In today’s competitive landscape, sourcing the correct trailer tire inflation pressure chart is essential for international B2B buyers looking to optimize their fleet operations and enhance safety standards. A key challenge faced by companies across Africa, South America, the Middle East, and Europe is ensuring that their trailers operate under optimal load capacities while maintaining compliance with regional regulations. This comprehensive guide addresses these concerns by delving into various types of tire inflation charts, their applications in different industries, and the critical importance of adhering to manufacturer specifications.

Throughout this guide, buyers will find actionable insights on selecting the right tire inflation pressure for their specific needs, understanding the implications of under- or over-inflation, and navigating the complexities of supplier vetting to ensure reliability and quality. Additionally, we will explore the cost factors associated with tire maintenance and replacement, empowering businesses to make informed purchasing decisions that align with their operational goals.

By leveraging this resource, international B2B buyers can enhance their understanding of trailer tire management, ultimately leading to improved performance, reduced costs, and enhanced safety for their fleets. Whether you’re in Brazil, Vietnam, or any other region, this guide serves as a valuable tool to navigate the global market for trailer tire inflation pressure charts effectively.

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Load Inflation Chart | Provides basic PSI recommendations based on tire size and load | General trailer manufacturing | Pros: Simple to use; widely applicable. Cons: May not account for specific load distributions. |

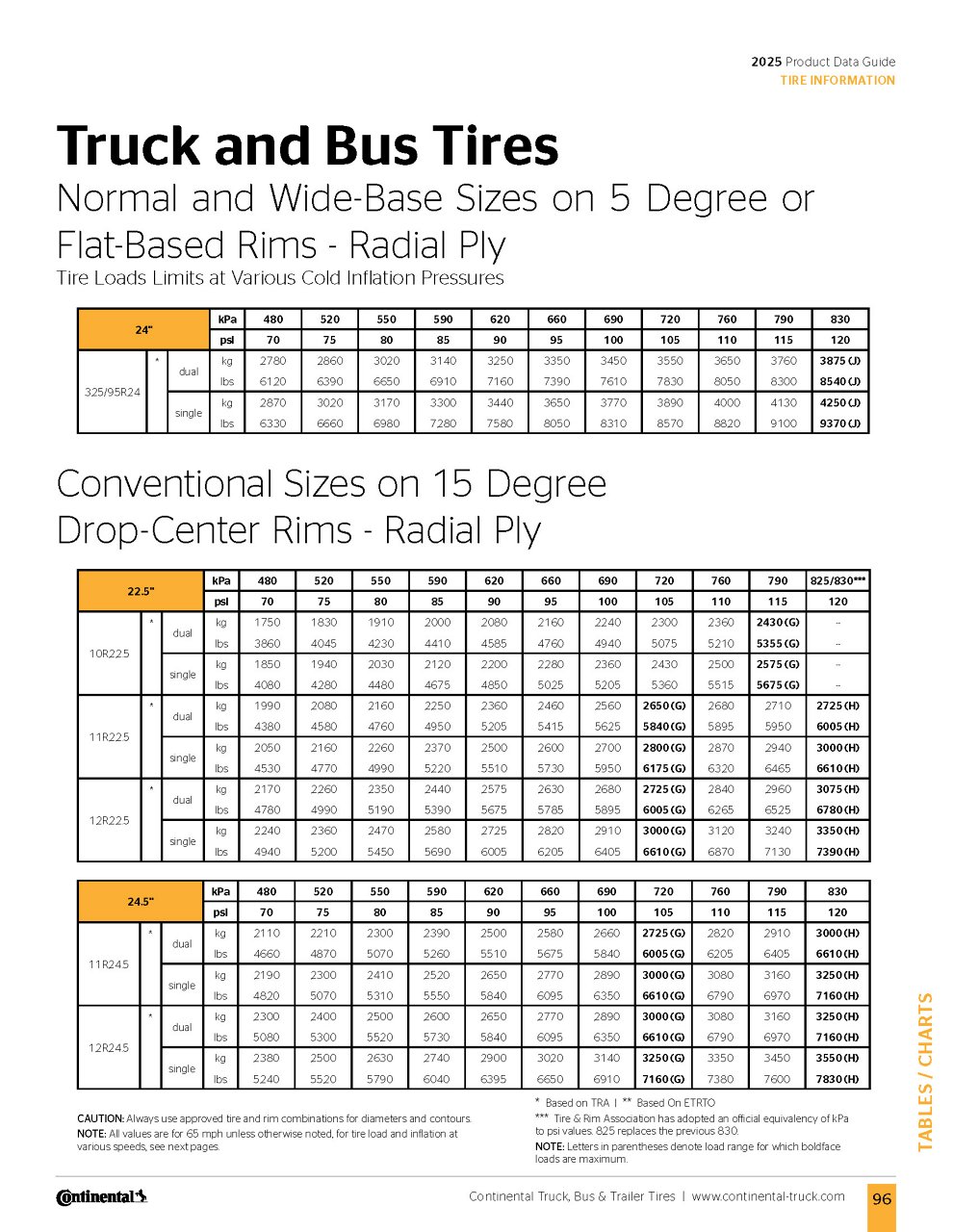

| Heavy-Duty Load Inflation Chart | Designed for high-capacity trailers with heavier loads | Commercial transport and logistics | Pros: Ensures safety under heavy loads. Cons: More complex to interpret; limited to heavy-duty applications. |

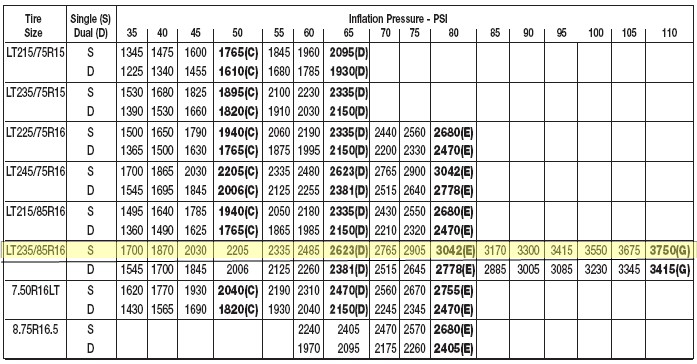

| Multi-Axle Trailer Inflation Chart | Takes into account weight distribution across multiple axles | RV and multi-axle trailer users | Pros: Improves safety and handling; tailored for specific configurations. Cons: Requires accurate weight measurements for effectiveness. |

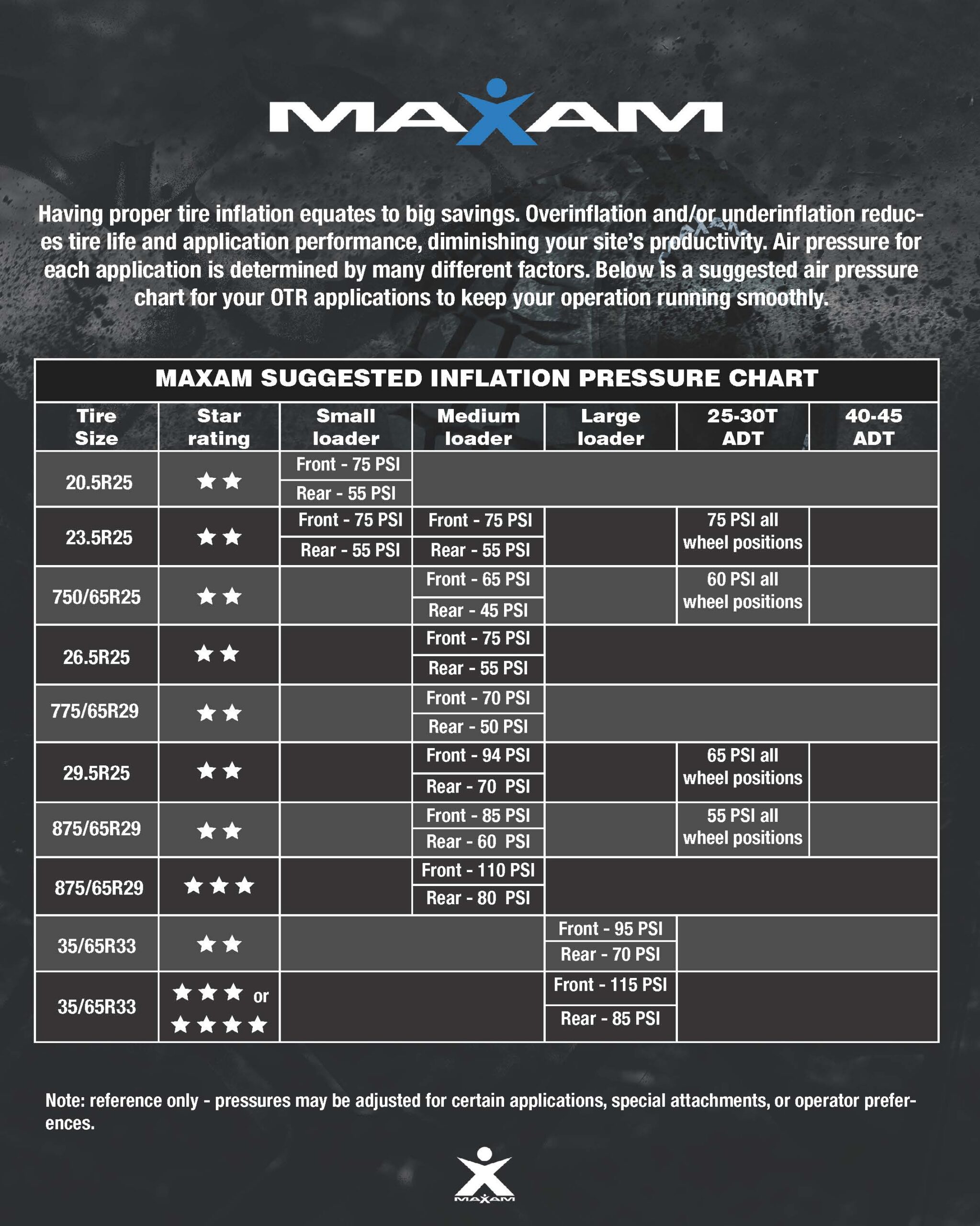

| Temperature-Adjusted Inflation Chart | Adjusts PSI recommendations based on ambient temperature | Seasonal or regionally-focused applications | Pros: Enhances tire performance in varying climates. Cons: Requires ongoing monitoring and adjustment. |

| OEM-Specific Inflation Chart | Based on manufacturer specifications for original equipment | OEM replacements and repairs | Pros: Ensures compliance with manufacturer standards. Cons: Limited to specific tire brands or models. |

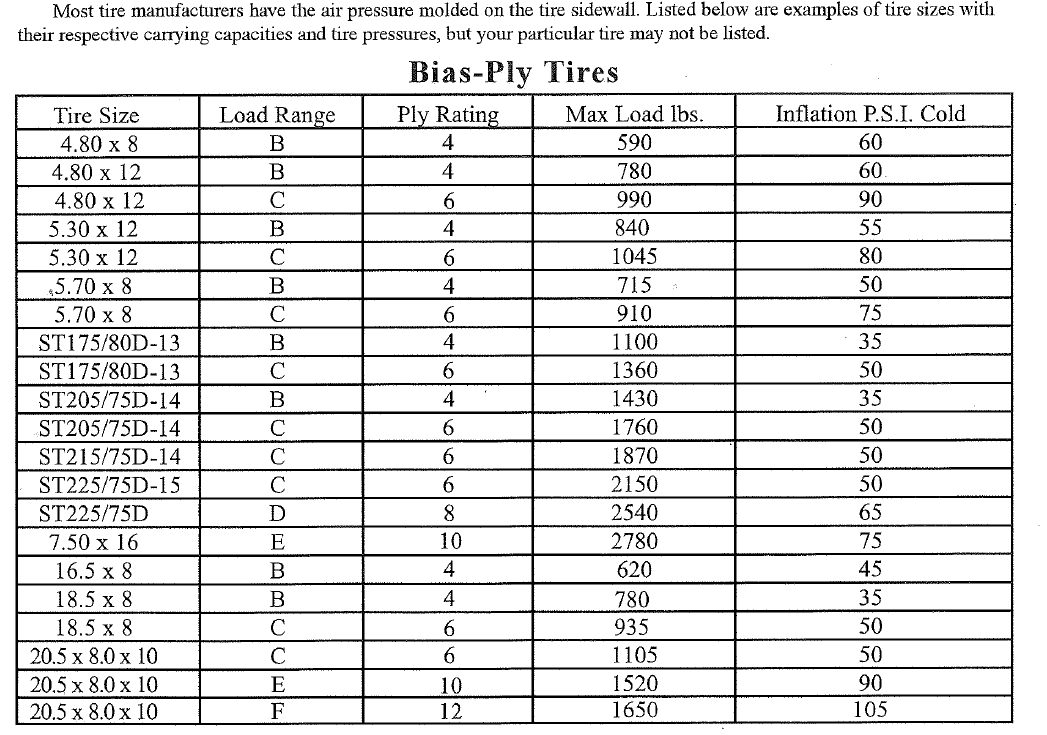

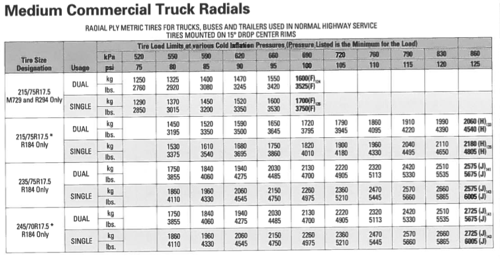

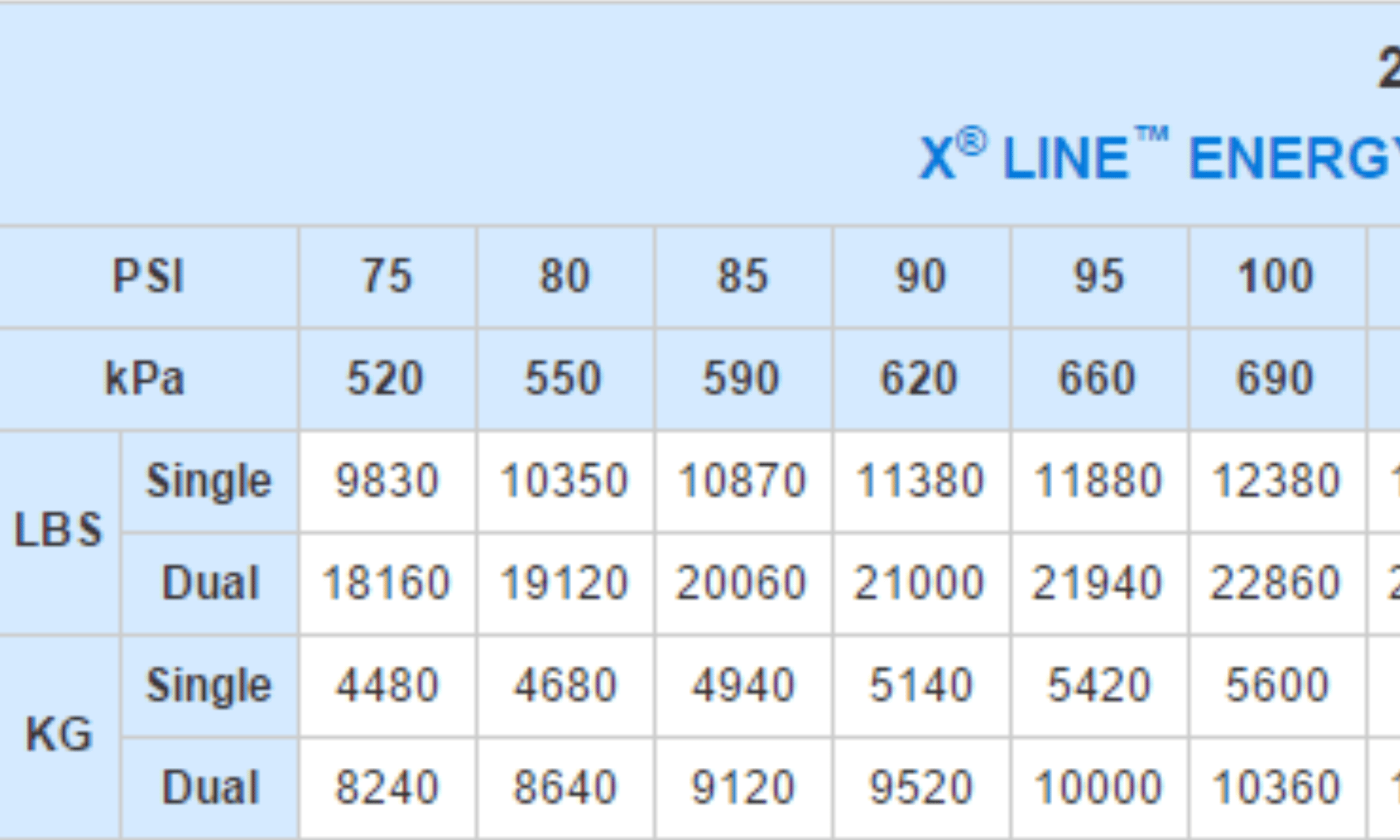

Standard Load Inflation Charts are fundamental tools that provide tire pressure recommendations based on tire size and load capacity. These charts are typically used across various industries for general trailer manufacturing, allowing buyers to quickly determine the appropriate PSI for their tires. While they are simple and widely applicable, they may lack the precision needed for specific load distributions, which can be a drawback for businesses that operate under varying load conditions.

Heavy-Duty Load Inflation Charts cater specifically to trailers that carry significant loads, such as commercial transport vehicles. These charts provide PSI recommendations that ensure safety and performance under heavy-duty conditions. While they are crucial for businesses involved in logistics and transport, they can be more complex to interpret and are primarily relevant to heavy-duty applications, potentially limiting their use for lighter trailers.

Multi-Axle Trailer Inflation Charts are designed to account for weight distribution across multiple axles, making them ideal for RV and multi-axle trailer users. These charts enhance safety and handling by providing tailored PSI recommendations based on the actual weight on each tire. However, their effectiveness hinges on accurate weight measurements, which can be a challenge for businesses without access to weighing equipment.

Temperature-Adjusted Inflation Charts offer PSI recommendations that vary based on ambient temperature, making them particularly useful for seasonal or regionally-focused applications. By adjusting for temperature fluctuations, these charts help maintain optimal tire performance. However, they require ongoing monitoring and adjustments, which could be seen as a drawback for businesses seeking a more straightforward solution.

OEM-Specific Inflation Charts are based on the manufacturer’s specifications for original equipment, ensuring that replacement tires meet the necessary standards. This is particularly beneficial for businesses involved in OEM replacements and repairs, as it guarantees compliance with manufacturer guidelines. However, their limitation lies in being specific to certain tire brands or models, which may not suit all buyers’ needs.

| Industry/Sector | Specific Application of trailer tire inflation pressure chart | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Logistics & Transportation | Ensuring optimal tire pressure for freight trailers | Reduces fuel consumption and tire wear, enhancing safety and efficiency | Sourcing high-quality tires compatible with load requirements; access to accurate inflation charts |

| Agriculture | Maintaining tire pressure for agricultural trailers | Increases load capacity and stability, improving crop transport efficiency | Availability of specialized agricultural tires; regional inflation guidelines for different terrains |

| Construction | Tire pressure management for heavy-duty construction trailers | Enhances safety and load management, reducing downtime due to tire issues | Compliance with local regulations; consideration of varying load weights on different construction sites |

| Tourism & Recreation | Optimizing tire pressure for RV and travel trailers | Improves ride comfort and safety, enhancing customer satisfaction | Access to comprehensive tire inflation charts; compatibility with various RV models and weights |

| Mining | Tire pressure control for mining haulage trucks | Ensures optimal load distribution and minimizes tire failure risks | Heavy-duty tire sourcing; adherence to strict safety standards and inflation guidelines specific to mining operations |

In logistics and transportation, the trailer tire inflation pressure chart is crucial for ensuring that freight trailers maintain optimal tire pressure. This is vital for reducing fuel consumption and extending tire lifespan. For international buyers, particularly in regions like Africa and South America, understanding local road conditions and temperature variations is essential for selecting tires that align with inflation recommendations. Proper tire pressure management also enhances safety, minimizing the risk of blowouts during long hauls.

Agricultural trailers often carry heavy loads of crops and equipment, making proper tire inflation critical. By using the trailer tire inflation pressure chart, farmers can ensure that their trailers are adequately inflated, which increases load capacity and stability. This is particularly important in varied terrains found in regions like Brazil and Vietnam. Buyers should consider sourcing tires that are specifically designed for agricultural use, as well as understanding local inflation guidelines to optimize performance and safety.

In the construction industry, maintaining accurate tire pressure for heavy-duty trailers is essential for safety and load management. The trailer tire inflation pressure chart helps construction companies determine the correct inflation levels to prevent tire failures that can lead to downtime. International buyers should be aware of local regulations regarding tire specifications and ensure that their tire choices accommodate the diverse load weights encountered on construction sites.

For the tourism and recreation sector, especially with RV and travel trailers, the trailer tire inflation pressure chart is vital for optimizing ride comfort and safety. Proper inflation enhances vehicle handling and reduces the risk of tire blowouts, which is crucial for customer satisfaction. Buyers in Europe and the Middle East should focus on sourcing tires that meet the specific requirements of their RV models while ensuring access to accurate inflation charts for various loading conditions.

In mining, tire pressure control is critical for haulage trucks that operate under extreme conditions. The trailer tire inflation pressure chart assists in ensuring optimal load distribution, which minimizes the risk of tire failures that can disrupt operations. Mining companies should prioritize sourcing heavy-duty tires that comply with stringent safety standards and consider the unique inflation guidelines that apply to their specific operational environments. This is particularly relevant for international buyers in regions with significant mining activities.

The Problem: Many B2B buyers encounter challenges when their trailer tire inflation pressure does not align with the load requirements specified for their vehicles. This misalignment can lead to severe consequences, including reduced tire performance, increased wear and tear, and potential safety hazards on the road. Buyers may struggle to interpret tire pressure charts correctly, leading to under-inflation or over-inflation of tires, which can compromise load-carrying capabilities. For instance, a logistics company transporting goods may find that their trailers are not adequately equipped to handle the weight, resulting in costly delays and safety violations.

The Solution: To overcome this issue, B2B buyers should prioritize training for their staff on how to accurately interpret trailer tire inflation pressure charts. This includes understanding the relationship between tire pressure and load capacity. Buyers can implement a systematic approach by conducting regular training sessions that focus on reading tire specifications and understanding the load inflation tables provided by tire manufacturers. Additionally, maintaining an updated database of tire specifications for each trailer type within their fleet will facilitate quick reference and ensure compliance with safety standards. Regular audits of tire pressures against the load requirements can also help to identify discrepancies early, allowing for timely adjustments.

The Problem: Companies often utilize multiple brands of tires across their fleet, leading to confusion regarding varying tire pressure recommendations. Each tire manufacturer may have different specifications for inflation pressure and load capacity, making it difficult for fleet managers to ensure uniformity. This inconsistency can result in operational inefficiencies and increased risk of tire failures during transport, which can be detrimental to business operations and customer satisfaction.

The Solution: To tackle this pain point, B2B buyers should develop a centralized tire management system that consolidates all tire specifications, including inflation pressures and load capacities from various manufacturers. This system can take the form of a digital dashboard that allows fleet managers to input tire brands and models, automatically generating the correct inflation pressures based on the current load. Implementing a routine maintenance schedule that includes checking tire pressures across all brands will help ensure that all vehicles are operating under optimal conditions. Additionally, engaging with a tire supplier that offers a diverse range of brands while providing comprehensive support can help streamline the process and reduce confusion.

The Problem: B2B buyers often overlook how environmental conditions impact tire inflation pressure, especially in regions with extreme climates. High temperatures can increase tire pressure, while cold weather can lead to under-inflation. This fluctuation can cause businesses to experience unexpected breakdowns and increased maintenance costs, particularly for companies that operate in diverse geographical areas with varying climates.

The Solution: To mitigate the impact of environmental factors on tire pressure, B2B buyers should implement a proactive monitoring system that includes regular tire pressure checks, particularly during seasonal changes. Utilizing tire pressure monitoring systems (TPMS) can provide real-time data about tire conditions, alerting fleet managers to any deviations from optimal pressure levels. Additionally, incorporating guidelines for adjusting tire pressure based on ambient temperature changes into the company’s maintenance protocols will enhance safety and efficiency. Providing training for employees on the importance of adjusting tire pressures according to environmental conditions can further empower them to take ownership of vehicle maintenance and operational safety.

When selecting materials for trailer tire inflation pressure charts, several factors come into play, including durability, temperature and pressure ratings, and international compliance. Here, we analyze four common materials used in the manufacturing of these charts, focusing on their properties, advantages, disadvantages, and considerations for B2B buyers across different regions.

Key Properties:

Polypropylene is a thermoplastic polymer known for its excellent chemical resistance and moderate temperature tolerance (up to 100°C). It is lightweight yet strong, making it suitable for various applications, including tire inflation pressure charts.

Pros & Cons:

The durability of polypropylene is a significant advantage, as it resists wear and tear, making it ideal for outdoor use. However, its relatively low temperature tolerance can be a limitation in extreme environments. Additionally, while it is cost-effective, the manufacturing complexity is moderate, requiring specialized molding processes.

Illustrative image related to trailer tire inflation pressure chart

Impact on Application:

Polypropylene is compatible with various media, including air and nitrogen, commonly used for tire inflation. Its chemical resistance ensures that it will not degrade when exposed to tire sealants or lubricants.

Considerations for International Buyers:

B2B buyers in regions like Africa and South America should ensure that polypropylene products meet local standards, such as ASTM or ISO certifications, to guarantee quality and safety.

Key Properties:

Aluminum is a lightweight metal with high corrosion resistance and excellent thermal conductivity. It can withstand high pressures, making it suitable for applications requiring robust performance.

Pros & Cons:

The primary advantage of aluminum is its durability and resistance to corrosion, which is crucial for outdoor applications. However, it tends to be more expensive than plastic alternatives, and its manufacturing process can be complex, requiring specialized equipment.

Impact on Application:

Aluminum’s ability to handle high pressures makes it suitable for tire inflation applications, particularly in regions with extreme weather conditions. Its compatibility with various gases ensures that it can be used universally.

Considerations for International Buyers:

Compliance with standards such as DIN or JIS is essential for B2B buyers in Europe and the Middle East. Buyers should also consider the environmental impact of aluminum production and look for suppliers with sustainable practices.

Key Properties:

Stainless steel is known for its exceptional strength, corrosion resistance, and ability to withstand high temperatures and pressures. It is often used in applications where durability is paramount.

Illustrative image related to trailer tire inflation pressure chart

Pros & Cons:

The main advantage of stainless steel is its longevity and resistance to corrosion, making it suitable for harsh environments. However, it is typically more expensive than other materials, and its weight can be a disadvantage in applications where weight savings are critical.

Impact on Application:

Stainless steel is highly compatible with various media, including air, nitrogen, and even aggressive chemicals. Its robust nature ensures that it can handle the pressures associated with tire inflation without risk of failure.

Considerations for International Buyers:

B2B buyers should ensure that stainless steel products meet international standards, such as ASTM or ISO, particularly in regions like Europe and the Middle East, where compliance is strictly regulated.

Key Properties:

PVC is a versatile plastic known for its strength, durability, and resistance to chemicals. It is widely used in various applications, including tire inflation pressure charts.

Pros & Cons:

PVC is cost-effective and easy to manufacture, making it a popular choice. However, its temperature tolerance is lower than that of metals, and it may not perform well in extreme conditions. Additionally, PVC can be less durable than other materials, leading to potential wear over time.

Impact on Application:

PVC is compatible with air and nitrogen, making it suitable for tire inflation. However, it may not withstand exposure to certain chemicals found in tire sealants.

Considerations for International Buyers:

Buyers in regions like Africa and South America should verify that PVC products meet local safety and environmental regulations, as there may be restrictions on certain chemicals used in its production.

Illustrative image related to trailer tire inflation pressure chart

| Material | Typical Use Case for trailer tire inflation pressure chart | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene | Outdoor tire inflation charts | Excellent chemical resistance | Limited temperature tolerance | Low |

| Aluminum | High-pressure tire inflation applications | High corrosion resistance | Higher cost | Med |

| Stainless Steel | Heavy-duty tire inflation charts | Exceptional durability | Expensive and heavier | High |

| PVC | General tire inflation charts | Cost-effective and easy to manufacture | Lower durability and temp tolerance | Low |

This analysis provides a comprehensive overview of the materials commonly used in trailer tire inflation pressure charts, allowing B2B buyers to make informed decisions based on their specific needs and regional considerations.

The manufacturing process for trailer tires, particularly those involved in inflation pressure charts, consists of several critical stages: material preparation, forming, assembly, and finishing. Each stage is integral to ensuring the performance and reliability of the tires, which is essential for B2B buyers who require high-quality products for their fleets.

The first stage involves sourcing and preparing raw materials, primarily rubber compounds, fabric, and steel. High-quality natural and synthetic rubber is mixed with additives to enhance durability, flexibility, and resistance to wear and tear. This mixture is then subjected to rigorous testing to ensure it meets the required performance standards.

Once the rubber compound is ready, it is processed into sheets or forms suitable for the next stage. Steel cords are also prepared, which serve as the backbone of the tire, providing strength and stability. The preparation phase must adhere to strict material specifications, as the quality of the raw materials directly impacts the tire’s performance and longevity.

During the forming stage, the prepared materials are shaped into tire components. This process typically employs techniques such as extrusion and calendaring. Extrusion is used to create the tire’s inner linings and treads, while calendaring involves layering rubber sheets with fabric or steel belts to form the tire’s body.

The precise control of temperature and pressure during this phase is crucial. This ensures that the components are uniformly shaped and free from defects, which is essential for maintaining consistent tire performance. Advanced manufacturing technologies, such as computer-controlled machinery, are often utilized to enhance accuracy and efficiency.

The assembly phase involves combining the various components, including the inner liner, body plies, bead wires, and tread. This is often done using automated systems that ensure precise placement and adherence. The assembled tire is then cured in a mold under heat and pressure, a process known as vulcanization. This step is vital as it chemically bonds the rubber and other materials, giving the tire its final shape and properties.

Finishing involves inspecting the cured tires for defects and ensuring they meet the necessary specifications. This includes checking for uniformity in size, tread depth, and overall integrity. Any tires that do not meet quality standards are discarded or reprocessed to prevent defects in the final product.

Quality assurance in the manufacturing of trailer tires is paramount, particularly for international B2B buyers. Compliance with international standards such as ISO 9001 ensures that manufacturers maintain a quality management system that promotes continual improvement and customer satisfaction.

In addition to ISO certifications, specific industry certifications such as CE (Conformité Européenne) for European markets and API (American Petroleum Institute) certifications are important. These certifications indicate that the products meet stringent safety and performance criteria, which is crucial for buyers operating in regulated markets.

Quality control (QC) processes are embedded at various checkpoints throughout the manufacturing stages. Key QC checkpoints include:

B2B buyers should implement a rigorous verification process for potential suppliers to ensure quality control standards are upheld. This can include:

Illustrative image related to trailer tire inflation pressure chart

When sourcing trailer tires from manufacturers in different regions, international buyers, particularly from Africa, South America, the Middle East, and Europe, should be aware of varying quality standards and certification processes. For instance, compliance with local regulations may differ significantly, impacting the acceptance of certain products in different markets.

Buyers should also consider the logistical aspects of certification, such as the time and cost involved in obtaining necessary documentation. Establishing clear communication with suppliers regarding these aspects can help mitigate risks associated with non-compliance.

Understanding the manufacturing processes and quality assurance protocols for trailer tires is essential for B2B buyers. By focusing on material preparation, forming, assembly, finishing, and adhering to relevant quality standards, buyers can ensure they are sourcing high-quality products that meet their operational needs. Additionally, implementing thorough verification processes will help maintain product integrity and enhance supplier relationships, ultimately leading to better business outcomes.

In the global marketplace, ensuring the safety and efficiency of trailer operations begins with correct tire inflation. This guide provides a step-by-step checklist for B2B buyers seeking to procure a reliable trailer tire inflation pressure chart. By adhering to these steps, buyers can ensure they make informed decisions that enhance performance, safety, and longevity of their trailer tires.

Understanding your specific requirements is critical when sourcing a trailer tire inflation pressure chart. Identify the tire sizes, load capacities, and types of trailers in your fleet. Knowing these parameters will help you select a chart that aligns with your operational needs and enhances safety.

Different regions have varying regulations regarding tire safety and inflation. Familiarize yourself with the local standards applicable to your operations, such as those from the European Tyre and Rim Technical Organization or the Tire and Rim Association. Ensuring compliance with these regulations is crucial for legal operation and risk mitigation.

Conduct thorough due diligence on potential suppliers of tire inflation pressure charts. Request company profiles, product certifications, and case studies from similar businesses. Look for suppliers with a proven track record in the industry to ensure reliability and access to high-quality resources.

Illustrative image related to trailer tire inflation pressure chart

Before making a bulk purchase, ask for samples or demonstrations of the tire inflation pressure charts. This allows you to assess the clarity, usability, and accuracy of the information provided. A well-designed chart should be easy to interpret and include essential metrics like load capacity at various pressures.

Confirm that the inflation pressure chart you are considering is based on the latest data and best practices. Tire technology and regulations evolve, so it’s vital that the chart reflects current standards. Suppliers should provide documentation showing how often their charts are reviewed and updated.

Evaluate the level of support and training offered by the supplier post-purchase. Comprehensive training on how to effectively use the tire inflation pressure chart can significantly enhance your team’s operational efficiency. Additionally, responsive customer service is essential for resolving any issues that may arise.

Finally, before finalizing your procurement, negotiate favorable terms and conditions. Discuss pricing, delivery timelines, and return policies. A clear agreement can prevent misunderstandings and ensure a smooth transaction process, ultimately contributing to your operational success.

When sourcing trailer tire inflation pressure charts, it’s essential to understand the cost structure that influences pricing. The primary cost components include materials, labor, manufacturing overhead, tooling, quality control (QC), logistics, and profit margins.

Materials: The primary materials involved in creating tire inflation charts are paper, ink, and possibly digital formats for online accessibility. The choice of durable, weather-resistant materials can impact costs significantly.

Labor: Labor costs encompass the time spent by skilled professionals in designing, printing, and quality checking the charts. This can vary based on the complexity of the design and the expertise required.

Manufacturing Overhead: This includes utilities, rent, and other indirect costs associated with the production facility. Efficient operations can help in reducing these overheads.

Tooling: If specialized tools or machinery are required for producing customized charts, these costs must be factored in. Investments in technology can lead to more efficient production processes.

Quality Control (QC): Ensuring the accuracy and reliability of the inflation pressure charts is critical. QC processes may include testing for durability and accuracy, which can add to overall costs.

Logistics: Shipping and handling costs, especially for international buyers, can be significant. Factors like distance, shipping method, and volume affect logistics pricing.

Margin: Suppliers typically add a profit margin to cover their costs and ensure profitability. This margin can vary based on market competition and demand.

Several factors can influence the pricing of trailer tire inflation pressure charts. Understanding these can help buyers make informed decisions.

Volume/MOQ: Purchasing in bulk usually results in lower per-unit costs. Suppliers often provide discounts for larger orders, making it advantageous for businesses with high demand.

Specs/Customization: Customized charts that cater to specific tire sizes or load capacities may incur additional costs. Standardized options typically offer better pricing.

Materials: The quality of materials used in the charts can impact costs. Higher-quality materials may lead to increased durability but at a higher price point.

Quality/Certifications: Charts that come with certifications or have undergone rigorous testing may cost more. However, they can offer peace of mind regarding accuracy and reliability.

Supplier Factors: Supplier reputation, reliability, and service quality can influence pricing. Established suppliers may charge more due to their expertise and track record.

Incoterms: Understanding the Incoterms (International Commercial Terms) is crucial for international buyers. These terms dictate the responsibilities of buyers and sellers regarding shipping, insurance, and tariffs, which can affect overall costs.

To maximize cost-efficiency, B2B buyers should consider the following strategies:

Negotiation: Engage in discussions with suppliers to negotiate better pricing, especially for bulk orders. Don’t hesitate to explore alternative suppliers to compare offers.

Evaluate Total Cost of Ownership (TCO): Look beyond the initial purchase price. Consider long-term costs such as durability, replacement frequency, and shipping to determine the true value of the charts.

Understand Pricing Nuances for International Buyers: Factors such as currency fluctuations, import duties, and local taxes can significantly impact pricing for buyers from regions like Africa, South America, the Middle East, and Europe.

Stay Informed on Market Trends: Keeping abreast of industry trends and competitor pricing can provide leverage in negotiations and help identify the best time to purchase.

Assess Supplier Reliability: Choose suppliers with a proven track record to minimize risks related to quality and delivery delays. Reliable suppliers often justify higher prices through consistent quality and service.

Prices for trailer tire inflation pressure charts can vary widely based on the factors discussed. It’s advisable for buyers to conduct thorough market research and seek multiple quotes to ensure they secure the best value for their needs.

When it comes to managing trailer tire inflation, various methods and technologies exist beyond the traditional tire inflation pressure chart. These alternatives can offer different benefits and drawbacks, making it essential for B2B buyers to understand their options. This analysis compares the trailer tire inflation pressure chart with two viable alternatives: Tire Pressure Monitoring Systems (TPMS) and Mobile Tire Inflation Services.

| Comparison Aspect | Trailer Tire Inflation Pressure Chart | Tire Pressure Monitoring System (TPMS) | Mobile Tire Inflation Services |

|---|---|---|---|

| Performance | Provides static data based on tire size and load | Real-time monitoring of tire pressure and temperature | On-site inflation adjustments and expert advice |

| Cost | Generally low-cost; requires no technology | Moderate initial investment, with ongoing maintenance costs | Variable costs based on service area and inflation needs |

| Ease of Implementation | Simple to use; requires manual reference | Requires installation and calibration | Requires scheduling; may have limited availability |

| Maintenance | No maintenance needed; relies on manual checks | Requires battery replacements and periodic checks | Minimal maintenance; relies on service provider |

| Best Use Case | Ideal for standard operations with known loads | Best for fleets needing real-time data for safety | Ideal for those needing immediate inflation adjustments or expert consultation |

TPMS provides a modern solution for tire pressure management by offering real-time data directly from the tires. The primary advantage is its ability to alert operators to low pressure conditions immediately, reducing the risk of tire blowouts and enhancing safety. However, the initial installation cost can be moderate, and ongoing maintenance such as battery replacements may be necessary. Additionally, the effectiveness of TPMS can be hindered if not properly calibrated or if sensors fail.

Mobile tire inflation services provide on-site tire inflation and maintenance, which can be particularly beneficial for businesses with multiple vehicles or those operating in remote areas. These services often come with expert advice, ensuring that tire pressures are adjusted according to the specific load conditions. While this approach offers convenience and expertise, costs can vary significantly based on location and service frequency. Additionally, availability may be limited in certain regions, making it less reliable for urgent needs.

Selecting the right tire inflation management solution depends on the specific operational needs of the business. For companies that operate within predictable parameters, the trailer tire inflation pressure chart offers a straightforward and cost-effective approach. In contrast, businesses seeking to enhance safety and efficiency through real-time monitoring may find TPMS to be a valuable investment. Meanwhile, organizations that frequently require immediate tire adjustments or expert insights might benefit most from mobile tire inflation services. Ultimately, understanding the unique requirements and operational contexts will guide B2B buyers in making the most informed decision for their trailer tire management strategies.

Understanding the technical properties associated with trailer tire inflation is crucial for B2B buyers, particularly those in industries reliant on transportation and logistics. Here are some essential specifications:

Illustrative image related to trailer tire inflation pressure chart

Load Index

The load index indicates the maximum weight a tire can safely carry at a specified inflation pressure. For instance, a tire with a load index of 112 can carry up to 2,540 pounds at the recommended pressure. Knowing the load index helps businesses ensure they are not overloading their tires, which can lead to tire failure and costly downtime.

Inflation Pressure

This specification refers to the recommended air pressure for the tires. It is essential for maintaining optimal performance, safety, and longevity of the tires. For example, a standard trailer tire may require an inflation pressure of 60 psi. Proper inflation minimizes tread wear and enhances fuel efficiency, translating to lower operational costs for businesses.

Tread Depth

Tread depth is a critical property that affects traction, handling, and safety. A minimum tread depth of 2/32 inches is typically required for safe operation. Regular checks on tread depth can prevent accidents and enhance the lifespan of the tires, making it a vital aspect for fleet managers and logistics providers.

Material Grade

The material grade of a tire impacts its durability and performance. Tires are commonly made from a combination of rubber compounds, fabric, and steel belts. A high-grade material can withstand harsher conditions, which is particularly important for businesses operating in diverse climates and terrains.

Temperature Resistance

This property defines a tire’s ability to withstand heat generated during operation. Trailer tires must be able to perform effectively under high temperatures, which can affect pressure and load capacity. For businesses, choosing tires with adequate temperature resistance can prevent blowouts and extend tire life.

Ply Rating

Ply rating indicates the strength and load-carrying capacity of a tire. A tire with a higher ply rating can support more weight, making it suitable for heavier loads. Understanding ply ratings is essential for companies that transport goods, as it helps in selecting the right tires for their trailers.

Familiarity with industry jargon can facilitate smoother transactions and clearer communications for B2B buyers. Here are some common terms:

OEM (Original Equipment Manufacturer)

This term refers to companies that produce parts and equipment that may be marketed by another manufacturer. In the context of trailer tires, OEM specifications are crucial for ensuring compatibility and performance, particularly when replacing tires.

MOQ (Minimum Order Quantity)

MOQ is the smallest number of units that a supplier is willing to sell. Understanding MOQ is vital for businesses to manage inventory costs and ensure that they can meet demand without overcommitting resources.

RFQ (Request for Quotation)

An RFQ is a standard business process where a buyer requests pricing and terms from suppliers. For trailer tires, submitting an RFQ can help businesses compare prices and services from multiple vendors, ensuring they get the best deal.

Incoterms (International Commercial Terms)

These are pre-defined commercial terms published by the International Chamber of Commerce (ICC) that clarify the responsibilities of buyers and sellers in international transactions. Understanding Incoterms is critical for businesses involved in international shipping of trailer tires, as it affects shipping costs and risk management.

Cold Inflation Pressure

This term refers to the tire pressure measured when the tire is cold, typically before the vehicle has been driven. Maintaining the correct cold inflation pressure is essential for optimal tire performance and safety, making it a key focus for fleet operators.

Tread Wear Indicators

These are small raised areas on the tire tread that indicate when the tire has worn down to a level where it needs to be replaced. Recognizing tread wear indicators helps businesses manage tire replacement proactively, reducing the risk of accidents and improving overall safety.

By understanding these technical properties and trade terms, B2B buyers can make informed decisions regarding trailer tires, ultimately leading to enhanced performance, safety, and cost-efficiency in their operations.

The trailer tire inflation pressure chart sector is experiencing significant transformation driven by global demand for safer and more efficient transportation solutions. Factors such as the rise of e-commerce, increased freight movement, and the expansion of logistics networks in regions like Africa and South America are propelling the need for reliable tire performance. International B2B buyers are particularly focused on the accuracy of inflation pressure charts, which ensure that tires operate within safe load limits. This is crucial for maintaining vehicle safety, minimizing breakdowns, and optimizing fuel efficiency.

Illustrative image related to trailer tire inflation pressure chart

Emerging technologies, such as IoT (Internet of Things) sensors and automated tire pressure monitoring systems, are revolutionizing how businesses approach tire maintenance. These advancements provide real-time data on tire performance, allowing for proactive adjustments based on load and pressure conditions. Moreover, the integration of mobile applications and cloud-based platforms is enabling B2B buyers to access tire inflation charts remotely, facilitating informed decision-making in real-time.

In addition to technology, regulatory changes surrounding vehicle safety standards are influencing sourcing trends. Buyers must stay abreast of evolving regulations in their respective regions, particularly in Europe, where stringent compliance is enforced. Understanding these market dynamics is essential for international buyers to navigate the complexities of sourcing high-quality tire inflation charts and ensuring optimal tire performance across diverse operational environments.

Sustainability is becoming a focal point in the trailer tire inflation pressure chart sector, with increasing awareness of the environmental impact associated with tire production and disposal. B2B buyers are recognizing the importance of sourcing materials and products that align with sustainable practices. The industry is seeing a shift towards using eco-friendly materials, such as recycled rubber and bio-based compounds, which not only reduce waste but also lower the carbon footprint of tire production.

Ethical sourcing is gaining traction, as businesses are pressured to ensure transparency within their supply chains. Buyers are now more inclined to partner with manufacturers that demonstrate commitment to ethical labor practices and sustainable sourcing. Certifications such as ISO 14001 for environmental management and the Global Recycling Standard (GRS) are becoming key differentiators in supplier selection.

Moreover, the adoption of circular economy principles is reshaping how companies approach tire life cycles. By focusing on tire longevity and recyclability, businesses can minimize environmental impact while enhancing brand reputation. For international buyers, aligning procurement strategies with sustainability goals not only meets regulatory expectations but also resonates with increasingly eco-conscious consumers, making it a critical consideration in sourcing decisions.

The history of trailer tire inflation pressure charts can be traced back to the increasing complexity of transportation needs in the mid-20th century. As commercial trucking and trailer usage surged, the need for standardized tire pressure guidelines became evident. Early tire manufacturers began to develop load and inflation tables to provide operators with crucial information about tire performance under varying conditions.

Over the decades, advancements in tire technology, coupled with a growing understanding of load distribution and tire maintenance, have led to the refinement of these charts. The introduction of regulatory frameworks aimed at enhancing road safety further solidified the importance of accurate tire inflation data. Today, these charts serve as essential tools for B2B buyers, enabling them to make informed decisions that ensure optimal tire performance and safety across diverse applications.

1. How do I determine the correct tire inflation pressure for my trailer?

To determine the correct tire inflation pressure, refer to the tire information placard found on the vehicle or trailer, usually located in the door jam or glove compartment. This placard provides the manufacturer’s recommended PSI for each tire based on the load capacity. It’s crucial to check the pressure when the tires are cold to ensure accurate readings. If you are using different tire sizes or types, consult the tire load and inflation charts specific to those tires to adjust the pressure accordingly.

2. What is the best way to source a reliable supplier for trailer tire inflation pressure charts?

To source a reliable supplier, start by researching manufacturers with a proven track record in the tire industry. Look for suppliers who provide comprehensive tire load and inflation charts, and ensure they comply with international standards. Request samples and product specifications to verify quality. Additionally, check reviews and ratings from other B2B buyers, and consider suppliers who offer after-sales support and consultation to assist with any technical queries.

3. How can I customize the tire inflation charts for my specific needs?

Many suppliers offer customization options for tire inflation charts tailored to your specific requirements, such as regional load specifications or unique tire sizes. Discuss your needs directly with the supplier to see if they can create a chart that meets your operational demands. Providing them with details about your tire types, loads, and specific applications will help them deliver a more accurate and useful chart.

4. What minimum order quantity (MOQ) should I expect when sourcing tire inflation pressure charts?

The MOQ for tire inflation pressure charts can vary significantly depending on the supplier and the complexity of the charts required. Typically, suppliers may require a MOQ ranging from 100 to 500 units for printed materials. It’s advisable to negotiate with the supplier, as some may be willing to accommodate smaller orders, especially if you express a commitment to future purchases or larger orders.

5. What payment terms are standard for international B2B transactions involving tire inflation charts?

Standard payment terms for international B2B transactions often include options like advance payment, letter of credit, or partial payment with the remainder due upon delivery. It’s essential to discuss and agree on payment terms before finalizing the order to avoid misunderstandings. Consider using escrow services for additional security, particularly for large orders, to ensure that both parties fulfill their obligations.

6. How do I ensure quality assurance (QA) for the tire inflation pressure charts I order?

To ensure quality assurance, request samples of the tire inflation charts before placing a full order. Verify that the charts are accurate and comply with international standards. Additionally, inquire about the supplier’s QA processes, including whether they conduct regular audits and checks on their products. Establishing clear communication regarding expectations and standards upfront can prevent quality issues later on.

7. What logistics considerations should I keep in mind when ordering trailer tire inflation charts?

When ordering trailer tire inflation charts, consider shipping times, customs clearance, and potential tariffs that may apply to international shipments. Choose a supplier who has experience with international logistics to ensure smooth delivery. It’s also important to discuss the packaging to protect the charts during transit and confirm the delivery timeline to align with your operational needs.

8. Are there any regulatory requirements for using tire inflation pressure charts in different regions?

Yes, there may be regulatory requirements governing tire inflation pressure charts, which can vary by country or region. For instance, some regions may require compliance with local automotive safety standards or environmental regulations. It’s crucial to familiarize yourself with the specific regulations in your target market, especially if you are exporting products. Consulting with a legal expert or industry association can provide clarity on these requirements and help ensure compliance.

Domain: yournexttire.com

Registered: 2008 (17 years)

Introduction: Tire Inflation Chart: The formula for calculating load capacity is Tire Weight / Tire Pressure = Load Capacity Pounds per PSI. Example: A 265/75R16 10-ply tire at 80 psi carries 3,085 pounds; at 60 psi, it carries 2,314 pounds; at 65 psi, it carries 2,507 pounds. A 265/75R16 6-ply tire at 50 psi carries 2,470 pounds, which is more than a 10-ply at 60 psi (2,314 pounds) and offers a better ride.

Domain: rvsafety.com

Registered: 1997 (28 years)

Introduction: Tire Inflation Tables & Codes for various tire brands including Michelin, Goodyear (RV and Truck Tires), Bridgestone, Firestone, B.F. Goodrich, Hankook, Yokohama, Toyo, Continental, Maxxis, Cooper, Sailun, and Towmax. Includes information on DOT Plant Codes, Speed Ratings (with corresponding speeds in mph), and Load Index (with load capacities in lbs).

Domain: toyotires.com

Registered: 1997 (28 years)

Introduction: Load and Inflation Tables provide assistance for replacing tires with optional sizes, including plus sizes not listed on the vehicle’s tire information placard (T.I.P) or in the owner’s manual. For original equipment (OE) size inflation pressure, refer to the T.I.P. found on the vehicle door jam, glove compartment, or near the gas cap. Important: Consult the vehicle’s owner’s manual for specific s…

Domain: fifthwheelst.com

Registered: 2011 (14 years)

Introduction: Step 4 – RV and Tow Vehicle Tire Inflation Procedures and Load Charts: 1. Check cold tire inflation pressure first thing in the morning before departure and when not affected by sunlight. 2. Tires should not have been driven more than one mile or wait 2-3 hours after parking before checking pressure. 3. Do not correct tire inflation pressure when the tire temperature is above ambient surroundings….

Domain: business.michelinman.com

Registered: 2001 (24 years)

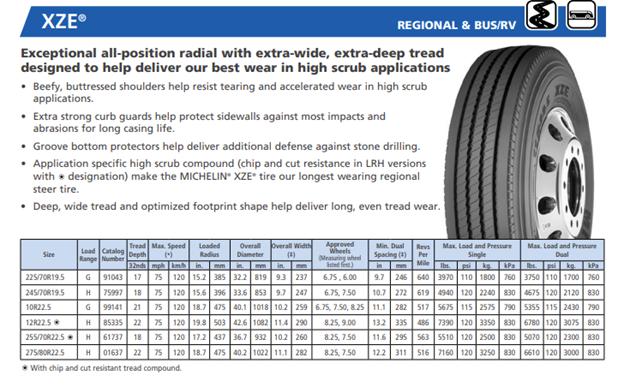

Introduction: Michelin offers a range of RV tires with specific load and inflation tables based on tire size. Key tire sizes include: 15″ Wheel Diameter (e.g., 205/65R15C), 16″ Wheel Diameter (e.g., LT215/85R16 E), 19.5″ Wheel Diameter (e.g., 225/70R19.5 G), and 22.5″ Wheel Diameter (e.g., 11R22.5 G). The load and inflation tables provide guidance on tire pressure based on axle weight, recommending that users w…

Domain: facebook.com

Registered: 1997 (28 years)

Introduction: This company, Facebook – Trailer TPMS Thresholds, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

Domain: etrailer.com

Registered: 1999 (26 years)

Introduction: This company, etrailer – Trailer Tires, is a notable entity in the market. For specific product details, it is recommended to visit their website directly.

In conclusion, grasping the intricacies of trailer tire inflation pressure is vital for ensuring optimal performance, safety, and cost-effectiveness in your operations. Accurate tire inflation not only maximizes load capacity but also enhances fuel efficiency and extends tire life, reducing the overall operational costs. As international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, leveraging precise tire inflation data can lead to informed sourcing decisions that enhance fleet reliability.

Strategic sourcing of quality tires and inflation management resources is essential for maintaining a competitive edge in today’s global marketplace. By prioritizing suppliers who provide comprehensive load and inflation charts, you can ensure compliance with safety standards while optimizing your fleet’s performance.

As we move forward, consider integrating advanced tire pressure monitoring systems (TPMS) into your fleet management practices. This technology can provide real-time data and alerts, allowing for proactive adjustments and reducing the risk of tire-related issues. Take the initiative to review your current tire management strategies today, and make informed sourcing decisions that will drive your business forward.

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.