inflation recommendations: 33 psi front and 30 psi rear for a 2025 Rogue SL. Overinflated tires can lead to blowouts and jittery handling, while underinflated tires decrease handling, wear faster, and create more heat that can also cause blowouts. A difference of 4 psi is generally acceptable due to temperature fluctuations. Ideal tire pressure range is between 30 and 36 psi.

Домен: dextergroup.com

Зарегистрирован: 2002 (23 года)

Введение: Dexter recommends inspecting tire pressure weekly and checking tire condition every 3 months or 3,000 miles. Tires should be replaced at least every five years, even with low use. Common tire wear patterns include:

– Edge Wear: Excessive wear on both sides, usually due to underinflation.

– Center Wear: Excessive wear in the middle, typically caused by overinflation.

– Cupping: Patches of uneven…

Домен: sullivantire.com

Зарегистрирован: 1996 (29 лет)

Введение: Buy 3, Get 1 Free on all in-stock Yokohama tires! Valid 11/10/2025 – 12/2/2025. Code: YOKO1125. Save $100 Instantly on Purchase and Installation of Goodyear Tires. Save Up To $300 on the Purchase and Installation of 4 Goodyear Tires after Instant Savings and Rebate on Select Goodyear Tires! Instant Savings Valid 11/1/2025 – 12/2/2025. Rebate Valid 10/1/2025 – 11/30/2025. Code: GY1125. Save $150 In…

Домен: rnrtires.com

Зарегистрирован: 2006 (19 лет)

Введение: This company, RNR Tires – Tire Wear Solutions, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

In summary, addressing under-inflated tire wear is crucial for optimizing tire longevity and ensuring vehicle safety. For international B2B buyers, particularly in regions such as Africa, South America, the Middle East, and Europe, understanding the implications of tire maintenance is not only a matter of operational efficiency but also a key driver of cost savings. Regular tire pressure checks, coupled with strategic sourcing of quality tires and services, can significantly reduce the risks associated with uneven tread wear, including blowouts and compromised vehicle control.

By prioritizing strategic sourcing, businesses can establish partnerships with reliable suppliers who offer quality products and expert services that cater to local conditions. This proactive approach not only enhances the safety of your fleet but also improves overall performance and fuel efficiency, translating into substantial financial benefits.

As we look toward the future, it is essential for B2B buyers to remain vigilant about tire maintenance practices and to engage with suppliers who understand the unique challenges of their markets. Take the next step in safeguarding your fleet by investing in comprehensive tire management solutions that will pave the way for safer, more efficient operations.

Illustrative image related to under inflated tire wear

Информация, представленная в данном руководстве, включая сведения о производителях, технические характеристики и анализ рынка, предназначена исключительно для информационных и образовательных целей. Она не является профессиональной консультацией по закупкам, финансовой или юридической консультацией.

Несмотря на то, что мы приложили все усилия для обеспечения точности и своевременности информации, мы не несем ответственности за любые ошибки, упущения или устаревшую информацию. Условия рынка, сведения о компании и технические стандарты могут быть изменены.

Покупатели B2B должны проводить независимую и тщательную юридическую экспертизу перед принятием решения о покупке. Это включает в себя прямые контакты с поставщиками, проверку сертификатов, запрос образцов и обращение за профессиональной консультацией. Риск, связанный с использованием любой информации, содержащейся в данном руководстве, несет исключительно читатель.